Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- GRT entered a price consolidation phase over the weekend.

- Bulls could look for profits if BTC closes above $21.9K.

The Graph [GRT] saw a slight consolidation on the lower timeframe over the weekend. However, the lower and higher timeframe charts were bullish at press time.

Notably, GRT bulls secured steady support at $0.1475, which could give them an impetus to book profits on the overhead resistances.

Is your portfolio green? Check out the GRT Profit Calculator

GRT formed a bullish order block at $0.1475 on the 12-hour chart: Can bulls sustain the recovery?

Source: GRT/USDT on TradingView

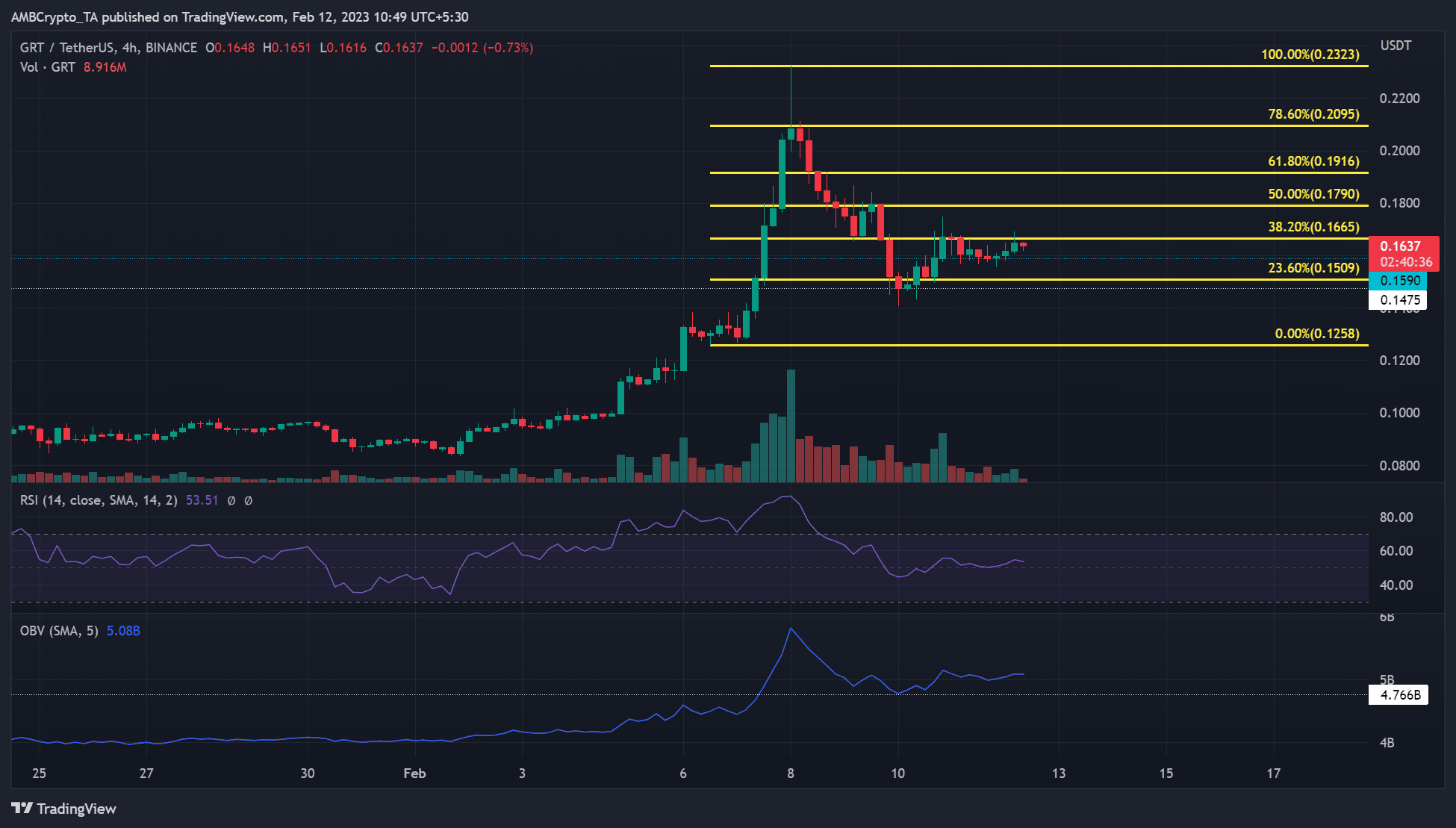

In the past week, GRT hiked by over 80%, rising from $0.1258 to $0.2323. However, after BTC lost hold of the $23.5K level, the ensuing correction saw it lose about half of the gains.

