Polygon Network is a promising player in the cryptocurrency market with the potential to dominate. It is a Layer 2 scaling solution for Ethereum aimed at solving scalability issues faced by the Ethereum network. Several factors could contribute to MATIC Network dominating the cryptocurrency market. Polygon offers faster and cheaper transactions, which can attract more users and developers to the platform.

The project has formed partnerships with well-known cryptocurrency and decentralized finance companies, which could lead to increased adoption and usage. The development team behind Polygon is strong and experienced, with a proven track record. MATIC has a large and engaged community of supporters who believe in the platform’s potential, which can help drive adoption and usage.

Polygon has maintained a strong position in the crypto rankings amassing a net value of $10 billion in market capitalization and a massive double-digit movement in the past 24 hours.

While January 2023 ended positively for MATIC, February has been even more bullish as the token was able to overcome its short-term resistance at $1. Read our Polygon price prediction to know if the token can break the other resistances or not!

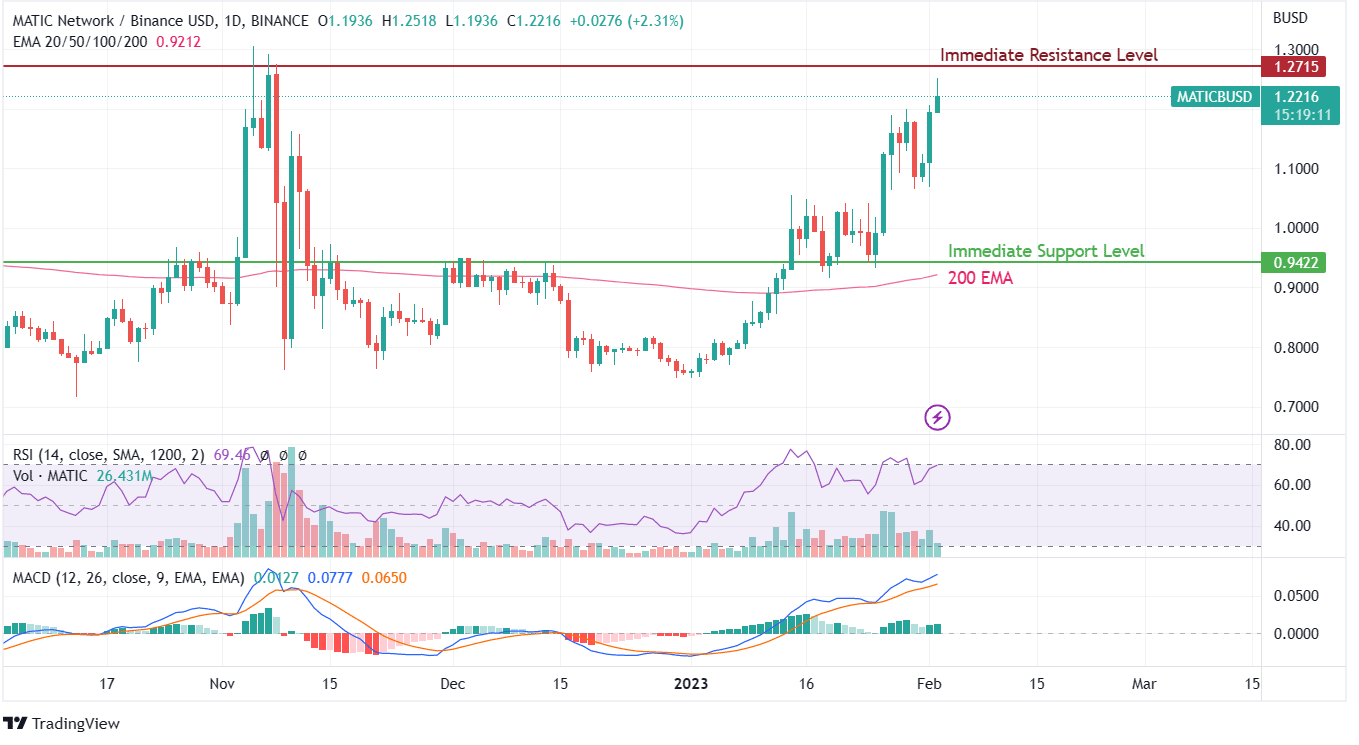

The daily and weekly charts confirm a similar resistance of $1.27; breaching it could provide a strong uptrend push we have been waiting to witness on MATIC. Polygon has created a strong rising price action pattern with small profit bookings along the way. The support can be seen available at $0.94, while resistance is available at $1.27.

The strength of Polygon’s bullish movement can be ascertained from the fact that its latest trading value is being traded at a huge premium from its 200 EMA curve, which confirms the beginning of a bull run.

This price trend could be at the very beginning of its formation. As technical indicators such as RSI and MACD are holding in any profit booking impact with decent gains in transactional volumes, we can witness MATIC rise to $2 with relative ease.

MATIC has an all-time high of $2.92. Compared to the progressive candlestick movement and recovery seen in leading market movers such as BTC is another positive element supporting a bull run. This run might be cut short by the impact of government policies on the active trading of cryptocurrencies as an asset. Hence those in profit should plan to book partial values by the end of the current fiscal year.