- Chiliz Chain 2.0 generated its first block amid a CHZ decline.

- Social metrics spiked but long suffered immense liquidations.

On 8 February, Chiliz [CHZ] announced that its recently launched chain 2.0 had produced its first block. According to the tweet shared by its CEO Alexandre Dreyfus, the event occurred at exactly 8:08 am UTC.

Breaking. @chiliz Chain 2.0 Genesis First Block was produced on 8th February at 8.08am UTC. The new Layer-1 EVM blockchain is launched with a great focus on South Korea thanks to Min-Jae Kim’s new role. A lot of news today about $CHZ. Stay tuned. pic.twitter.com/H2DBN4D85q

— Alexandre Dreyfus (@alex_dreyfus) February 8, 2023

How much are 1,10,100 CHZs worth today?

Five years is no celebration for CHZ holders

Interestingly, the block generation coincided with Chiliz’s fifth anniversary since its launch. Recall that the Chiliz Chain 2.0 had passed several Testnet phases. And, the project added an NFT collection a week back.

With the launch of its Layer-one (L1) EVM, Dreyfus stated that it would help in growing the Chiliz developer community. As such, the project would launch a hackathon.

News: To support the launch of the @chiliz layer-1 protocol, we will organize a Chiliz World Tour series of Hackathons in stadiums & sports arenas globally. This will help grow the dev community but also grow the exposure of Web3 x Sports in mainstream media. $CHZ pic.twitter.com/8XRWrPW5QI

— Alexandre Dreyfus (@alex_dreyfus) February 8, 2023

Despite the developments, CHZ resisted the upside. According to CoinMarketCap, the blockchain sports token price fell a whopping 10.98% in the last 24 hours. The volume which describes the transaction happening on the network also dropped by 52.57%.

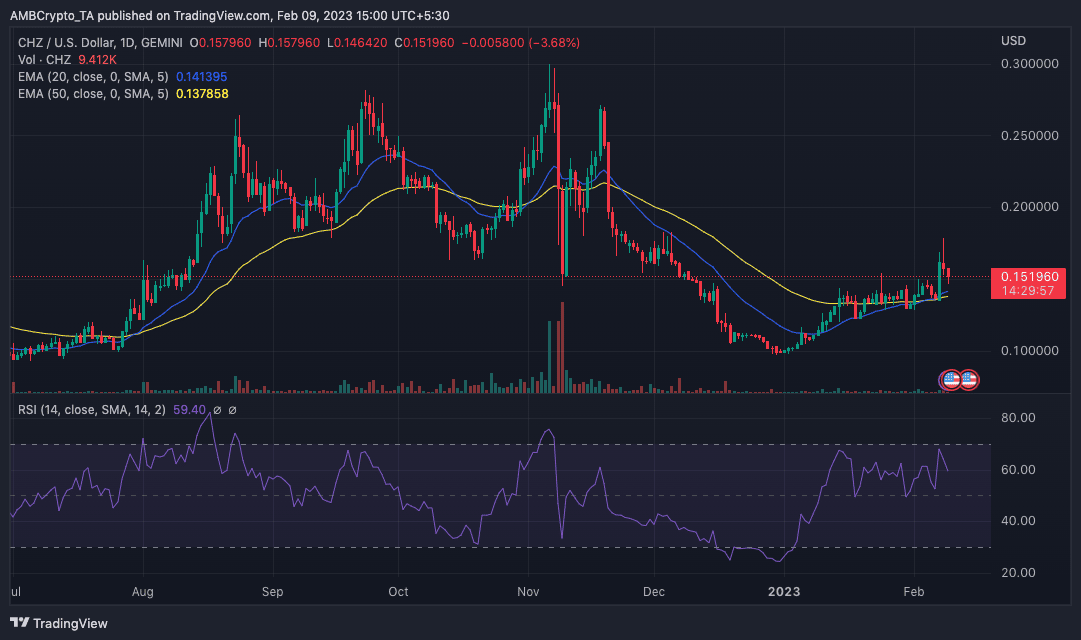

However, an indication from the daily chart showed that CHZ had recently exited an overbought level per the Relative Strength Index (RSI).

At the time of writing, the RSI was at 59.40— a good buying momentum. But with the trend facing downwards, there was a chance that the CHZ momentum might eventually become bearish.

As per the Exponential Moving Average (EMA), the signals from the daily placed 20 (blue) and 50 EMA (yellow) close to each other.

A scenario like this reeks of possible consolidation. Hence, investors might need more observations to decide if to go long or short CHZ in the interim.

