Bitcoin is on a continuous fall, trading at about $22,886 early Tuesday morning. On the other side, Ethereum has recently been able to maintain stability at the $1,600 mark. Market players are concerned following Friday’s surprisingly positive job data. While investors await the Fed chairman’s address later today.

Bitcoin was on an upward trend in the first week of February, reaching a new high of more than $24,000. The token, however, was unable to hold the $24,000 level, and the price dropped below the $23,000 mark. Market experts believe that February will be less successful than January.

Market experts have warned that the current trend in crypto and stocks may reverse this month due to the uncertainty around the possible impact of upcoming macroeconomic data from the United States on market sentiment. However, the reason for the negative trend could be attributed to the Federal Reserve’s recent interest rate rises.

What Powell’s Speech Could Mean For Crypto Prices?

The US markets were relatively quiet after last weekend, with interest rates remaining unchanged and inflation data continuing to be weak. The next couple of times the Federal Reserve raises interest rates will depend on how the economy evolves over the coming period. People are expecting a decline in economic conditions, which may prompt policy easing. The dollar and US Treasury yields have enjoyed a period of appreciation, but that is now likely to change. This is undermining the effectiveness of the Fed’s hikes around the short end of the curve as it tries to maintain a low level of inflation in its system.

His appearance at the Economic Club of Washington on Tuesday, 7th February was a highlight for the week. In case the Fed fails to push back meaningfully against the market reaction, this could imply that the Fed itself is relaxed with what’s been happening. This risks pushing it further in the direction of pricing future interest rate cuts. Several other Federal Reserve officials are scheduled to speak during the week.

Introducing The Most Powerful Crypto Miner Ever: What It Can Do For You

Riot just announced that they produced 740 Bitcoin in January, a new annual record. The amount is proof that the company has been succeeding in its goal of generating more Bitcoin and creating new records. Analysts say that this was considered a key factor in stabilizing the BCH price.

Riot faced significant challenges to its business following the disastrous collapse of its competitor and the subsequent crypto winter. Bitcoin’s value had decreased by 64% by 2022, which affected mining difficulty and why it increased.

As the price of Bitcoin rises, some companies have been increasing their mining output. This is because they see an opportunity to make an even greater profit by using the new resources provided. The riot was able to boost its Bitcoin mining output by 62% from January 2022 to the present. They generated 740 BTC in January 2018, a significant increase over the 458 BTC they generated in January 2022.

Why The US Dollar Is Losing Its Power?

The recent dips in the US dollar were another crucial element that might limit further losses in the BTC. The US dollar fell from its early-week gain on Tuesday, but it stayed near a one-month high as traders raised their forecasts of US Federal Reserve interest rate levels necessary to limit inflation.

Markets were recovering from the surprise of Friday’s US job statistics, which indicated that non-farm payrolls increased by 517,000 in January, showing a continuously healthy labor market.

However, the report boosted the US dollar in earlier sessions, but it gave back some of those gains in Tuesday’s Asian trade after it took traders off-guard, who were betting on the Fed’s rate-hiking cycle coming to an end.

Bitcoin Price

In the last 24 hours, Bitcoin has seen over a 0.50% increase in its value and the daily trading volume is $24 billion. Its live market cap is $442 billion based on data from CoinMarketCap.

Bitcoin is gaining immediate technical support near the $22,700 level. Closing candles above this level have the potential to drive the Bitcoin price higher toward the next resistance level of $23,200.

Further up, additional upward momentum could push the BTC price toward the $23,600 level.

Technical analysis tools such as RSI and MACD have shown signs of a possible increase in buying, which could lead to the value of BTC surging to $23,550.

The BTC/USD pair could find support at $22,750, and a break below this level could expose BTC to the $22,400 level.

