- The count of active users on PancakeSwap in the last month totaled 1.37 million.

- CAKE’s buying pressure is on a decline, hence a price correction might be due.

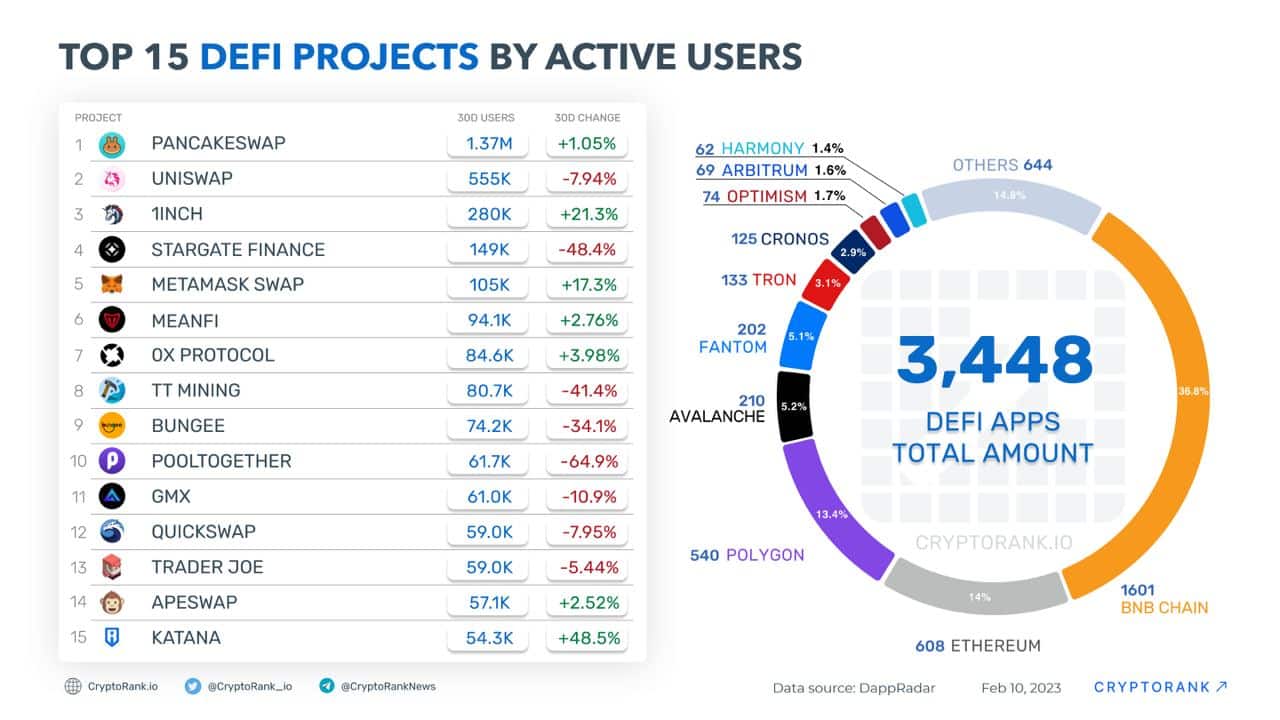

With 1.37 million users in the last 30 days, PancakeSwap led as the decentralized finance (DeFi) protocol with the most active users in the last month, data from CryptoRank revealed.

Source: CryptoRank

Housed within the BNB Chain, PancakeSwap is a decentralized exchange (DEX) that allows users to trade various cryptocurrencies.

