Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ZIL’s uptrend momentum weakened.

- Open Interest rates and sentiment declined, further reinforcing a possible reversal.

Zilliqa’s [ZIL] increasing divergence amongst key technical indicators could impact investors and traders, not counting the 90% gains ZIL posted in its most recent rally.

Read Zilliqa’s [ZIL] Price Prediction 2023-24

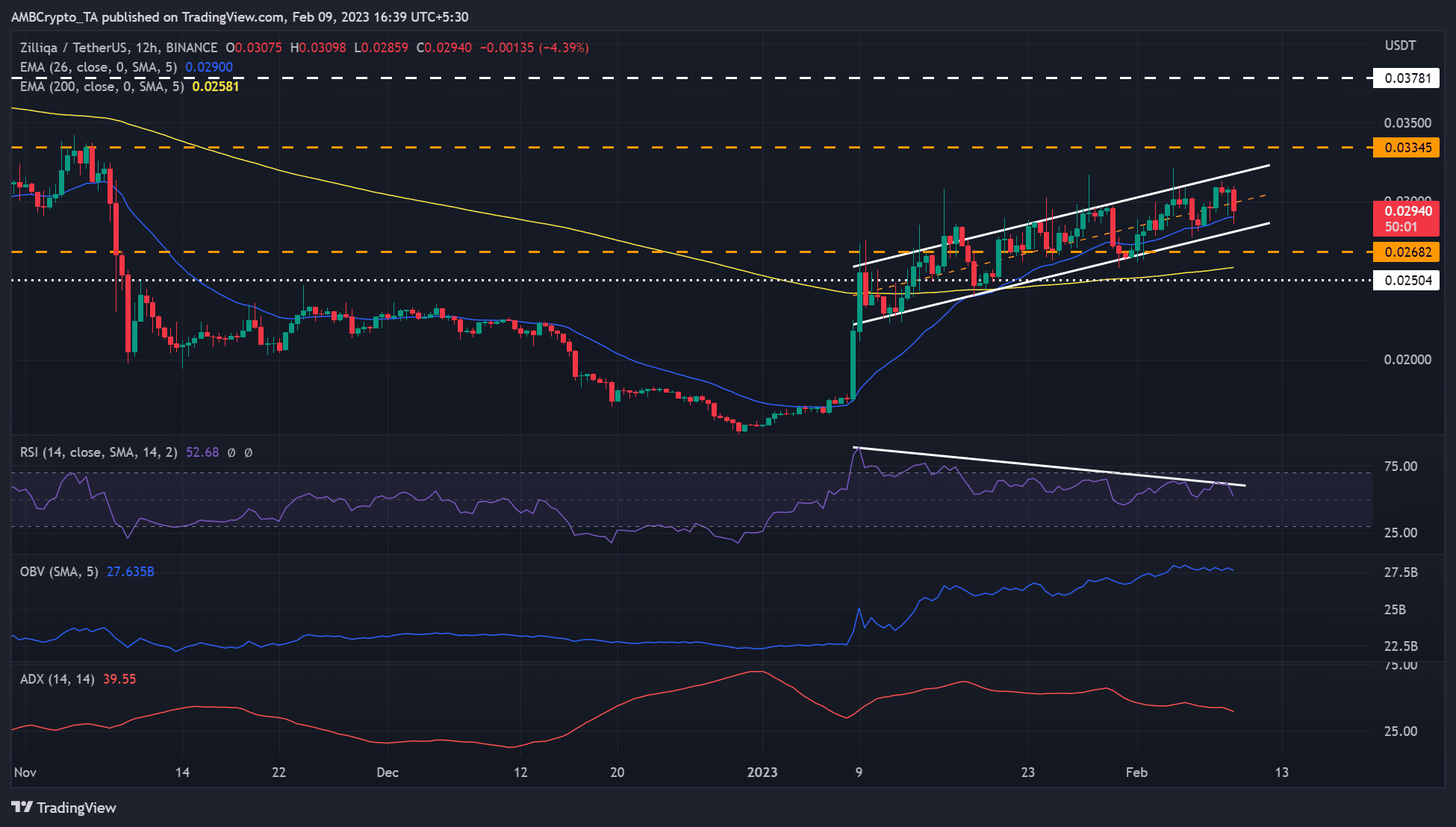

Increasing RSI divergence on 12-hour timeframe chart – Is a price reversal likely?

Source: ZIL/USDT on TradingView

The formation of an ascending channel pattern captured ZIL’s recent rally. Notably, the uptrend saw a massive boost from rising buying power, as evidenced by the rising volumes (uptick in OBV).

However, the surging price action was also marked by a declining Relative Strength Index (RSI), forming a price/RSI divergence. The divergence could suggest a likely reversal, which could target the $0.02504 support level – a 10% plunge. So far, the 26 and 200-period EMAs (exponential moving averages) have been keeping extended drops in check.

