The FOMC meeting on 1 February was perhaps the most anticipated event in the investment landscape. This includes the cryptocurrency market, hence the heavy expectations, especially among Bitcoin investors and enthusiasts.

The biggest question of the day was whether the Federal Reserve (Fed) would continue raising interest rates and by how much. FED chairman Jerome Powell revealed during the FOMC meeting that the Federal Fund Rate would increase by 25 basis points. This was within investors’ projections and has so far contributed to a more bullish outlook for Bitcoin.

The FOMC results’ impact on Bitcoin and the broader crypto market

Satoshi Nakamoto’s vision may have been to create a new financial system that would be detached from the traditional finance system. Fast forward to the present and it is clear that there is a significant correlation between the crypto market and traditional finance. This mostly has to do with how investors respond to economic changes.

This is the second consecutive time that the FED increased rates by 25 BPS. Bitcoin reacted positively to the news with a bit of an uptick hours after the new rate hike was announced.

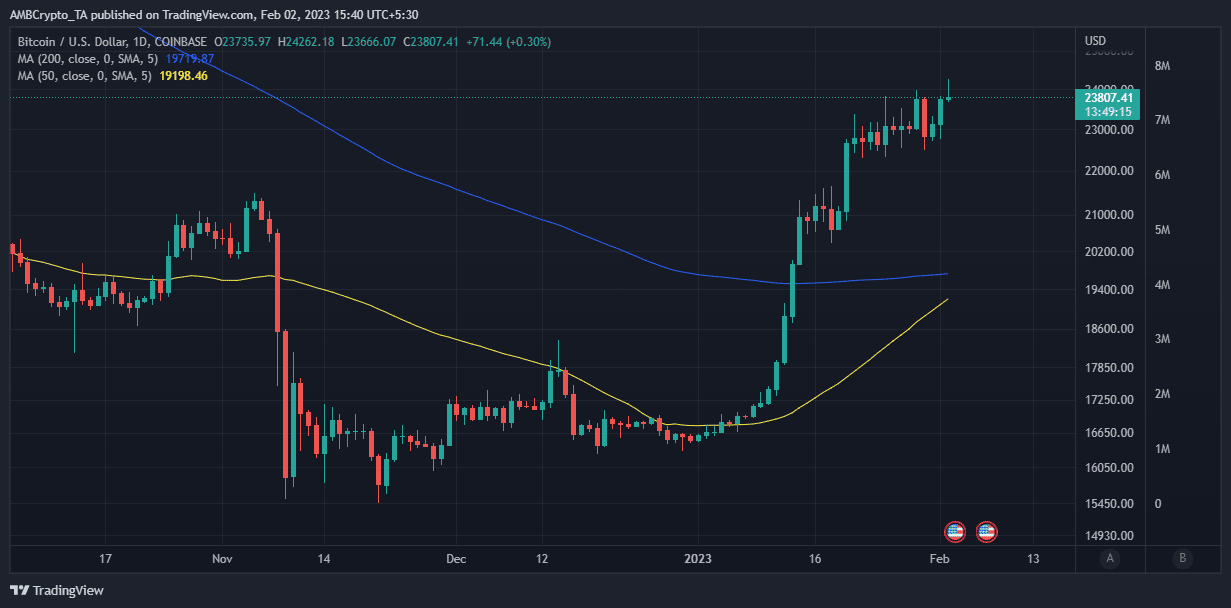

It even managed to briefly push above the $24,000 price level. The overall cryptocurrency market cap was up by 4.5% at the time of writing.

The bullish result confirms that investors are optimistic about the FED’s decision. This is mainly because maintaining the rate confirms that quantitative tightening puts the FED on the right track toward economic normalcy.

This outcome may also usher in a more bullish outlook for February just as we saw in January. However, this will depend on whether there will be significant demand to sustain a price surge.

