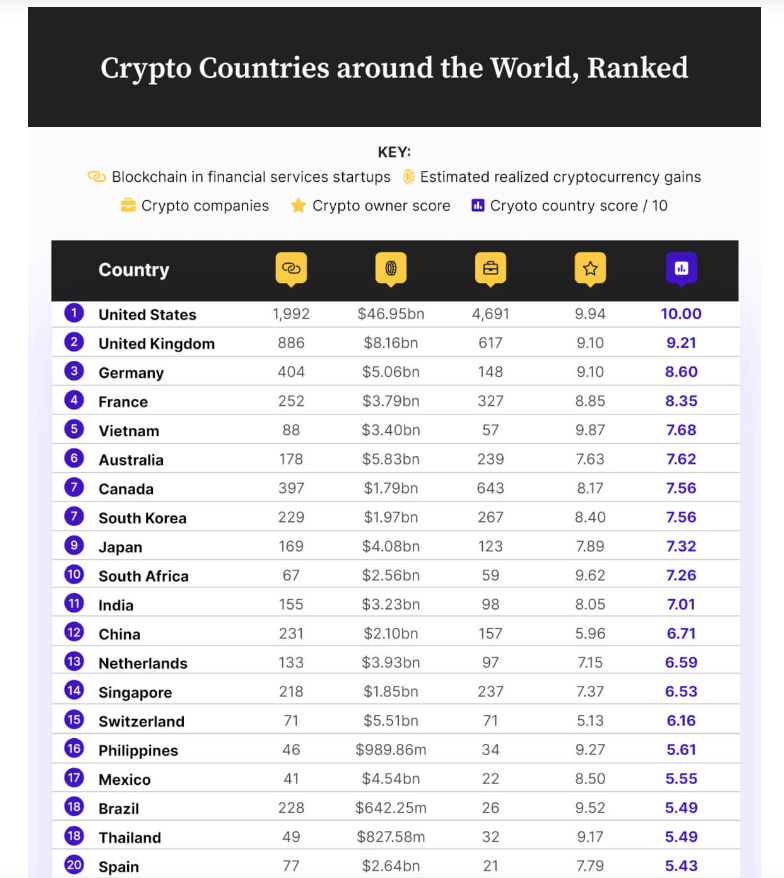

The United States sits perched atop Coin Journal’s list of most desirable crypto countries, garnering a 9.94 score out of 10, recognized as having 1,992 crypto-related businesses that employ 5,691 people, worth $46.95 billion.

The next more successful country, the UK, has a crypto industry worth an estimated $8.16 billion dollars, which employs 617 people across 817 crypto-centric businesses.

Germany came in at number 3, followed by France and Vietnam, with a combined total of $17 billion worth of blockchain fin-tech start-ups and businesses between them.

Together with the UK, the remainder of the top 5 did not even value half that of crypto startups in the US.

In crypto, money talks, and the industry tends to gravitate towards geographies with capital that can be put to work.

In years past, other countries have sporadically made various top five lists, such as Switzerland, home to Zug ‘s famous “crypto valley” canton; the United Arab Emirates , home to Binance and famously CZ himself, and Estonia, once referred to as the “digital capital of Europe.”

The list, but also other lists like Chainalysis’ annual crypto city rankings, tend to draw heated debate online, as people argue about whether other factors such as quality of life or cost of living should factor into the methodology of rankings.

According to Coin Journal’s report, which is its first, multiple factors were taken into its methodology. They included the number of cryptocurrency owners by country, investment companies, crypto startups, and the estimated average gains from crypto per country.

Whereas other reports — such as the more extensive Geography of CryptoCurreny Report, published annually by Chainalysis — include wider issues like the macroeconomic environment, policy, and regulatory conditions when making its recommendations.

Though money obviously plays a key role in determining the success of any crypto environment, it does not necessarily reveal the whole picture. Moreover, with the cryptocurrency industry itself also subject to near-constant change, not to mention the whack-a-mole with regulators getting swifter by the year, the US–at least according to this year’s Coin Journal report–continues to be the risk-off destination of choice for crypto capital.