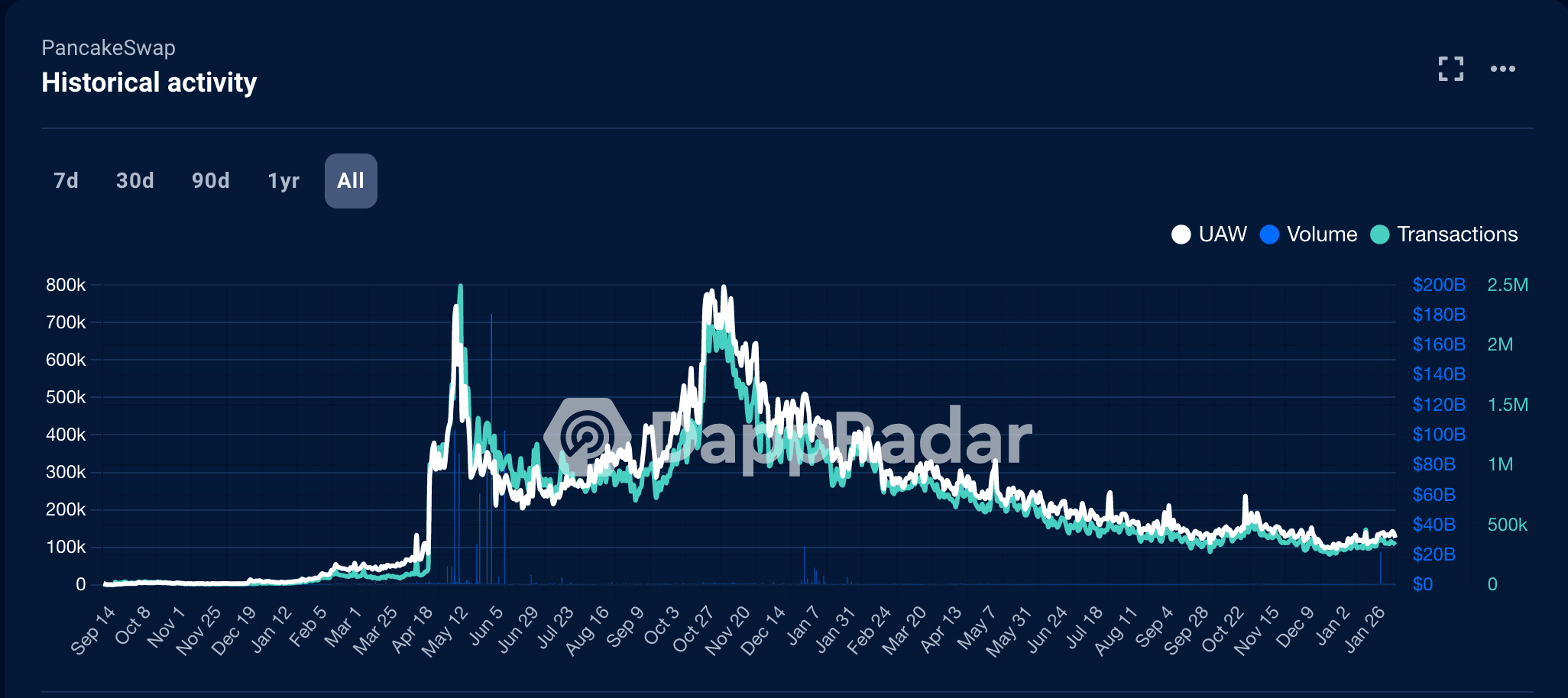

Due to increased user activity on the project in the last month, the transaction count grew as well.

Per data from DappRadar, in the last 30 days, the transactions completed on PancakeSwap totaled 10.26 million, rallying by 14%.

Likewise, due to the rapidly growing transaction count on the protocol, the total fiat value of all transactions completed within the period under review skyrocketed by an astonishing 900%.

At press time, the volume of all transactions completed on PancakeSwap in the last month stood at a whopping $26.52 billion.