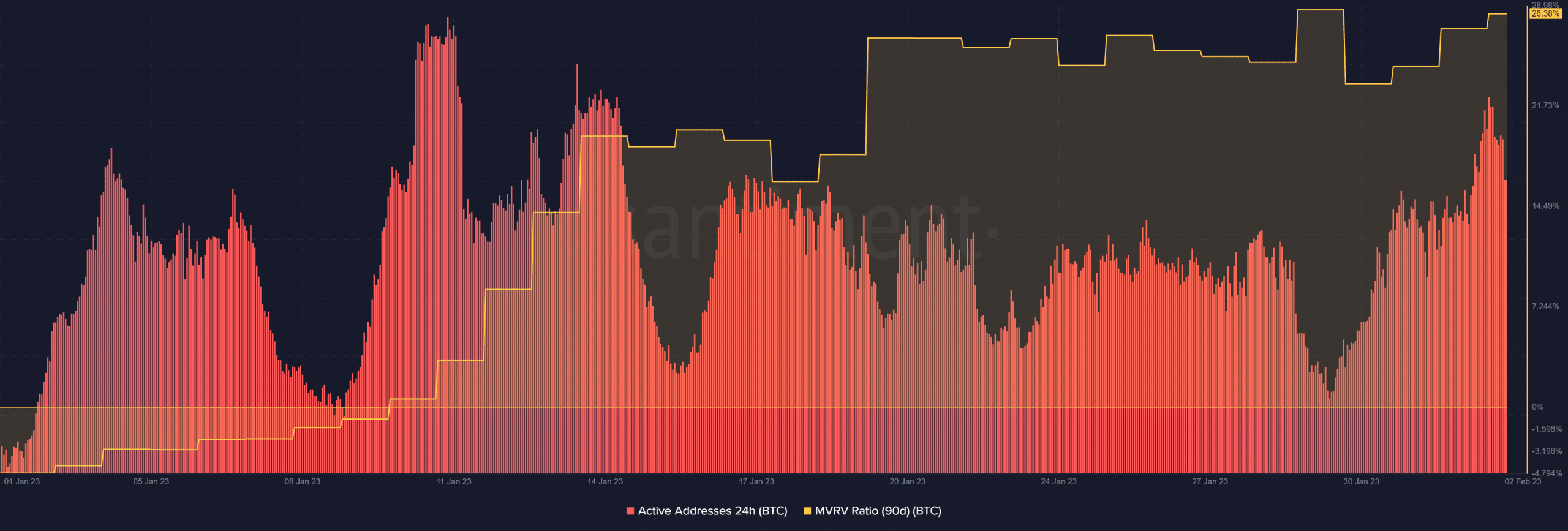

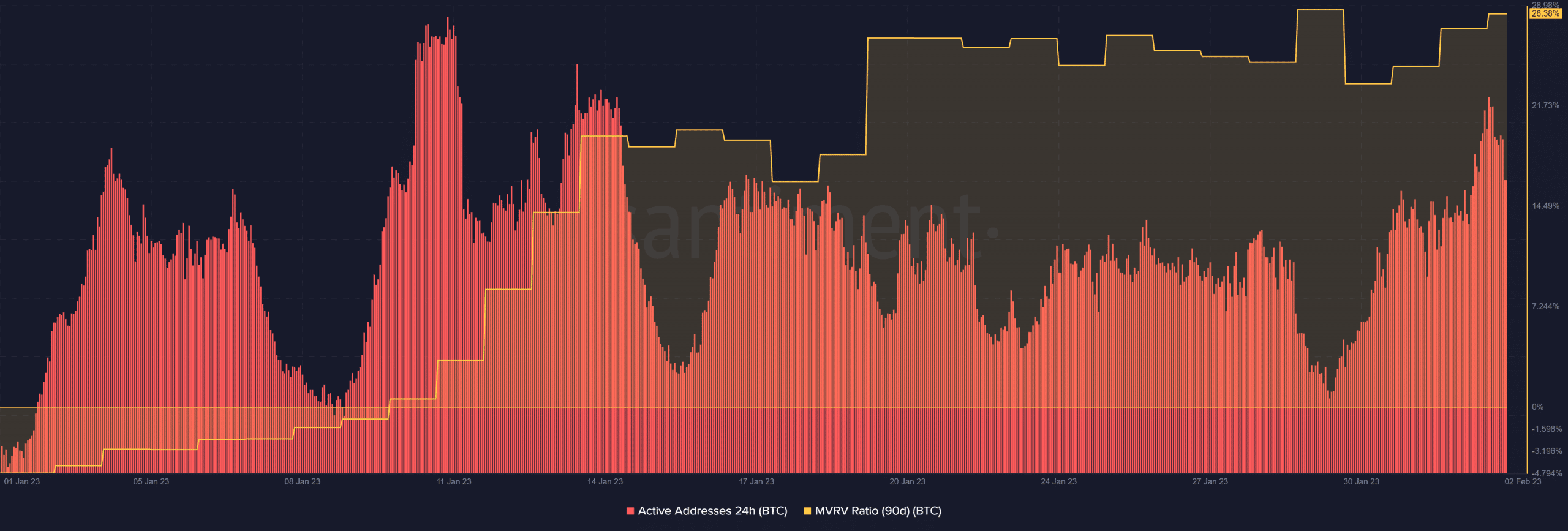

So far the last few hours since the FOMC meeting has triggered a resurgence of demand. The number of daily active addresses increased significantly, confirming an influx of buyers in the retail segment. BTC’s MVRV ratio was up consecutively for the last three days, confirming significant demand during this period.

Source: Santiment

The risk is not over yet

The Fed aims to stock quantitative tightening measures by June. This means it has a tight deadline to reach its 2% target rate. It might thus have to raise the rates higher within the next three months if there is a risk of missing the target.

Powell noted during the FOMC meeting that the Fed will continue reducing its balance sheet. A restricted stance may thus be on the table for the next few months to come.

Another rate hike above the current level may push the crypto market into a tight corner. That would translate into another bearish scenario that may potentially push Bitcoin below $20,000.

This is why the next FOMC meeting in March will carry more weight as far as the market impact is concerned. Powell confirmed that the FED is willing to raise rates higher if need be.

There is also a chance that the risk of a potentially higher rate hike in March may influence investor sentiment this month. Perhaps observations in the market may already point towards such an outcome.

