- Ethereum network’s validator numbers remained steady despite bear market.

- Decreased whale interest, network growth, velocity, and trader sentiment raised concerns.

Validators on Ethereum [ETH] could play a significant role in the network’s future. New data on 6 February suggested that the number of new validators added to the network remained constant in 2022, even during the bear market.

Did you know that there were 218,068 new Ethereum validators (almost 7 million ETH worth) that were spun up in 2022 alone?

This was roughly the same number of validators that were spun up in 2021.

Bull or bear, the demand for ETH staking is insatiable. pic.twitter.com/4gIthHw6KP

— sassal.eth (@sassal0x) February 6, 2023

Is your portfolio green? Check out the Ethereum Profit Calculator

Thus, there was interest amongst stakers, even in a volatile market. The upcoming Shanghai Upgrade was expected to further incentivize new validators to join the network.

Recent validator interest could be driven by the positive developments surrounding Ethereum.

Looking at the positives

A positive indicator for Ethereum was the declining number of addresses in loss, reaching a five-month low according to Glassnode.

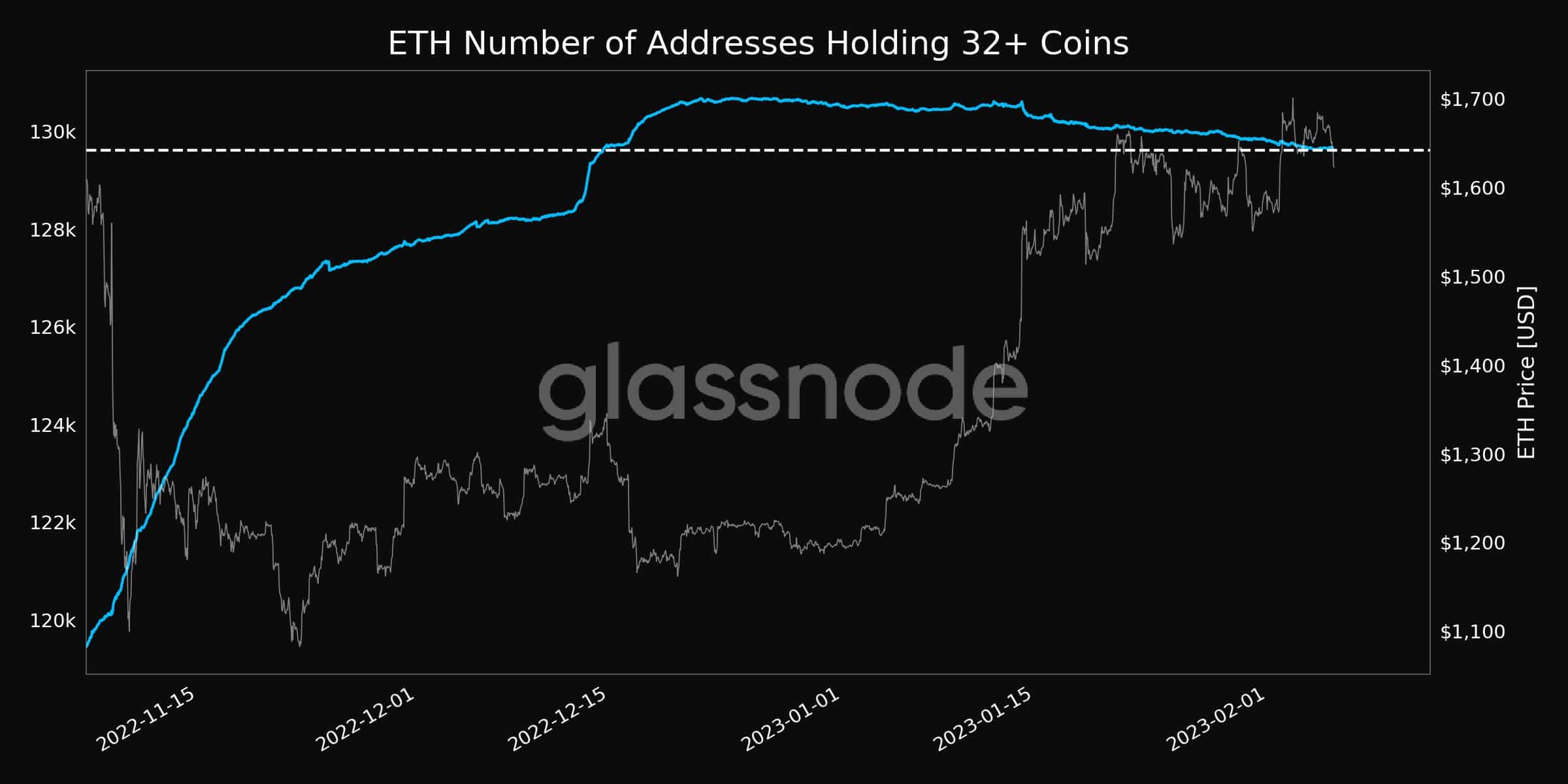

However, despite this positive news, whale interest decreased over the last month. If large addresses decided to sell their investments, it could negatively impact retail investors.

