- Ethereum led the market at press time, as it remained the largest L1 in terms of TVL and fees.

- ETH’s on-chain performance looked bullish.

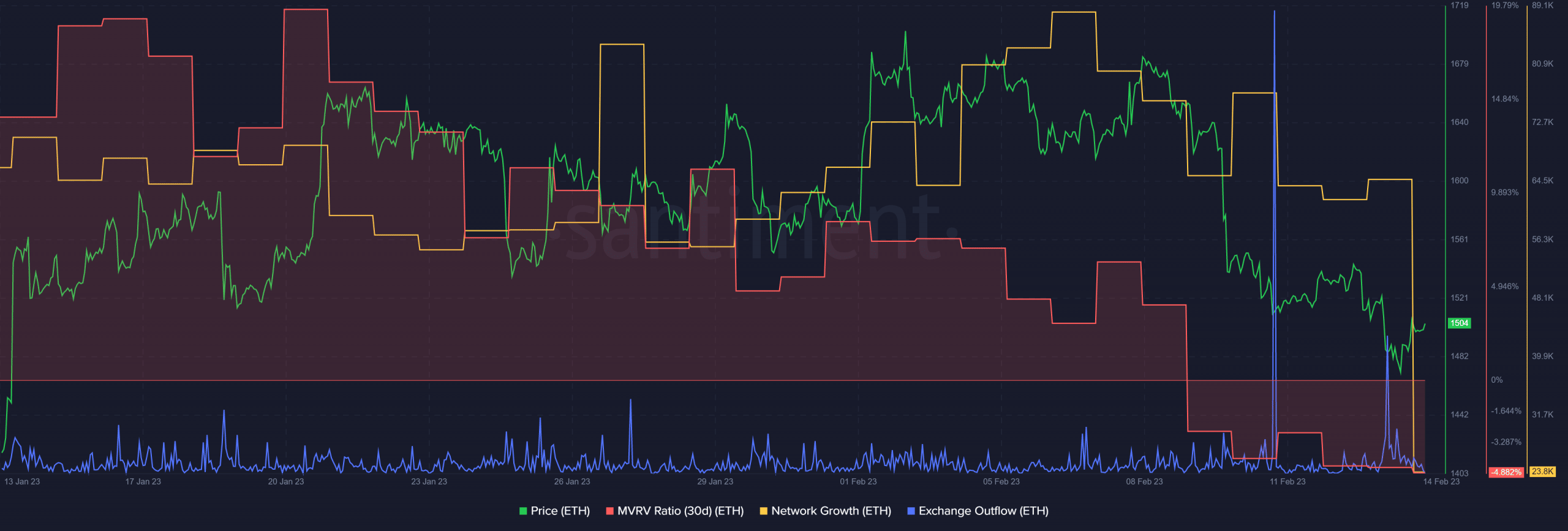

Ethereum [ETH] registered massive gains during this year’s bull market. However, since peaking on 7 February, ETH’s price dropped by 13%. At the time of writing, it was trading at $1,501.74, with a market capitalization of more than $183 billion.

Read Ethereum’s [ETH] Price Prediction 2023-24

Interestingly, not everything looked bad for Ethereum, as Santiment’s data revealed that despite the price decline, the amount of available ETH sitting on exchanges continued to fall, which looked bullish. To be more specific, there have been 37% fewer coins in terms of dollar valuation on exchanges since the merge.

#Ethereum has dropped -13% since peaking at $1,688 back on February 7th. However, the good news is that the amount of available $ETH sitting on exchanges (and available to sell) continues to fall. Since the #merge, there are 37% less coins on exchanges. https://t.co/HOnHO6iLpJ pic.twitter.com/YpReloS8iT

— Santiment (@santimentfeed) February 13, 2023

ETH still the market leading in this aspect

Ethereum continued to dominate the market at press time, as it remained the largest L1 in terms of TVL and fees. With nearly $28 billion in TVL, ETH’s TVL was 5.6 times higher than that of the next largest L1, which was Binance [BNB].

Ethereum still the largest L1 by TVL and fees

– At ~$28B TVL, ETH is 5.6x that of the next largest L1 in BNB

– At $3.4m daily fees, ETH is almost 3x that of BNBNote that ETH is #3 in active address (behind BNB and BTC) and #5 in transactions. pic.twitter.com/xGOND2Ow9a

— Artemis (@Artemis__xyz) February 13, 2023

Ethereum’s performance on the social front also looked promising. LunarCrush’s data revealed that Ethereum’s social mentions and social dominance recently hit three-month highs. All these updates looked favorable for Ethereum. Therefore, let’s have a look at the king of altcoins’ on-chain metrics to find out whether a new bull rally is around the corner.

Is ETH getting ready for a bull run?

According to CryptoQuant’s data, Ethereum’s exchange reserve was decreasing, which was a bullish signal as it indicated less selling pressure. Yet another positive signal was that Ethereum’s total number of transactions was on the rise. As per Glassnode, ETH’s open interest in perpetual future contracts reached a three-month high of $296,148,748 on Deribit.

#Ethereum $ETH Open Interest in Perpetual Futures Contracts just reached a 3-month high of $296,148,748 on #Deribit

View metric:https://t.co/5MhXAkWLAZ pic.twitter.com/HDQV1d9gcA

— glassnode alerts (@glassnodealerts) February 14, 2023

Realistic or not, here’s ETH market cap in BTC’s terms

This was good news, as it reflected higher demand for ETH in the derivatives market. The same was further proven by the taker buy/sell ratio, which revealed that buying sentiment was dominant in the derivatives market. Santiment’s chart revealed that ETH’s network growth remained high throughout the week.

Furthermore, ETH’s exchange outflow spiked twice in the last few days, which was bullish. However, ETH’s MVRV Ratio was down considerably, which might restrict ETH from initiating a bull run in the coming days.

Source: Santiment