- Rising gas prices could affect Ethereum.

- NFT trades decline, but traders show optimism.

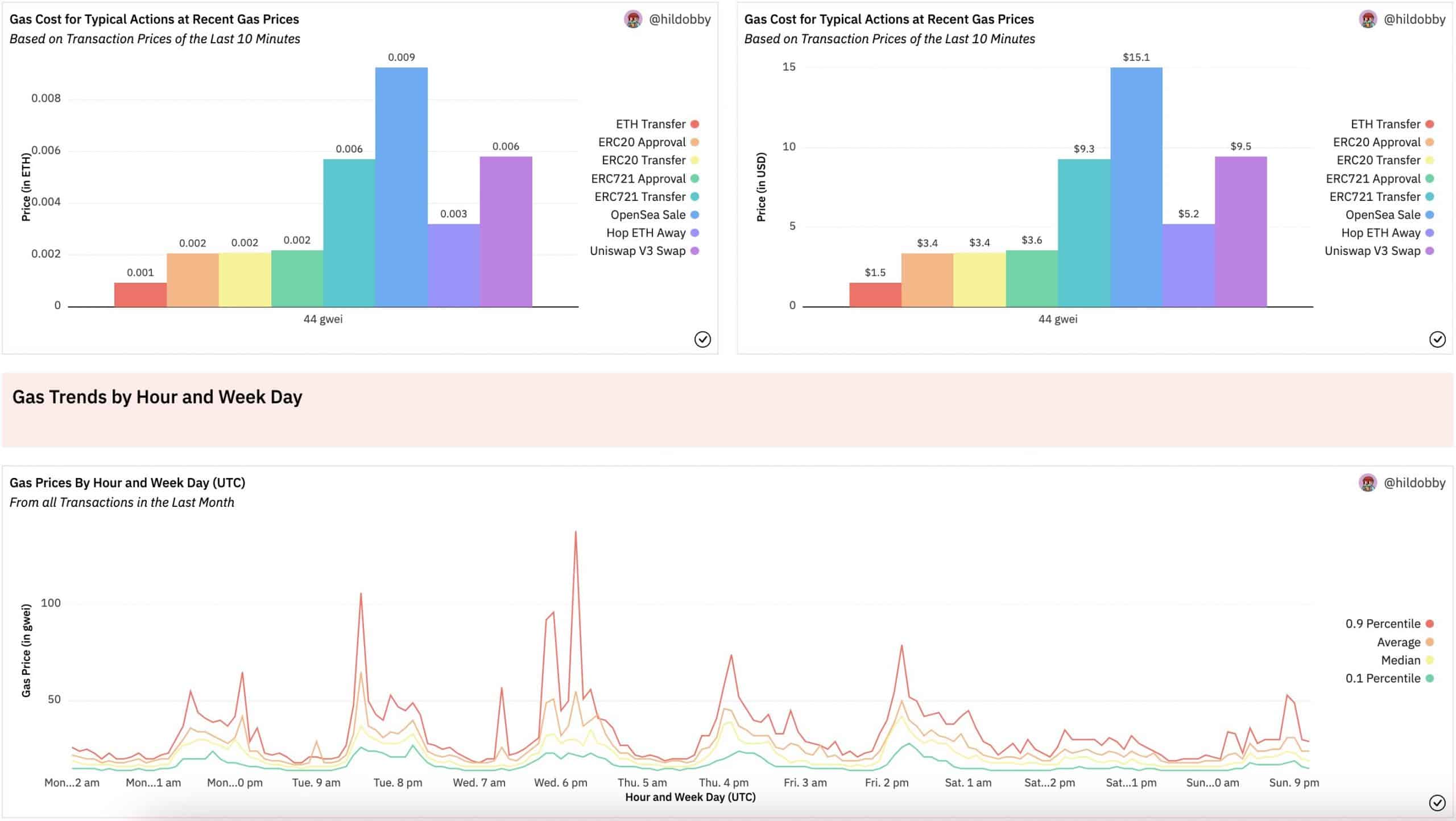

As the Ethereum [ETH] network continues to grow, new data has revealed an alarming trend. Gas fees on the Ethereum network have been steadily increasing since the network’s recent merge. This rise in gas prices might hinder the adoption of Ethereum, as it could make the network inaccessible to users who cannot afford the fees.

Ever since the Ethereum merge, gas prices have been on an uptrend

1/2 pic.twitter.com/TzEl7cAgzA

— hildobby (@hildobby_) February 6, 2023

Read Ethereum’s [ETH] Price Prediction 2023-2024

The growing gas prices have had a direct impact on the number of active addresses on Ethereum. As the cost of transactions increases, fewer users may be willing or able to take part in the network, leading to a decline in active addresses.

The NFT market gets affected

The cost of transactions also varies depending on the type of transaction, with the highest gas prices seen for Ethereum NFT transactions. This has contributed to a decline in interest in Ethereum NFTs, as the cost of creating and trading these digital assets becomes increasingly prohibitive.