Source: glassnode

Having a look at Ethereum, on-chain

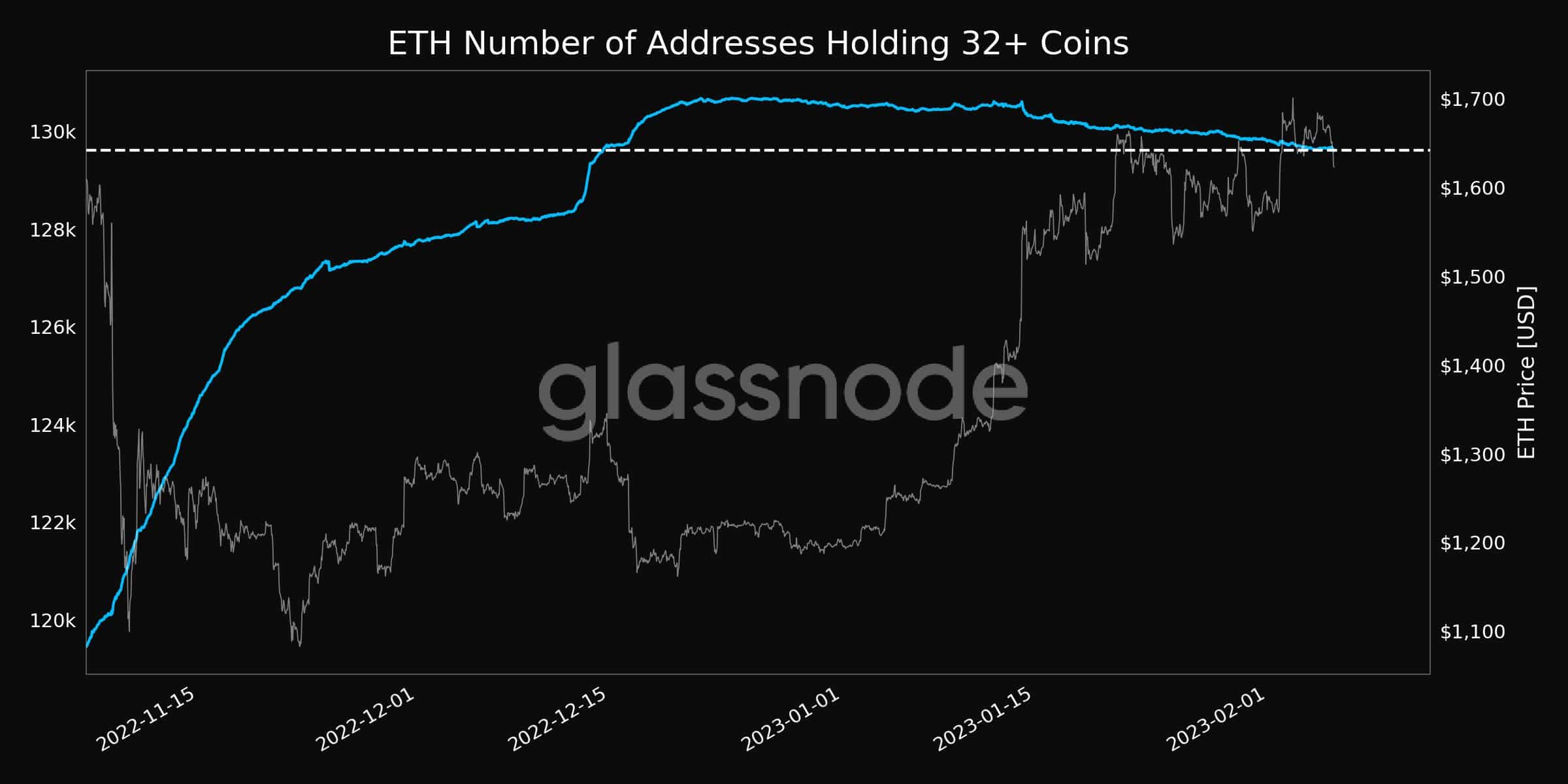

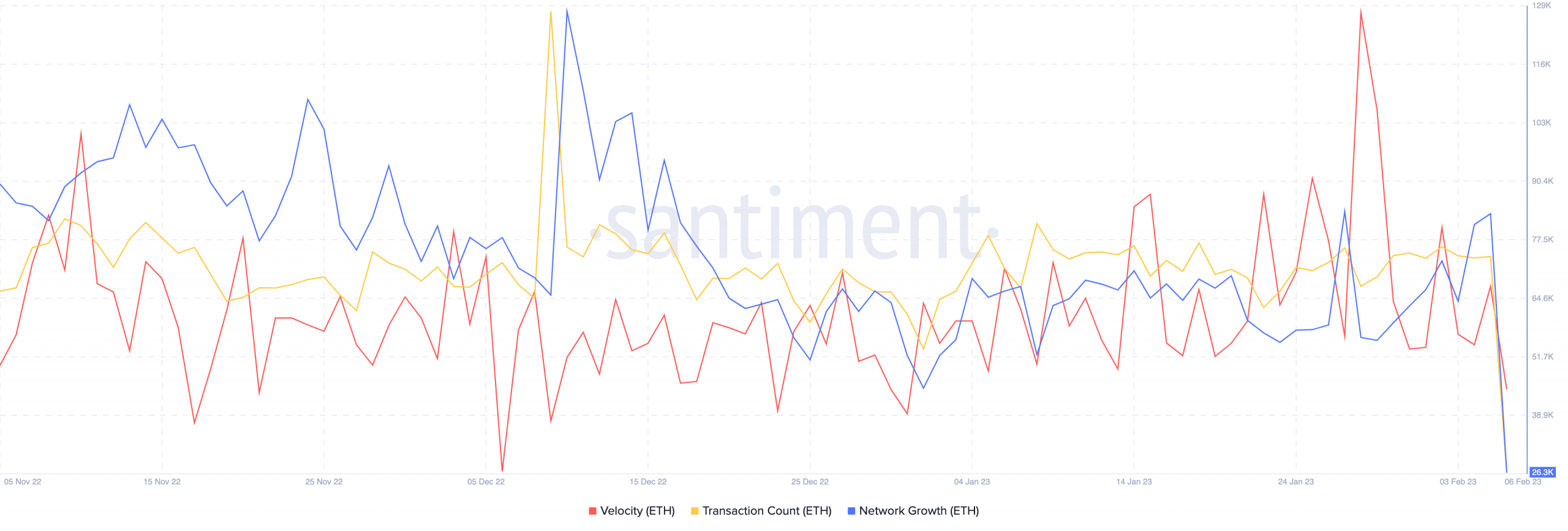

Ethereum’s declining network growth could be one reason for the decrease in whale interest, as there was a cutback in new addresses transferring ETH for the first time. This suggested that new addresses were not showing interest in the network.

