- Bitcoin-native NFTs recorded a 25% growth in network fees.

- Bitcoin mining revenue rose sharply, powered by an increase in transactions.

The new Ordinals NFT platform on Bitcoin [BTC] recorded exponential growth since mid-January, data from crypto research firm Messari showed. The daily Ordinal NFT mints soared by 300 times in the same time period.

1/ If we told you #Bitcoin NFTs were making waves in the sector would you believe us?

The New #Ordinals NFT project on Bitcoin is attempting to challenge the longstanding debate that the blockchain should primarily be used for simple financial transactions. pic.twitter.com/2O0jHjzRLZ

— Messari (@MessariCrypto) February 9, 2023

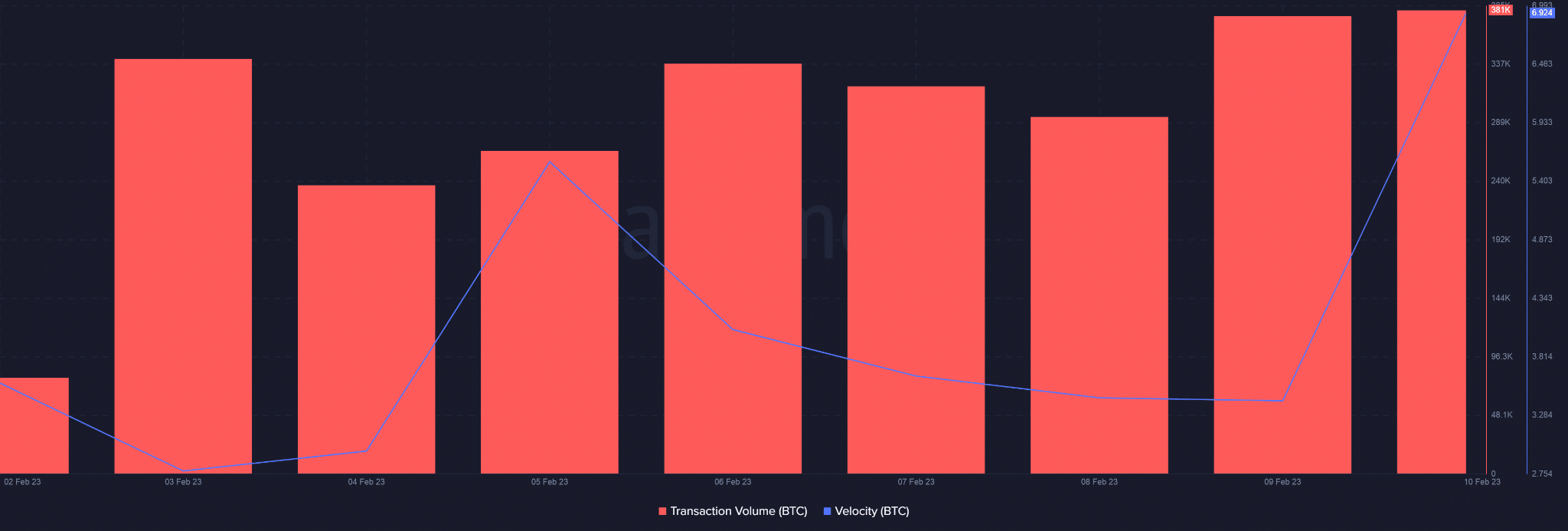

Additional data from Messari’s Twitter thread pointed towards a 25% growth in network fees and an increased share of the available block space.

While Ordinals has presented an exciting new use case, it has also triggered debates around the ultimate purpose of the Bitcoin chain.

Read Bitcoin’s price prediction 2023-2024

How do NFTs on Bitcoin work?

In simple terms, Ordinals are NFTs that can be minted directly onto the Bitcoin blockchain, as opposed to NFTs on Ethereum [ETH] which point to off-chain data and rely on token standards like ERC 721 to create a collection of tokens. Since Ordinals are minted on the blockchain, all content stored is permanent and immutable while Ethereum NFTs can be altered using metadata.

Ordinals focus on BTC‘s smallest units, satoshis. According to NFTNow, the protocol allows users to inscribe each satoshi with data. This data can include smart contracts which are then used to enable NFTs.

Another potential advantage of Bitcoin NFTs over Ethereum NFTs could be the low transaction fee due to the Taproot upgrade which was intended to make Bitcoin transactions more efficient.

However, Ordinals has divided opinions in the crypto community with the naysayers objecting to its non-financial use case which would congest the network and drive up transaction fees on the chain.

On-chain activity picks up decisively

The growth of the Ordinals platform seemed to have heightened the network activity on Bitcoin, data from Santiment showed.

The transaction volumes proliferated over the last week, increasing by more than four times. The velocity indicator revealed a sharp spike as well, implying that BTC moved frequently between wallets.

Source: Santiment

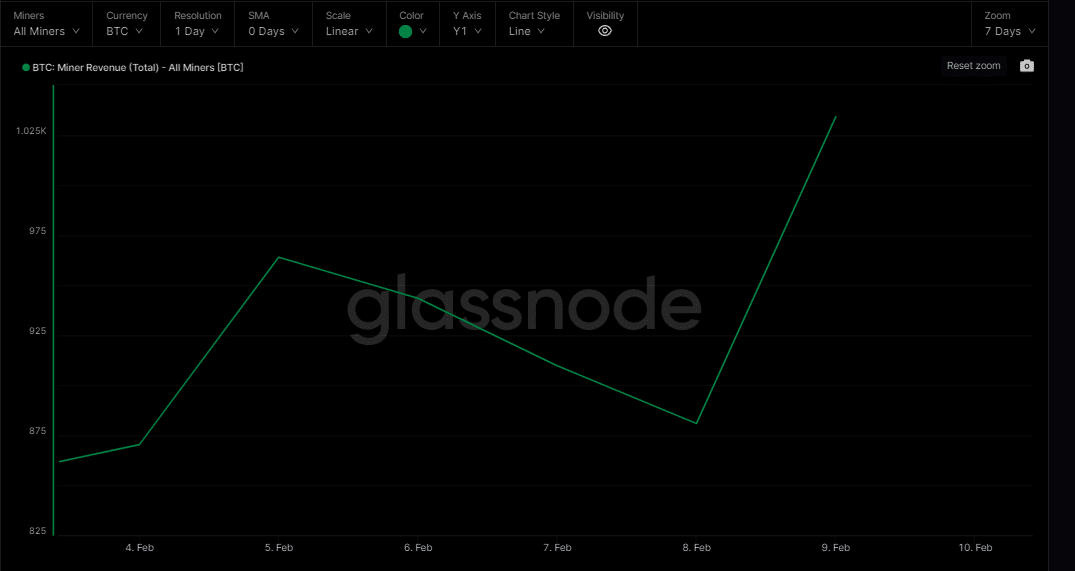

While BTC purists may be spooked by the idea of more network congestion, miners got a chance to rejoice. As per data from Glassnode, the miner revenue witnessed considerable growth after sustained periods of downturn.

With increased rewards for their efforts, BTC mining could become more profitable which is coming from the lows of the 2022 bear market.

Source: Glassnode

How many are 1,10,100 BTCs worth today?

With BTC wilting under pressure due to the SEC’s increased regulations on the crypto market, Bitcoin-native NFTs could provide it with the much-needed impetus in the short run.

With a new target audience in place, it can put the chain in direct competition with market leaders in NFT trading such as Ethereum [ETH] and Solana [SOL].