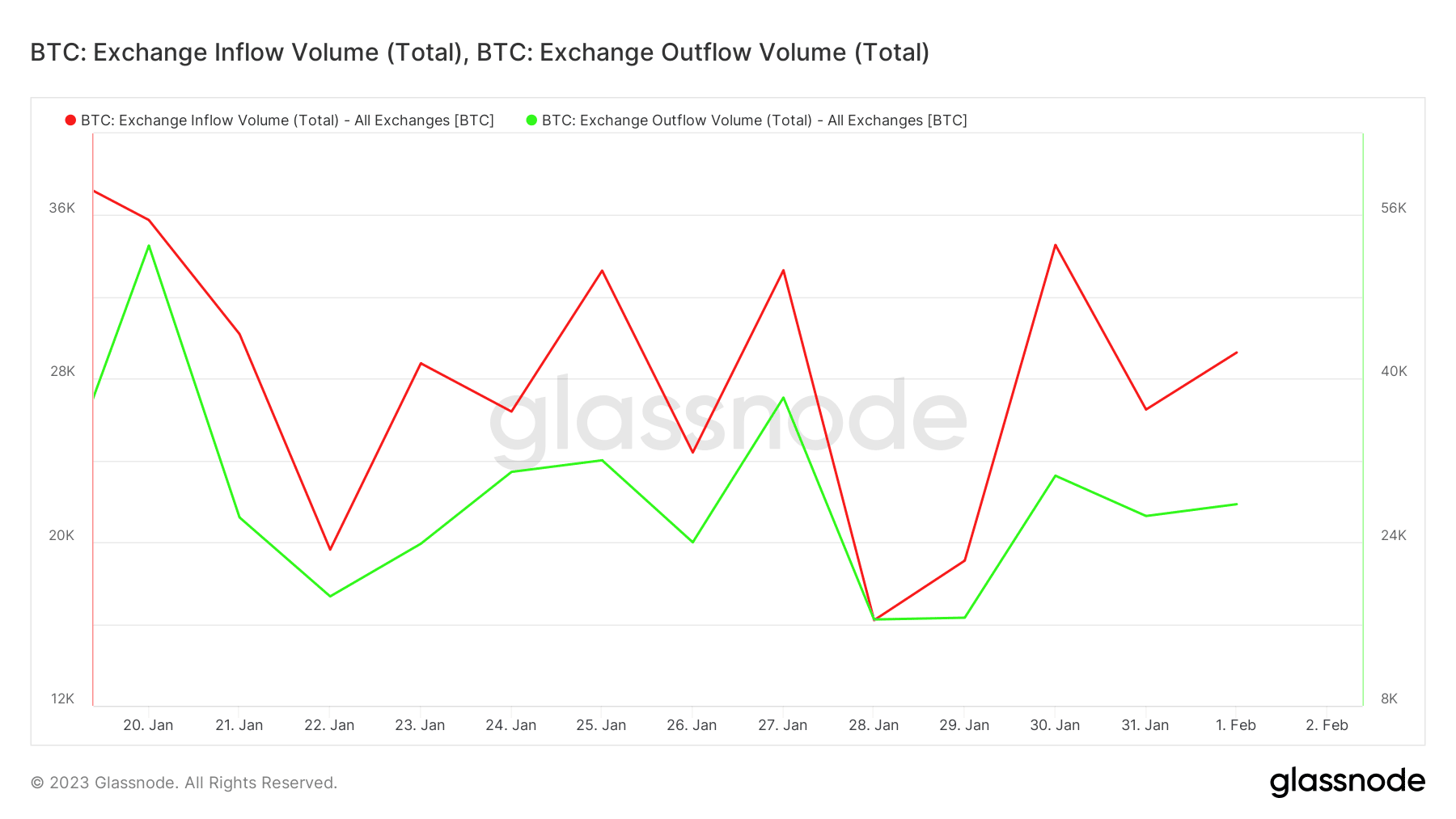

For example, the amount of Bitcoin exchange inflows in the last 24 hours remained notably higher than outflows.

Source: Glassnode

The higher exchange inflows may indicate that more investors are shifting their BTC to exchanges and possibly preparing to sell. If this happens, then February might not be as bullish as January.

Is Bitcoin still the right horse for the 2023 rally?

There is no doubt that altcoins tend to follow in Bitcoin’s footprints. However, a more open-minded approach may favor those looking for better opportunities.

This is already evident in some assets in the last few days. For example, Bitcoin rallied by roughly 6.77% in the last three days. Meanwhile, Cardano’s ADA jumped by as much as 11% during the same timeframe, thus outperforming BTC.

Source: TradingView

How many are 1,10,100 BTCs worth today

There is also the fact that ADA still has more ground to cover than BTC before reaching its previous ATH. Nevertheless, a more diverse approach would be favorable since there is still a lot of uncertainty ahead.

Conclusion

Judging by Powell’s statements, the Fed may pivot from the current direction if need be. This means there is still a significant risk of FUD flowing back into the market within the next two or three months.

Nevertheless, the FED’s battle against inflation is going well, hence the long-term prospects are still in favor of Bitcoin and the overall market recovery.