- Lido highlighted improvements in many areas.

- LDO surged while network growth declined.

Lido Finance’s [LDO] tweet on 6 February highlighted the impressive growth of MakerDAO [MKR] and Aave’s [AAVE] lending pools on its protocol. Over the last week, MakerDAO’s steCRV experienced a surge of 636%, while Aave’s Wrapped stETH [wstETH] increased by 140%.

Lido Analytics: Jan 30 – Feb 06, 2023

TLDR:

– Lido crossed 5.05M ETH staked on Beacon Chain.

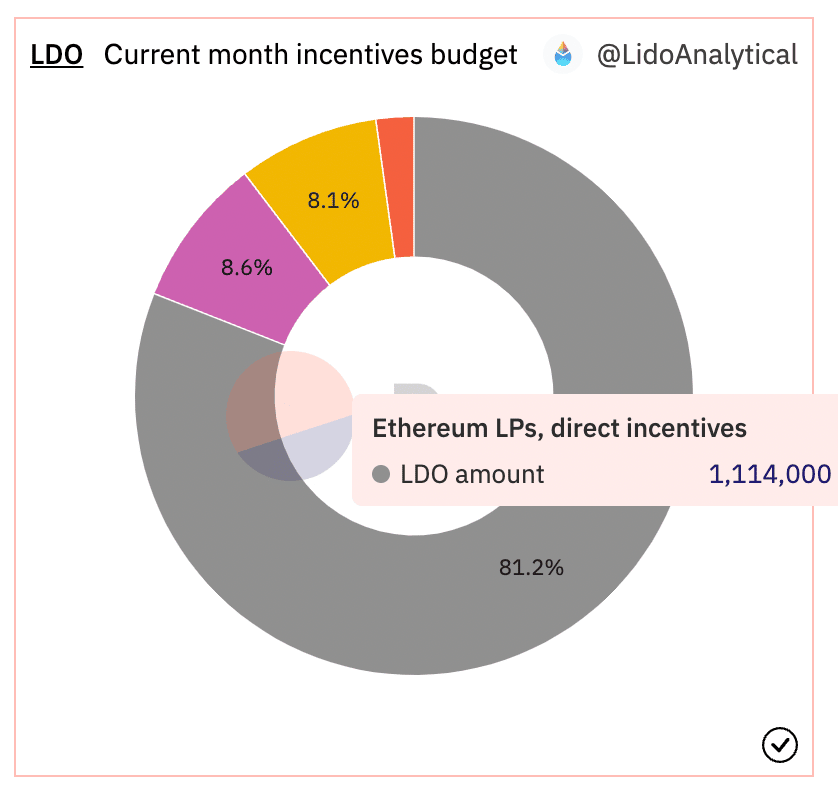

– Feb incentives of 1.95M LDO are live.

– New lending pools on Ethereum are rocketing, incl @MakerDAO steCRV: 33,599 (7d: +636%) and @AaveAave V3 wstETH: 29,480 (7d: +140%). pic.twitter.com/w6CJXIrXcc— Lido (@LidoFinance) February 6, 2023

Is your portfolio green? Check out the Lido Profit Calculator

This growth can be attributed to several factors, including the growing number of ETH staked on the beacon chain through Lido.

New incentives

In addition, Lido has also been offering an increasing number of rewards and incentives to attract more users. These efforts have led to a significant increase in TVL and deposits.

Over the last seven days, the overall TVL for Lido grew by 3.83%. It stood at $8.42 billion at press time, according to Defi Llama.

Source: Dune Analytics

Whales flock to Lido

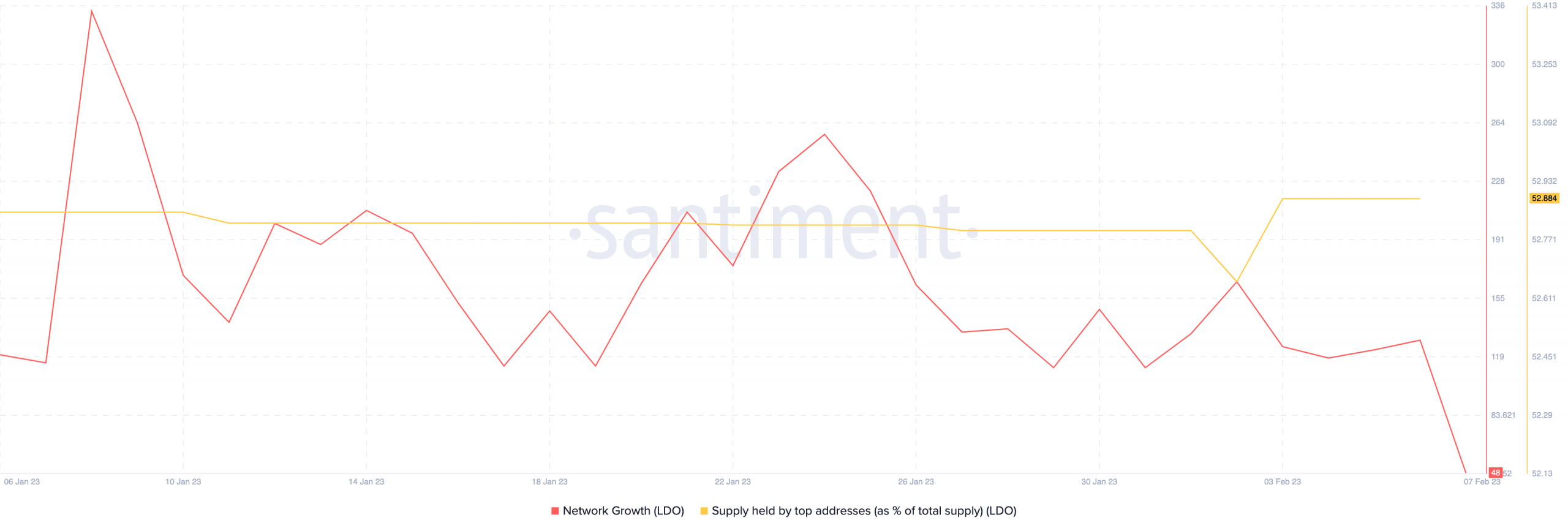

These positive developments piqued the interest of whales, as they showed interest in the token over the last week. According to data provided by Santiment, the percentage of LDO held by large addresses grew. This suggested that large investors wanted to be exposed to Lido protocol’s growth.

However, the increasing whale interest could pose a threat to retail investors. If these whale addresses decided to sell their positions for a profit, it could result in retail investors losing a lot of money.

This could be one reason why the LDO token witnessed a decline in network growth, as new addresses may not be as interested in LDO as once thought.

How much is 1,10,100 LDO worth today?

Source: Santiment

Despite this, the growth of MakerDAO and Aave’s lending pools on the Lido protocol was a positive sign for the crypto community. It suggested that users were increasingly looking for decentralized lending and borrowing solutions.

Whether Lido will continue to thrive in the face of declining network growth remains to be seen.