Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The higher timeframe market structure remained strongly bullish.

- The $0.4-$0.42 is an important region of resistance- but ADA is likely to push higher.

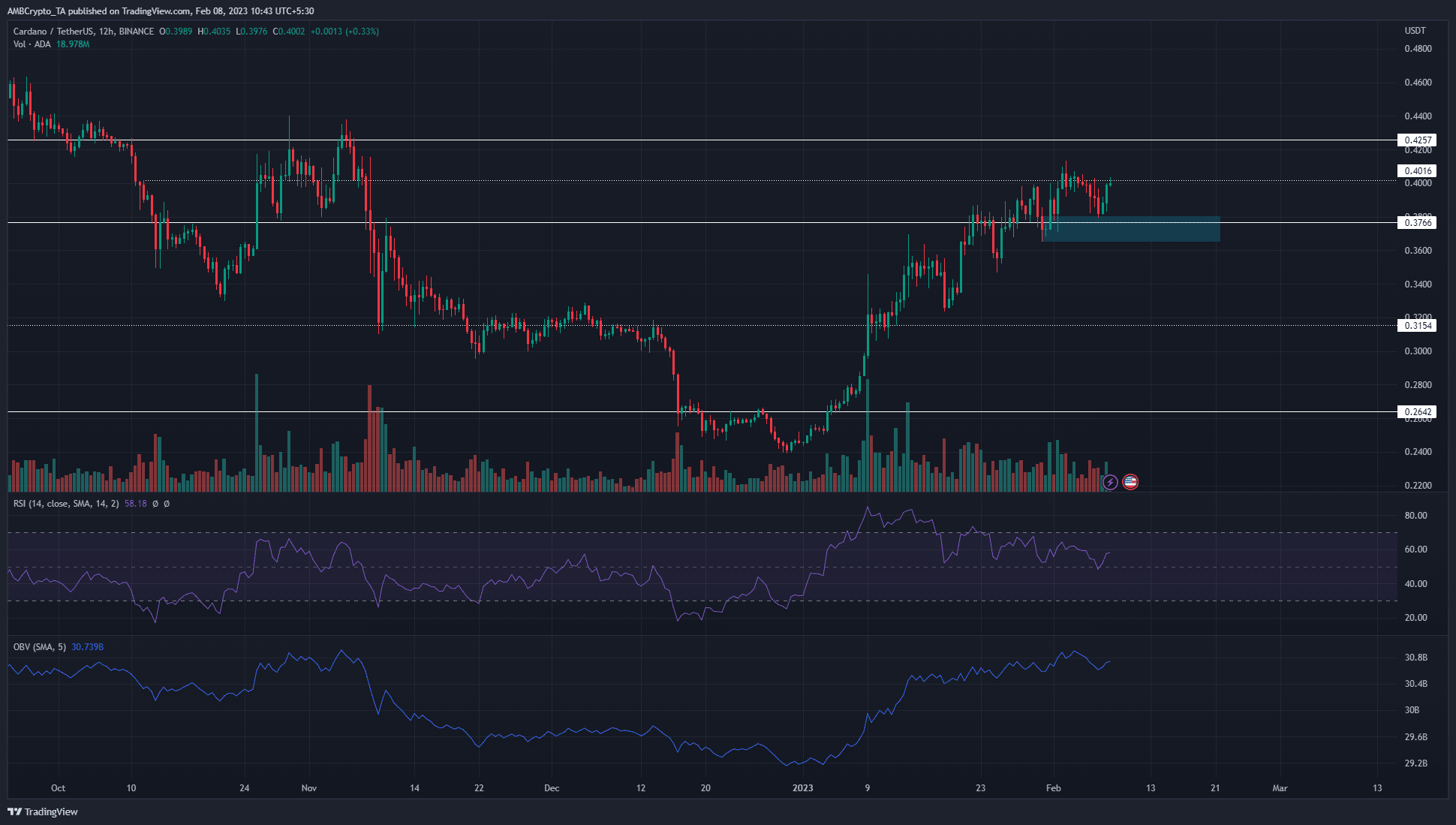

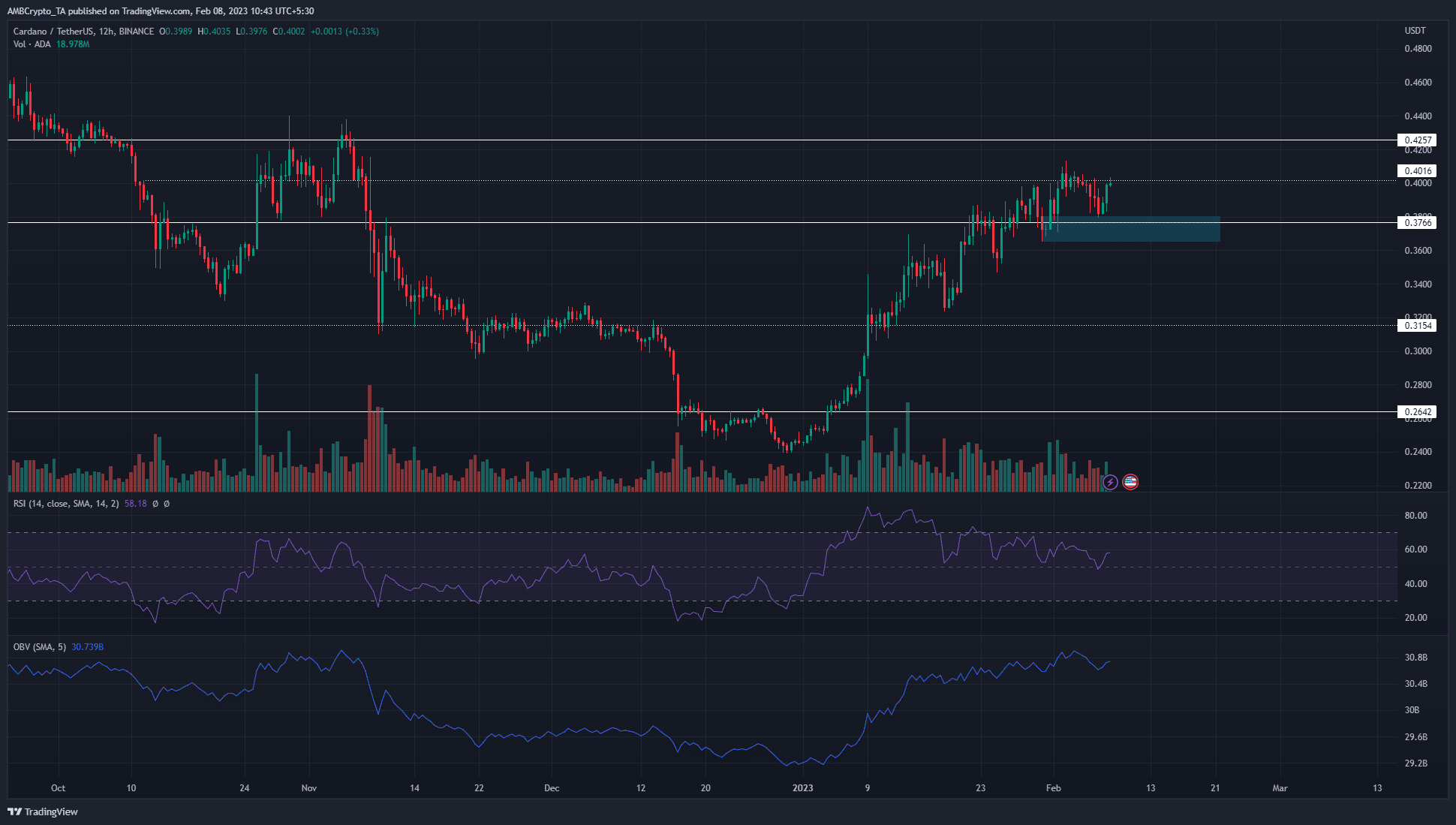

Cardano [ADA] bounced from $0.38 to reach the $0.4 level of resistance over the past three days. Its technical structure remained bullish on the one-day timeframe – a move above $0.4 and subsequent retest could be a buying opportunity.

Is your portfolio green? Check the Cardano Profit Calculator

The increase in whale transactions saw a significant increase after 3 February. This raised concerns that buyer dominance was weakening.