Buy BTC Now

Ethereum Price

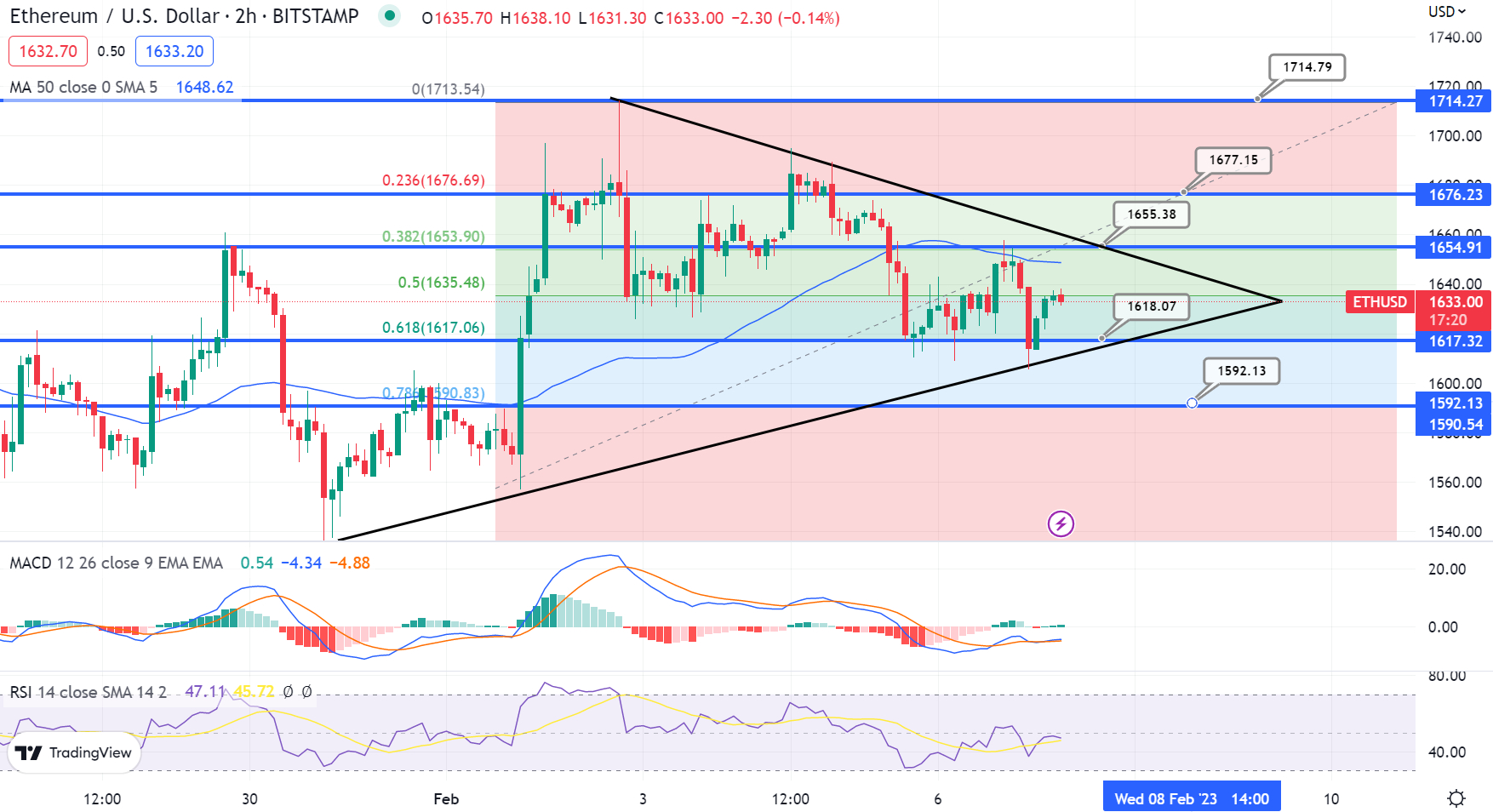

The live Ethereum price today is $1,636 with a 24-hour trading volume of $6.7 billion. Ethereum is up 0.50% in the last 24 hours. The current CoinMarketCap ranking is #2, with a live market cap of $200 billion.