But a convincing break above the channel would leverage bulls to reclaim the pre-November level of $0.03345. Such an upswing would invalidate the bias described above.

Regardless, such an upswing may be difficult because of the weakening uptrend momentum, as shown by the Average Directional Index (ADX). The ADX has been making lower highs since mid-January, suggesting the uptrend weakened.

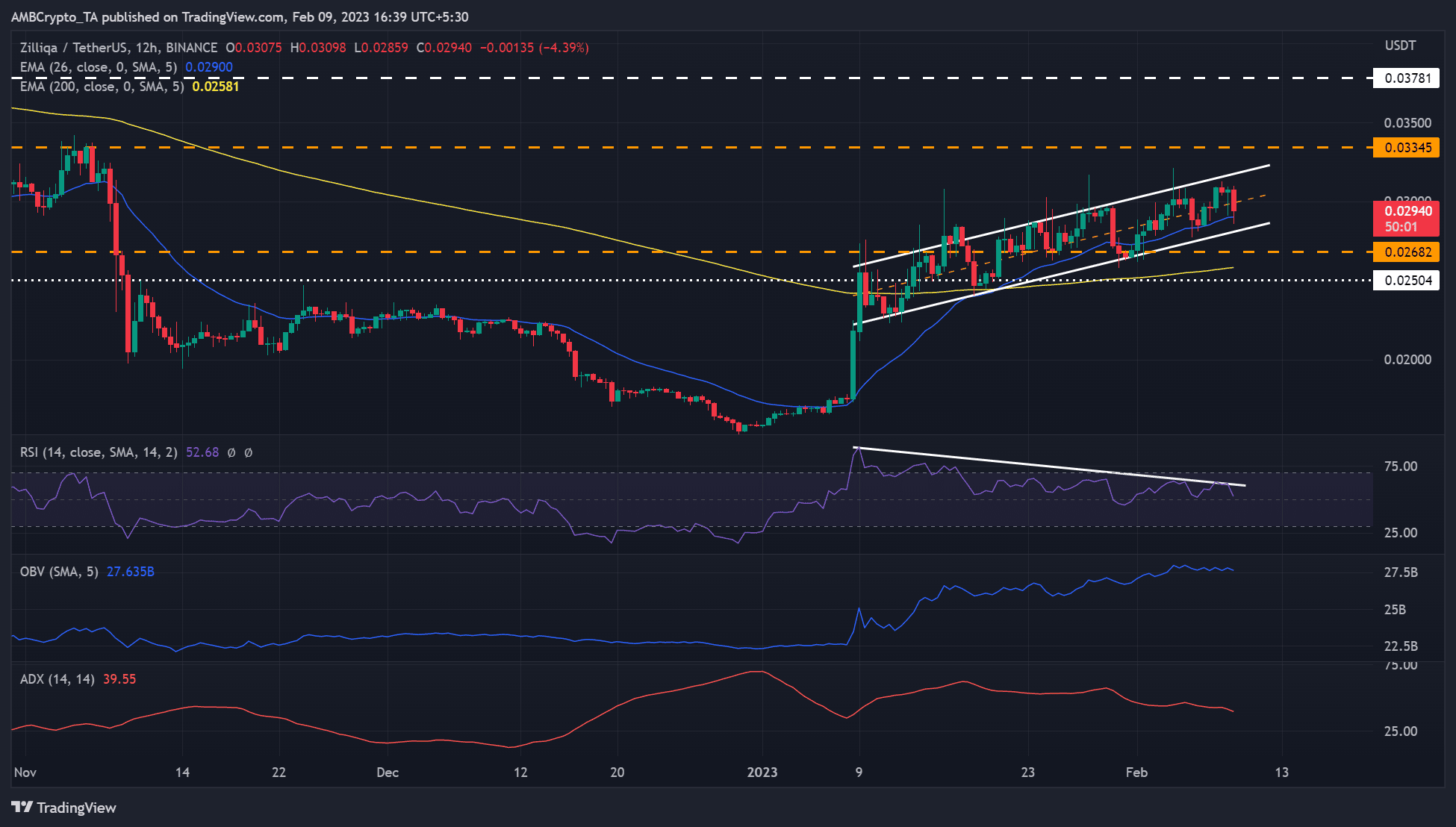

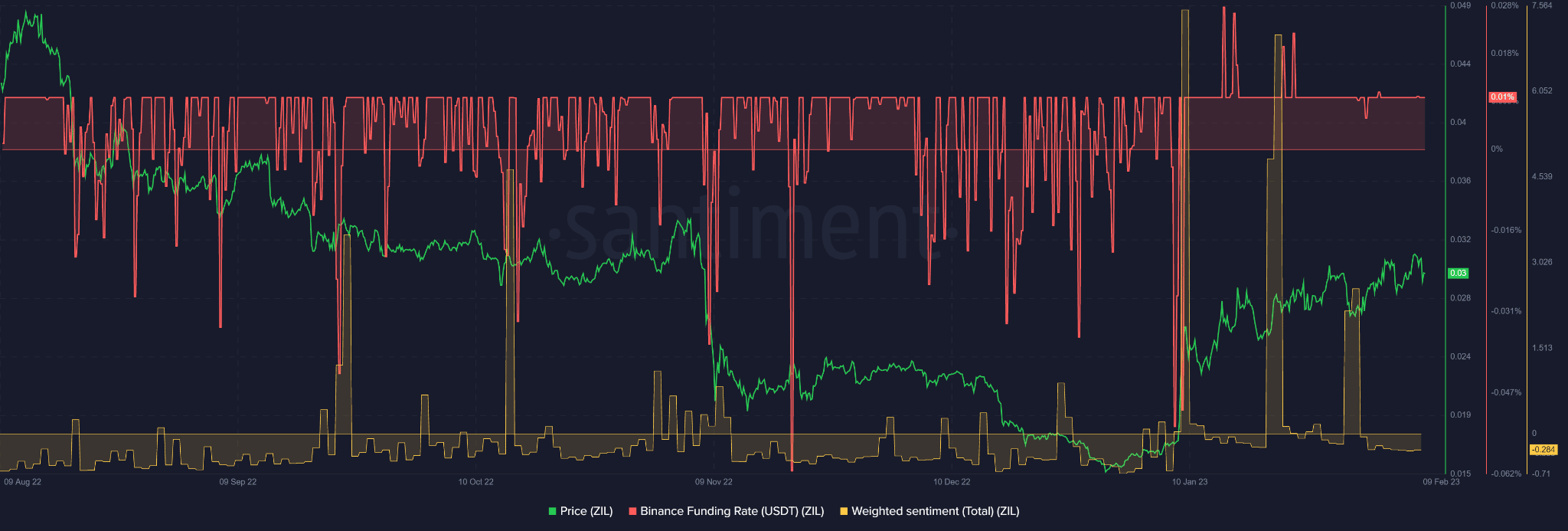

Sentiment turned negative as OI declined

Source: Santiment

ZIL has seen an increase in demand since January, as evidenced by a positive Funding Rate in the same period. However, the asset’s weighted