Source: Dune Analytics

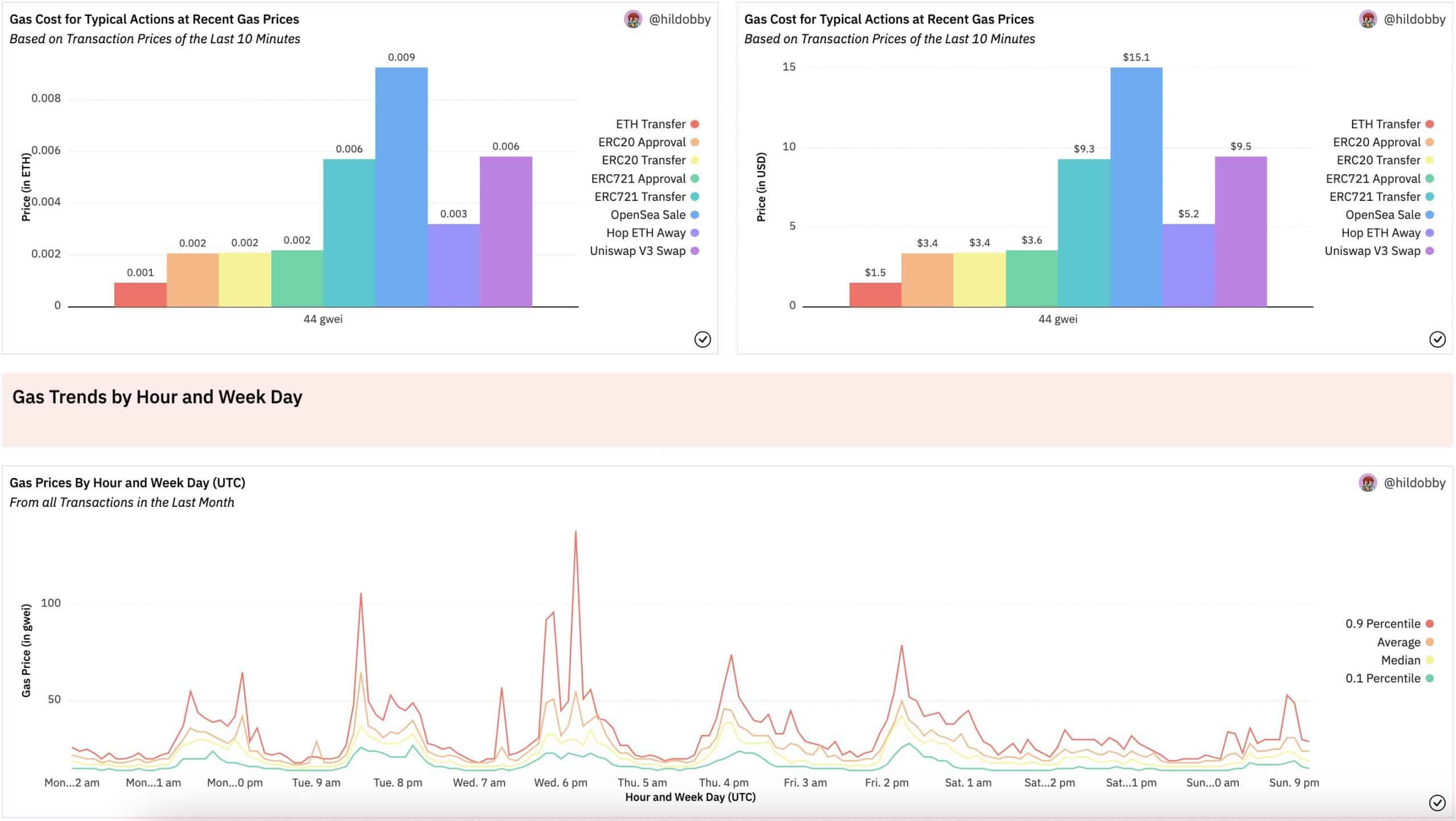

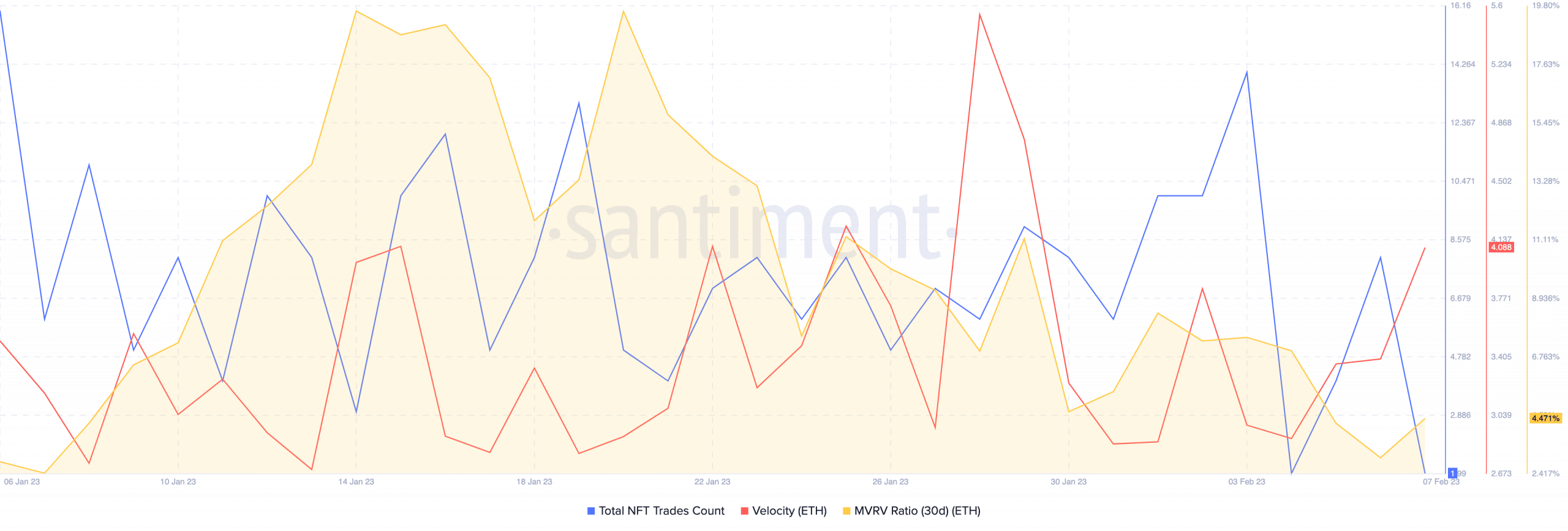

Despite the challenges posed by the rising gas prices, there are some signs of optimism on the Ethereum network. One of these is a surge in the velocity of ETH, indicating that the frequency with which ETH is being traded amongst addresses has increased.

At the same time, the MVRV ratio declined, meaning that most Ethereum holders would not make a significant profit if they were to sell their holdings at this time. This reduced the sell pressure on Ethereum and made it less likely that the price will drop in the future.

Source: Santiment

Traders turn positive

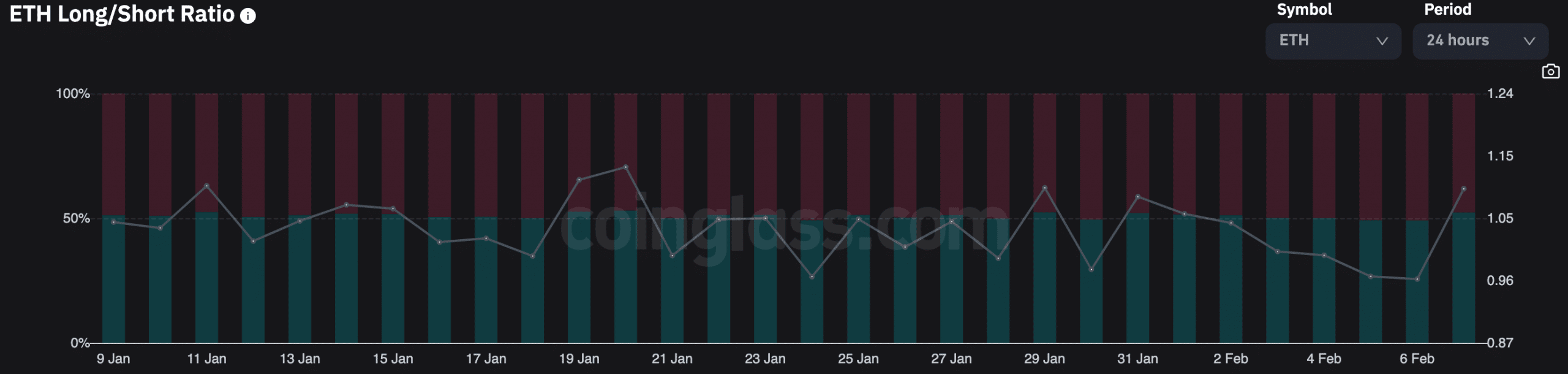

Additionally, traders were becoming increasingly optimistic about Ethereum as long positions on the network increase. According to Coinglass, over 52% of all positions on Ethereum were long positions. This indicated that traders believed that the price of ETH would continue to rise. This growing optimism, coupled with the reduced sell pressure, could contribute to a more stable Ethereum market in the future.

How much are1,10,100 ETH worth today?

Source: coinglass

Overall, the increasing gas prices on the Ethereum network are a cause for concern for holders.

While these rising costs could potentially limit the network’s adoption, there are also indications of growing optimism and stability in the network. Only time will tell whether these positive developments will outweigh the challenges posed by the rising gas prices.