Any pumps into the $0.42 area will be to take profits on

Source: ADA/USDT on TradingView

Cardano has seen a remarkable run so far. A jump above $0.31 and the subsequent retest of $0.32 saw the support on the daily market structure decisively broken. The bias remained bullish, although the RSI continued to drop lower to show weakened bullish momentum.

This was because ADA encountered a stern band of resistance around $0.4. It is an important higher timeframe horizontal level. The $0.425 level acted as support from May to October 2022. Beneath it, the $0.4 and $0.376 levels also acted as important support and resistance levels in October and November.

How much is 1, 10, 100 ADA worth today?

Therefore, ADA bulls late to the party must recognize that the meat of the move upward is finished. Lower timeframe scalps within the $0.4-$0.42 region is possible. Longer-term buyers can wait for the flip of $0.42 to support before bidding and must be ready to cut the trade on a drop below $0.4.

The rising OBV meant some demand was present behind ADA. Above $0.42, $0.51 and $0.6 are the next high timeframe levels to watch out for.

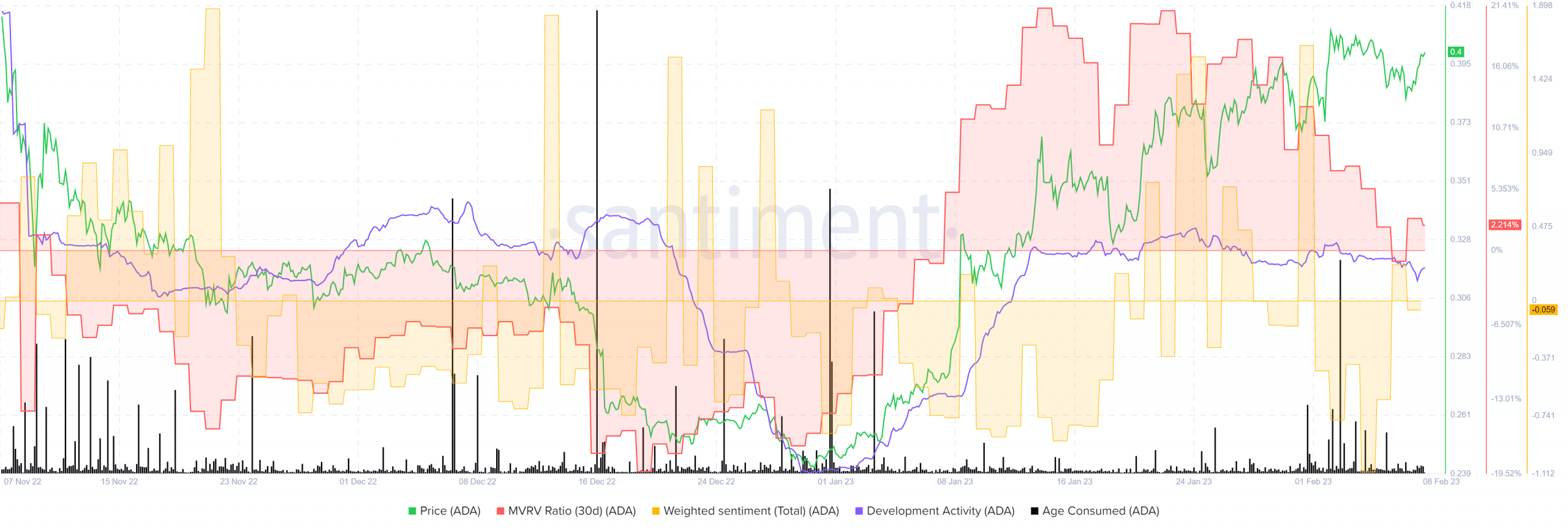

Sentiment has been lukewarm in February

Source: Santiment

Weighted sentiment fell below the zero mark as February 2023 began and hasn’t recovered since. The MVRV ratio (30-day) also tumbled, but the price did not see a significant sell-off. This hinted that near-term holders might have finished booking profits, and selling pressure could soon abate.

The development activity was unaffected by the higher price swing, which should encourage long-term holders. The age-consumed metric saw a swift spike in early February when ADA pulled back from $0.413.