Source: TradingView

Of euphoria and rip-ups

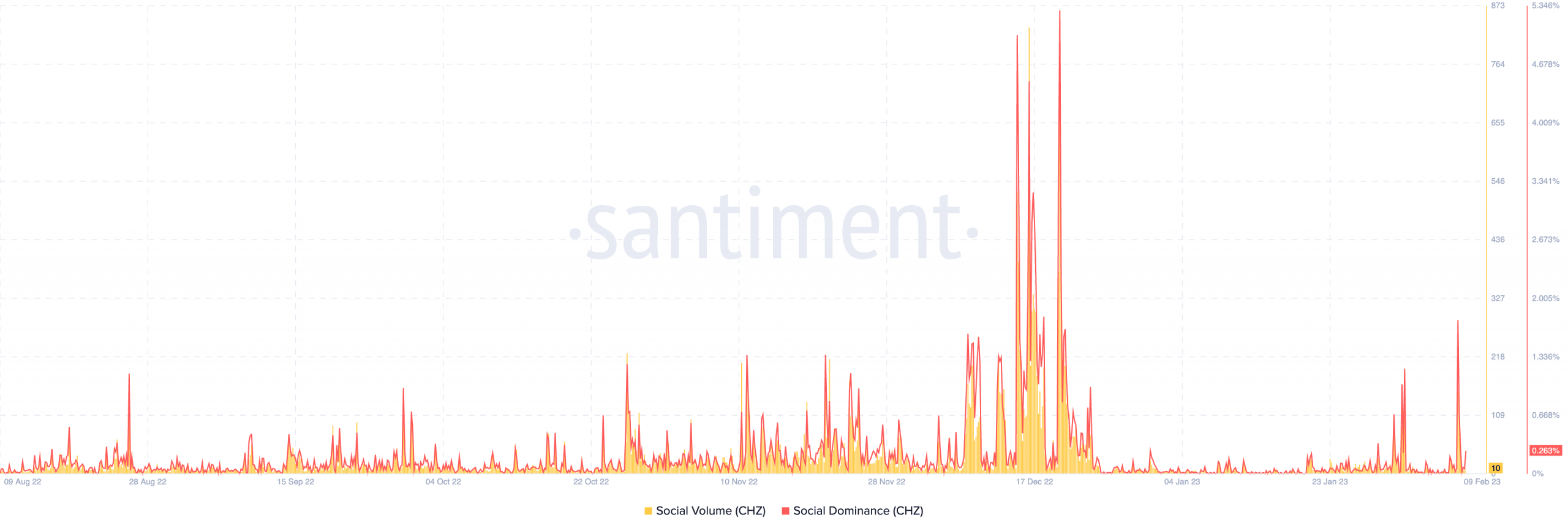

While the CHZ price swung towards the negative, there was some positive outlook on-chain. Based on information coined from Santiment, the social volume hit a two-month high as it burst through to 1.72% on 8 February.

Social dominance is built on data measuring the discussion around an asset. So, the increase implied that CHZ was one of the tokens on the investors’ radar on the said date.

Is your portfolio green? Check out the Chiliz Profit Calculator

While the social volume also picked a similar trend, data at press time showed that it had decreased. This means that the search for the asset had reduced compared to the previous highs.

Source: Santiment

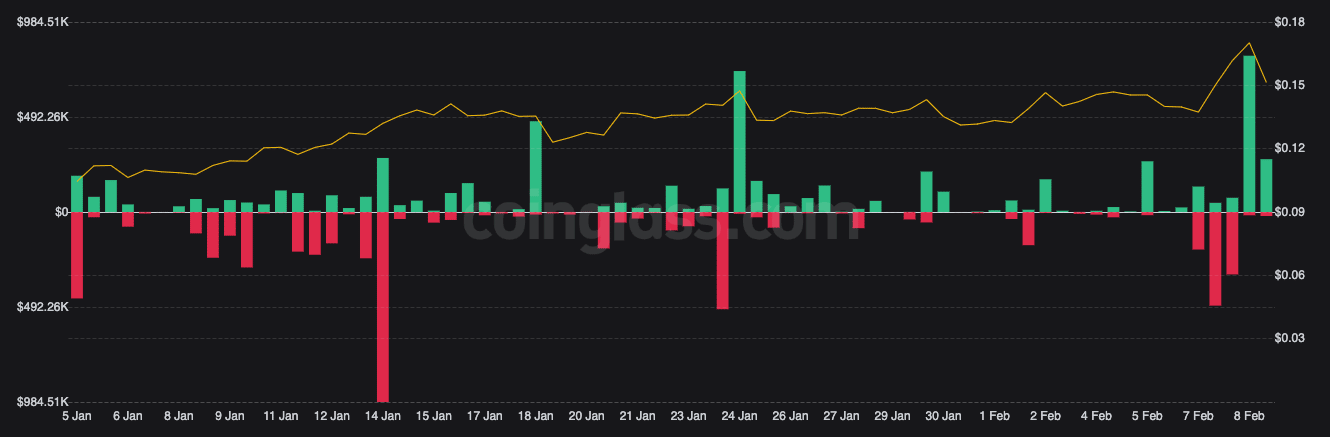

Meanwhile, long-positioned traders bore the brunt of the CHZ decline. According to Coinglass, about $1.14 million worth of traders’ open orders were liquidated in the last 24 hours.

An evaluation of the data shown by the derivatives information provided that longs accounted for over 90% of the wipeout while shorts suffered little.

Source: Coinglass