Source: Santiment

Another reason for the lack of whale interest could be the decline in Ethereum’s velocity, meaning that the frequency of ETH trades decreased.

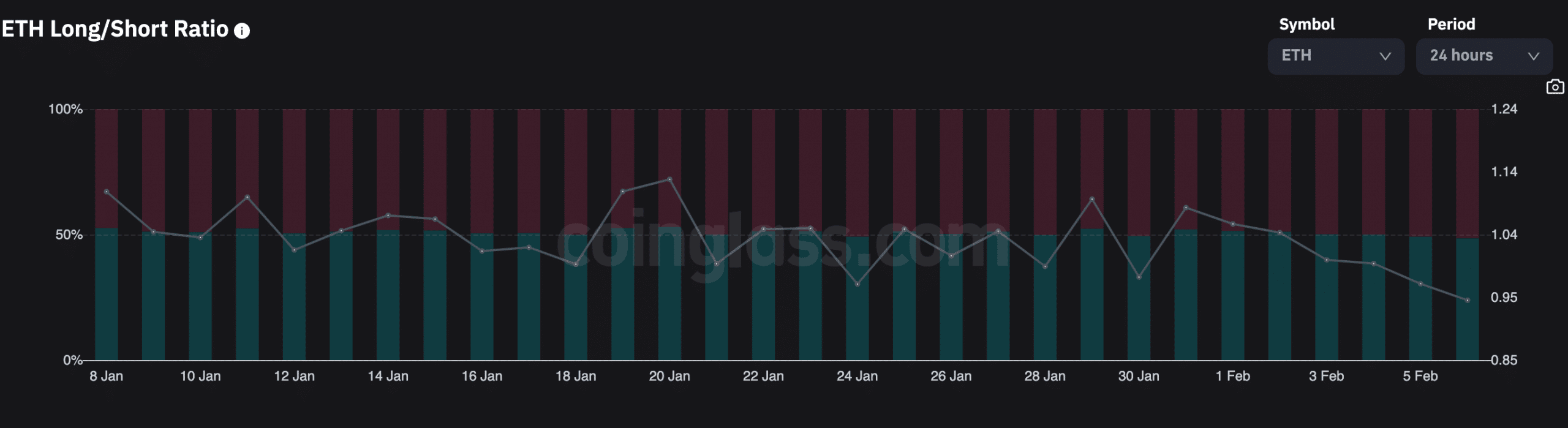

Additionally, trader sentiment also turned negative during this period. Short positions against Ethereum increased, according to Coinglass. This surge in short positions increased after 1 February. At press time, the percentage of short positions against ETH was 51.57%.

Source: Coinglass

Even though traders were pessimistic about Ethereum, a new development with Visa could improve the network’s odds of success. As per a 6 February tweet, Visa was using the Ethereum network to test USDT transactions.

VISA: We’ve been testing how to actually accept settlement payments from issuers in USDC starting on Ethereum and paying out in USDC on Ethereum. And these are large value settlement payments. https://t.co/M2PkeQDNBL

— Wu Blockchain (@WuBlockchain) February 6, 2023

Read Ethereum’s [ETH] Price Prediction 2023-2024

The aforementioned partnership could help increase Ethereum adoption and improve sentiment among traders and whales.

Overall, the number of validators on the network and their continued growth, despite market volatility, suggested a promising future. The Shanghai Upgrade and Visa’s partnership are key indicators to watch out for, as they have the potential to positively impact the king altcoin’s adoption and its overall future.