Source: DappRadar

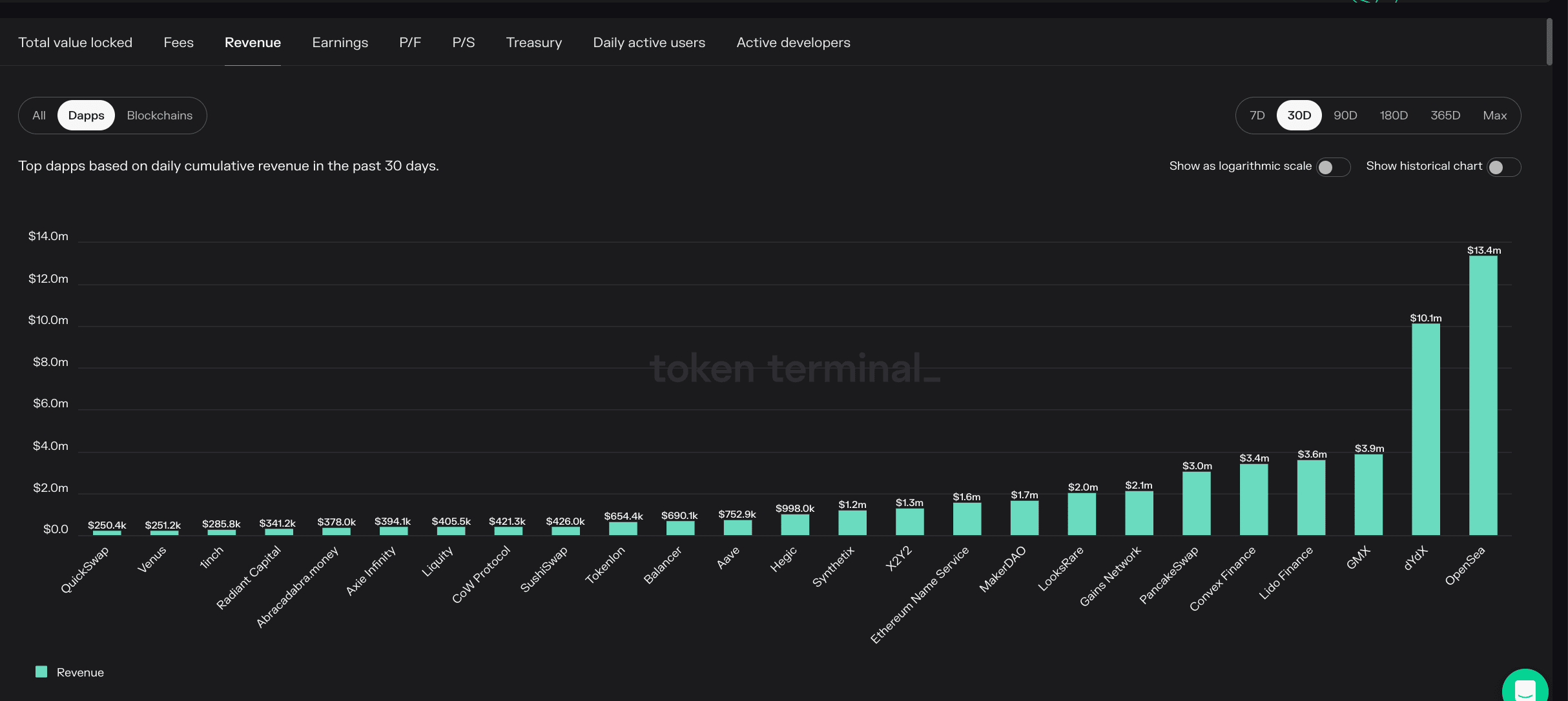

As expected, the growth in user activity and transaction count in the last month culminated in a corresponding growth in protocol revenue within the same period, data from Token Terminal showed.

In the last 30 days, revenue on PancakeSwap spiked by 55%, bringing its total revenue during that period to $3.04 million.

In addition to increased user activity on the protocol in the last month, the jump in revenue was also attributable to a 54% rally in fees paid to process transactions on PancakeSwap.

According to Token Terminal, fees paid by the protocol’s users in the last month amounted to $9.51 million.

Source: Token Terminal

With a revenue of $3.04 million in the last month, PancakeSwap ranked as the sixth decentralized application (Dapp) with the highest revenue in the last 30 days, after Convex Finance, Lido Finance, GMX, dYdX, and OpenSea.

