Bitcoin has been recovering strength and is now trading above the $23,000 mark, after the announcement on Tuesday by US Federal Reserve Chair Jerome Powell that inflation is beginning to decrease. On the other side, Ethereum has recently been able to maintain stability at the $1,650 mark.

Furthermore, the news that Digital Currency Group and Genesis have reached a preliminary deal with their key creditors has been regarded as another important element that has strengthened the market confidence and contributed to bitcoin’s rise.

However, the market reacted positively to the news and reached a market worth of $1.09 trillion. While Ethereum is up a startling 3 percent and trading at $1,680, Bitcoin is up 1.72 percent and has surpassed the $23,000 barrier.

Current Market Scenario

The crypto market is flashing green, and expressing confidence, as the US Fed chairman has signaled that the fight against inflation might be over and the disinflationary process has begun.

The market reacted quickly to the favorable news, reaching a market worth of $1.09 trillion. US Federal Reserve Chair Jerome Powell reiterated his anti-inflation position yesterday. This mindset has benefited the cryptocurrency market, especially the price of Bitcoin.

As a result, the BTC price soared dramatically, hitting $23,300 levels.

Furthermore, the news that Digital Currency Group and Genesis have reached a preliminary arrangement with a group of their key creditors has also played a huge role in underpinning the crypto market confidence. Notably, the agreement involves the sale of Genesis’ insolvent firms, as well as the refinancing of existing loans.

Will The Bearish US Dollar Propel Bitcoin To All-Time Highs?

The US dollar fell on Wednesday as Federal Reserve Chair Jerome Powell gave no hint of a hawkish pushback against the country’s solid labor market. This encouraged chances that interest rates will not increase much higher.

Powell recognized that if economic conditions continued favorable, interest rates could need to increase more than anticipated. But he reaffirmed his belief that a process of disinflation was already in motion.

The US dollar strengthened last week after it appeared that the employment statistics would show an increase in the unemployment rate and the number of employed people. But its climb was short-lived and has since significantly dropped again, closer to what it was during this summer.

There was increased optimism among investors around the U.S. dollar index of 103.96, which ultimately lead to a one-month high in Fed Funds on Tuesday. Interest rates are expected to reach their target level of 5% by June according to futures trading.

Genesis & Digital Currency Group Reach A Historic Agreement To Transform The Digital Assets Market

According to remarks made by Sean O’Neal of Cleary Gottlieb, who is representing Genesis, a restructuring arrangement has been reached with significant creditors. The agreement will involve restructuring the debt that Genesis Holdco, one of the companies that previously applied for Chapter 11 protection, owes to Digital Currency Group, the company that controls Genesis and its subsidiaries.

These conditions include a second lien term loan arrangement with a June 2024 maturity date.

Plus, this would also include the sale of Genesis Global Trading, among other actions geared to maximize the estate’s recovery. As a result, this positive development has had a significant positive influence on Bitcoin prices

Bitcoin Price

The current Bitcoin price is $23,206, and the 24-hour trading volume is $26.9 billion. Bitcoin has increased by 1.13% in the last 24 hours. With a live market cap of $447 billion, CoinMarketCap currently ranks first.

On the 4-hour timeframe, Bitcoin is now facing immediate resistance at the $23,325 level, with closing candles below this level potentially leading to a drop in BTC price to $22,750 or $22,350.

Because technical indicators like the RSI and MACD are in a buying zone, an increase in buying pressure could push the price of bitcoin toward the $23,700 mark. The BTC/USD pair may find support at $22,750, with a break below this level exposing BTC to the $22,400 level.

Buy BTC Now

Ethereum Price

The current price of Ethereum is $1,673, with a 24-hour trading volume of $8.5 billion. In the previous 24 hours, Ethereum has gained 2.39%. CoinMarketCap now ranks #2, with a live market cap of $204 billion.

The ETH/USD pair has broken through a symmetrical triangle pattern that was extending resistance at $1,675, and closing candles above this level is likely to push the ETH price up to $1,725 or $1,725.

On the lower side, a break below the $1,620 level can expose BTC to $1,550 levels.

Buy ETH Now

Bitcoin and Ethereum Alternatives

The top 15 cryptocurrencies for 2023 were recently identified by CryptoNews Industry Talk. If you want to invest in something more promising, there are many other options to consider.

The number of available cryptocurrencies and new ICOs (Initial Coin Offerings) increases on a weekly basis.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

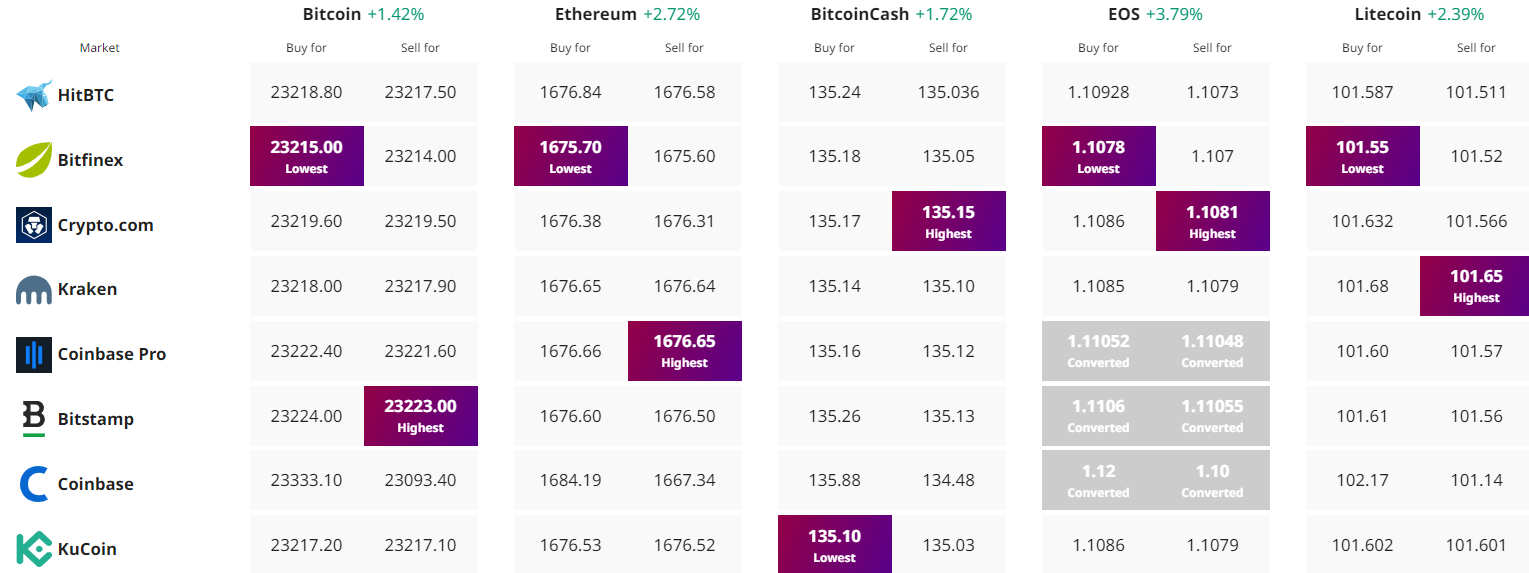

Find The Best Price to Buy/Sell Cryptocurrency