U.S. crypto exchange Coinbase has launched a defense of its staking services, after the future of the practice was thrown into doubt by the Securities and Exchange Commission’s enforcement action against Kraken last week.

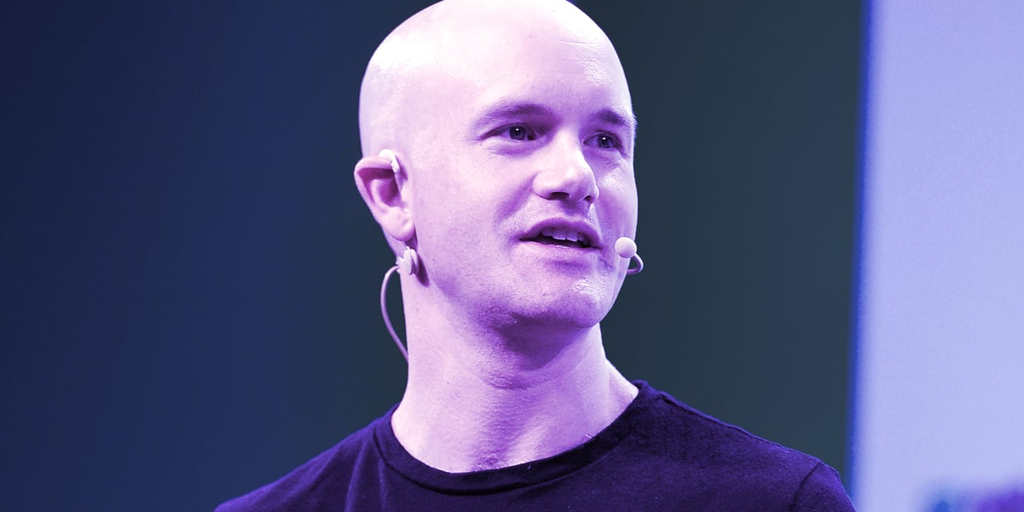

Coinbase CEO Brian Armstrong tweeted on Sunday that the company’s staking services are not securities. “We will happily defend this in court if needed,” Armstrong said.

It comes after the SEC hit rival exchange Kraken with a $30 million fine for offering its staking-as-a-service without registering it. Just before the announcement, Armstrong warned that he had heard rumors of a wider crackdown on staking in the pipeline.

Coinbase and staking

When cryptocurrency holders “stake” their coins, they agree to lock them up for a period of time in order to help keep the blockchain running, and in exchange receive rewards.

Users can take part in the process directly, or through an intermediary like Kraken or Coinbase.

However, following the SEC’s decision, Coinbase has sought to emphasize the differences between its own offering and Kraken’s.

Coinbase’s chief legal officer, Paul Grewal, told Decrypt last week that Kraken “was essentially offering a yield product”.

“Coinbase’s staking services are fundamentally different and are not securities.”

He expanded on this in a Coinbase blog post on Friday, which Armstrong shared alongside his defiant promise to defend staking in court.

In the post, Grewal argued that staking fails the Howey test, a key tool used by the (SEC) to evaluate what counts as a security. The four elements of the test are investment of money, common enterprise, reasonable expectation of profits, and efforts of others.

“The purpose of securities law is to correct for imbalances in information,” Grewal wrote. “But there is no imbalance of information in staking, as all participants are connected on the blockchain and are able to validate transactions through a community of users with equal access to the same information.”

Grewal argued that staking fails on all four fronts to meet the criteria. Staking is not an investment, he wrote, because the staker isn’t giving up one thing to get another–“they own exactly the same thing they did before”.

As for the expectation of profits, he wrote, “rewards are simply payments for validation services provided to the blockchain, not a return on investment”.

This last point may be a tough sell in a market that tends to frame staking rewards as returns. In its enforcement against Kraken, the SEC took issue with how the firm advertised its unregistered products with annual investment returns of as much as 21%. Coinbase’s own program advertises staking on coins such as Ethereum and Solana with rewards expressed in APY–annual percentage yields.

Decrypt has contacted Coinbase for further comment.