sentiment turned negative at press time. Moreover, waning investors’ confidence could undermine ZIL’s uptrend further.

Is your portfolio green? Check the ZIL Profit Calculator

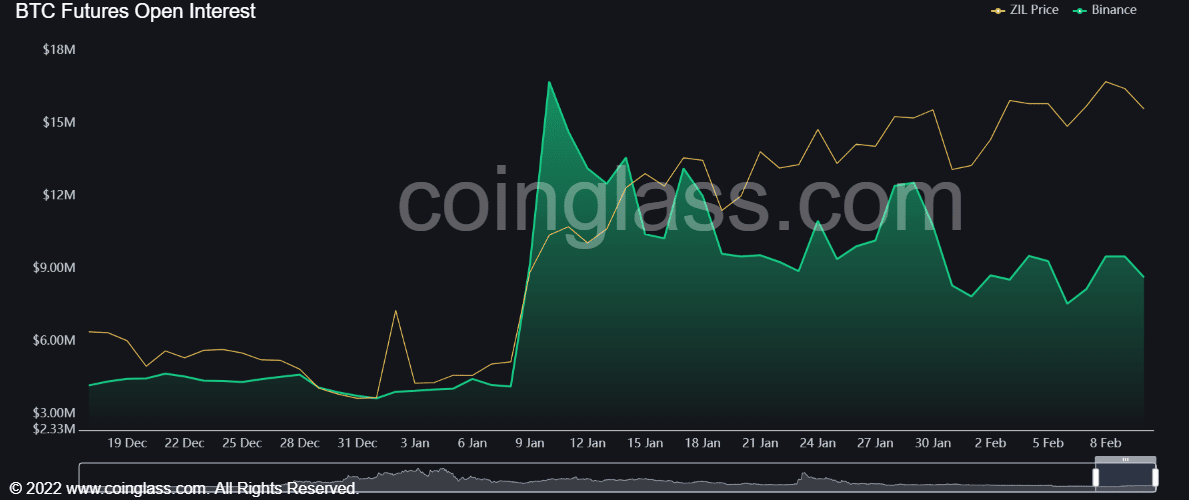

In addition, ZIL’s open interest (OI) rate has been declining since January 10, despite the increasing prices. Therefore, more money flowed out of ZIL’s futures market, which undermined a strong uptrend momentum.

Source: Coinglass

Moreover, the increasing price/OI divergence could signal a possible trend change. Therefore, investors and traders should be cautious with their moves, as the press time ZIL market structure could be a potential “bull trap.”