Bulls found steady support at $0.1475 – which was also a bullish order block on the 12-hour timeframe chart.

The asset was bullish on 23.6% and 38.2% Fib pocket levels before entering a short-term consolidation over the weekend.

How much are 1,10,100 GRTs worth today?

However, given the bullish structure on lower and higher timeframe charts at the time of writing, GRT could break above the 38.2% Fib level. The RSI was at 53, despite the recent sideways movement, indicating a bullish structure. Similarly, OBV (On Balance Volume) hiked slightly.

Near-term bulls could look for gains at the 50% Fib level of $0.1790 after buying GRT just above $0.17 (38.2% Fib level). Cautious bulls could wait for a retest of the 38.2% Fib level before making moves.

On the other hand, short-term sellers could book profits at $0.1509 (23.6% Fib level) if GRT breaks below $0.1590.

GRT saw a short-term accumulation trend

Source: Santiment

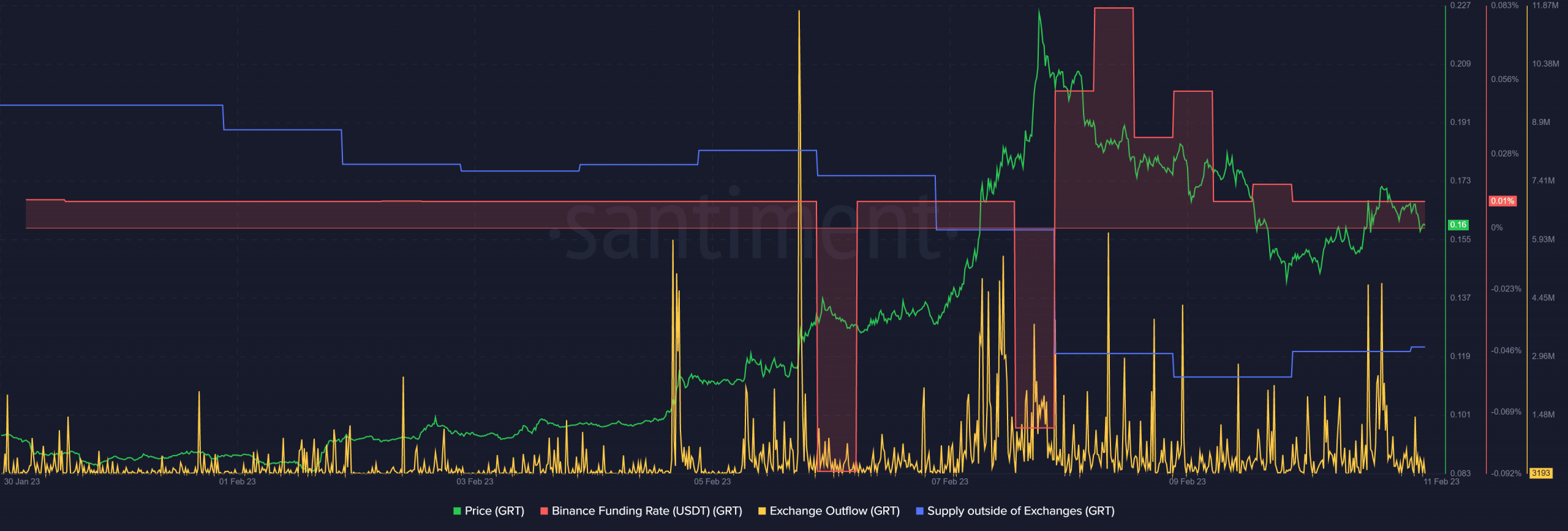

The token registered spikes in supply out of exchanges and exchange outflow, indicating accounts were accumulating the asset. Besides, the recent drop in demand, as indicated by the falling Funding Rate since 8 February, steadied over the weekend. The stagnant demand correlates with the price consolidation between $0.1590 and $0.1665 in the same period.

The accumulation trend could boost short-term bulls to climb above the 38.2% Fib level, especially if BTC closes above $21.9K. However, any blockage at this level could tip bears to devalue GRT.