Source: Token Terminal

Now might be the time to get out

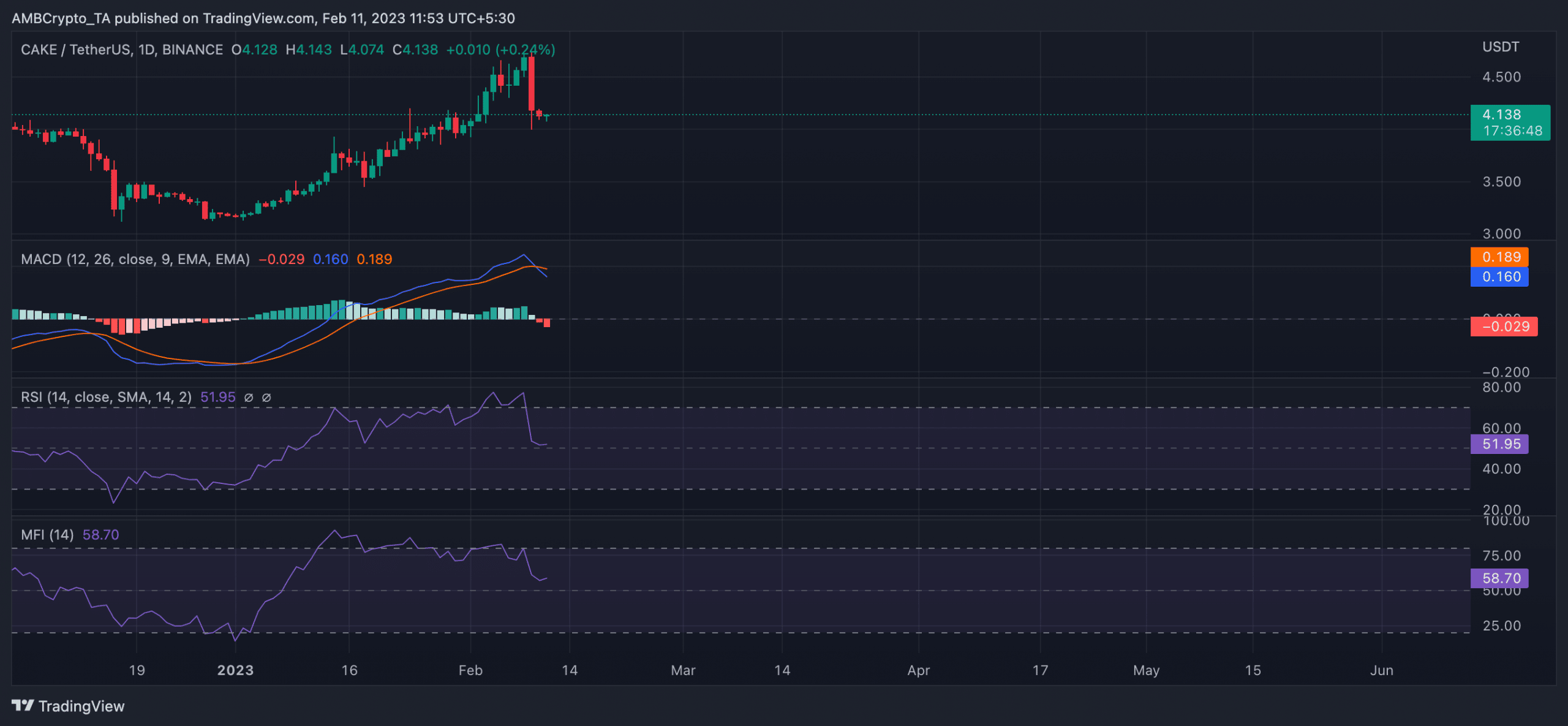

On a year-to-date (YTD), CAKE’s price has increased by 30%. However, according to CoinMarketCap, with a decline in buying activity since 8 February, the alt’s price has embarked on a downtrend. CAKE’s value has since dropped by 10%.

The price decline corresponded with the commencement of a new bear cycle on the daily chart, as could be gleaned from the position of CAKE’s moving average convergence/divergence (MACD).

The MACD line intersected with the trend line on 8 February, marking the re-entry of bears into the CAKE market following a prolonged period of price growth.

In addition, key momentum indicators Relative Strength Index (RSI) and Money Flow Index (MFI), have since been on a downtrend.

At press time, CAKE’s RSI was 51.95, while its MFI was 58.70. With both indicators looking to breach their respective neutral lines in a downtrend, buying pressure has fallen significantly, and a further price decline might be on the horizon.

Source: CAKE/USDT on TradingView