Earn users have seen a fall that no one expected. Their holdings are stuck with withdrawals halted by – now a bankrupt venture – Genesis. Gemini appears to be coming to the rescue of the Earn users by announcing its plan to pump $100 million into Genesis for bankruptcy recovery. The move was announced during a status conference for Genesis, a venture that owes its creditors billions of dollars.

FTX reported a liquidity crunch, and the effect quickly cascaded to Genesis, majorly affecting the Earn program, where users were promised interest of up to 8%.

Calling the move a critical step towards a substantial recovery of assets, Geminis has established that it demonstrates the continued efforts of the exchange platform to help Earn users achieve full recovery.

It is being said that the promissory Note will be equitized so that it yields some value to the process. Meanwhile, Gemini has thanked its community for trusting its efforts during what one can only call challenging times. Users of Gemini have earlier come forward to help Genesis resolve the issues by lending money to the platform. Gemini Earn was later forced to cancel the program following the halt put by Genesis on its withdrawal process. Approximately 340,000 retail clients of Gemini are facing the issue, and they have filed a class action against ventures.

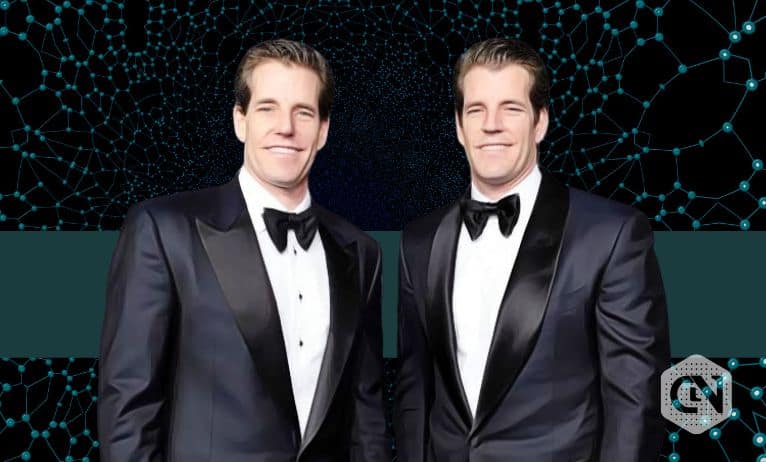

The issue has a basic ground of the Winklevoss Twins alleging mismanagement of Genesis by Barry Silbert. Both sides have been in an argument for a long time. Genesis had reportedly loaned over $500 million in cash and Bitcoin to DCG, the parent company of Genesis, to fund Silbert’s venture investments.

Favor could be coming back since DCG has committed to contribute to Genesis through two-tranche debt facilities. The facility matures in June 2024, with one carrying an interest of 11% and another bearing a 5% interest-paying Bitcoin tranche. According to the Genesis lawyer, these come to around $500 million. Additionally, DCG has announced the issue of convertible preferred stock to the creditors of Genesis.

The promissory note in the picture comes following the collapse of Three Arrows Capital. This move has been blasted by the Twins, calling it a gimmick since there were not fruitful results to the efforts.

Headquartered in New York, Gemini was founded in 2014 as a centralized exchange with more than 20 coins listed on the platform. Every Gemini exchange review often refers to the Twins from the 2004 social media controversy; however, it would be right to assume that they have moved on to create something more valuable to them in their professional career.

Their management of Gemini and updates on the issue are up on the internet. A series of tweets recently posted by Cameron Winklevoss, for instance, informs the community about Gemini and Genesis reaching an agreement to contribute to the recovery plan.

It was announced in the Bankruptcy Court, and details have later been shared with the community through the internet.