The ETH/USD pair is trading sideways, maintaining a narrow trading range of $1,620 to $1,660. On the upside, a break above $1,660 could expose ETH price towards $1,680 and $1,720 levels.

On the lower side, a break below the $1,620 level can expose BTC to $1,550 levels.

Buy ETH Now

Bitcoin and Ethereum Alternatives

The top 15 cryptocurrencies for 2023 were recently identified by CryptoNews Industry Talk. If you want to invest in something more promising, there are many other options to consider.

The number of available cryptocurrencies and new ICOs (Initial Coin Offerings) increases on a weekly basis.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

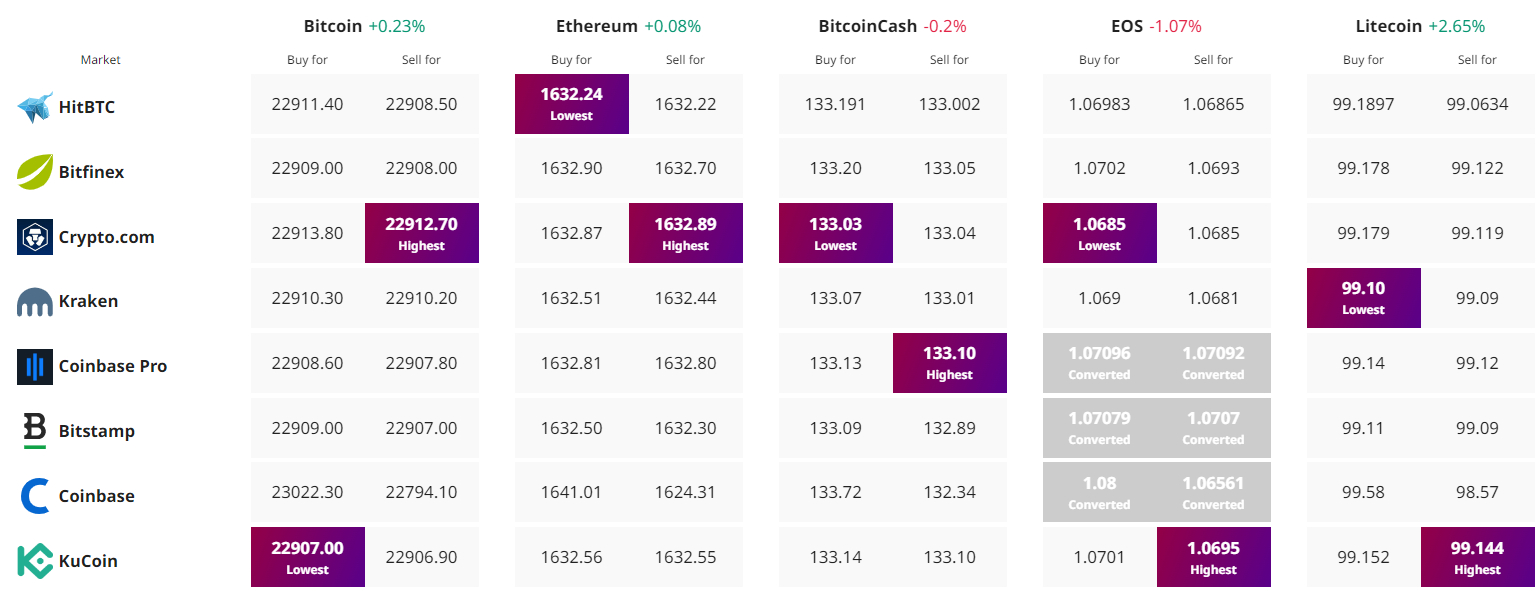

Find The Best Price to Buy/Sell Cryptocurrency