- a16z could have been the group influencing most Uniswap proposals.

- The protocol’s founder had not answered to the allegation but UNI dropped 5%.

Recently, Uniswap [UNI] holders who have stuck to the protocol for a long while might need clarity on the operational model of the project.

The reason for this was the evidence flying around that a16z, the Silicon Valley venture capitalist firm, controls the decision and proposal approval of Uniswap.

Read Uniswap’s [UNI] Price Prediction 2023-2024

Holders living in a bubble

Bubblemaps, the blockchain data information visualizer confirmed that the speculation might be facts. This is because the investment firm owns 4.15% of the total UNI supply. And 4% is the required supply to own in order to pass any proposal.

You’re being lied to about the governance of UNI@a16z could control 41.5M UNI through 11 wallets, which represents more than 4% of the supply

4% is the required amount to pass any proposal ↓ https://t.co/mVdTukYstD pic.twitter.com/u7l9kBFIWF

— Bubblemaps (@bubblemaps) February 5, 2023

Details from the revelation showed that a16z owned 11 wallets which summed up to the aforementioned supply. This means that Uniswap whales were in control of on-chain voting while retail investors were mostly sidelined.

Also, 0.25% supply is the required amount to submit a proposal. Interestingly, one of the a16z wallets with that amount sent a proposal recently.

Decentralized technology advocate Chris Blec knocked the institution for using its voting power to distort a UNI proposal to launch on the Binance Coin [BNB] chain.

While the reaction from Binance CEO CZ showed that he was surprised by the disclosure, Blec responded that he had known about the irregularities for a while.

We’ve known it for a while. https://t.co/1YLxPt1WDN

— Chris Blec (@ChrisBlec) February 5, 2023

All these are in contrast to what the Uniswap protocol preaches. As a Decentralized Finance (DeFi) protocol, Uniswap boasts of having a 310,000 member DAO who all have a say in its governance and utilization of its $1.6 billion treasury.

But to find out that a few big wigs have been the approvers and naysayers of proposals could be a dent to its play in the DeFi sphere.

Unbiased in the midst of silence

However, there were diverging comments on Twitter per the news. While some saw nothing wrong in the way voting ran, others opined it to be dishonest. Meanwhile, there has been no official response from Uniswap at the time of writing.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Additionally, founder Hayden Adams had also not responded to the allegations. His last tweet at press time centered around Ethereum [ETH] and Optimism [OP] with no mention of the project he leads.

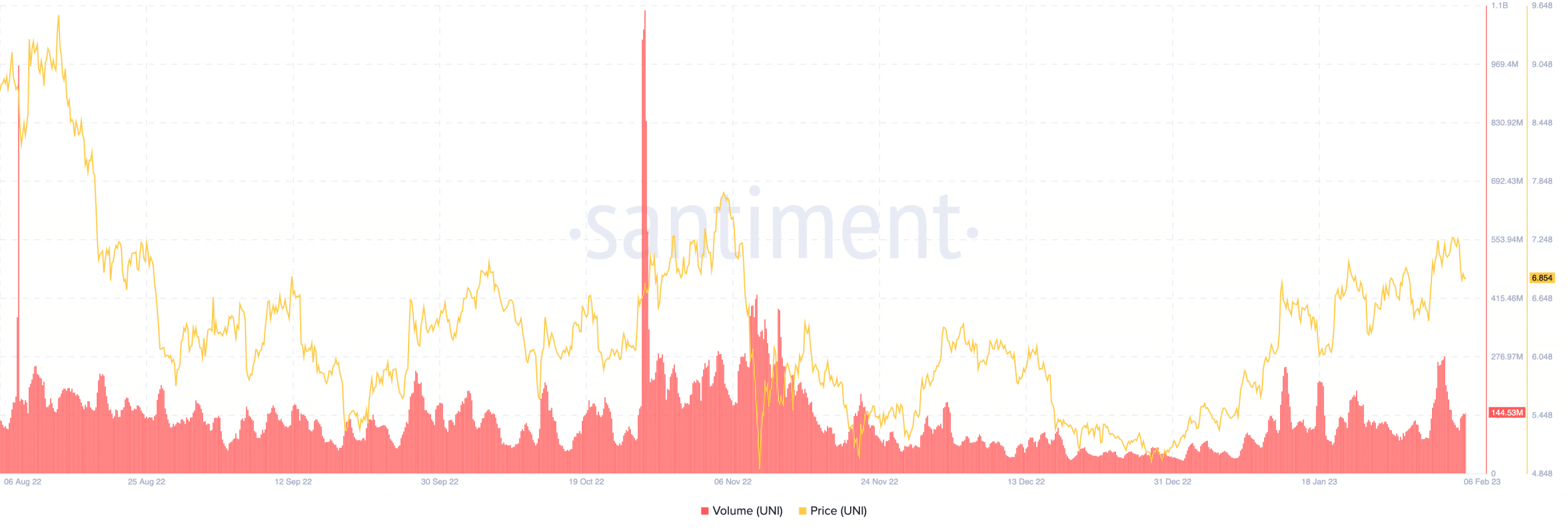

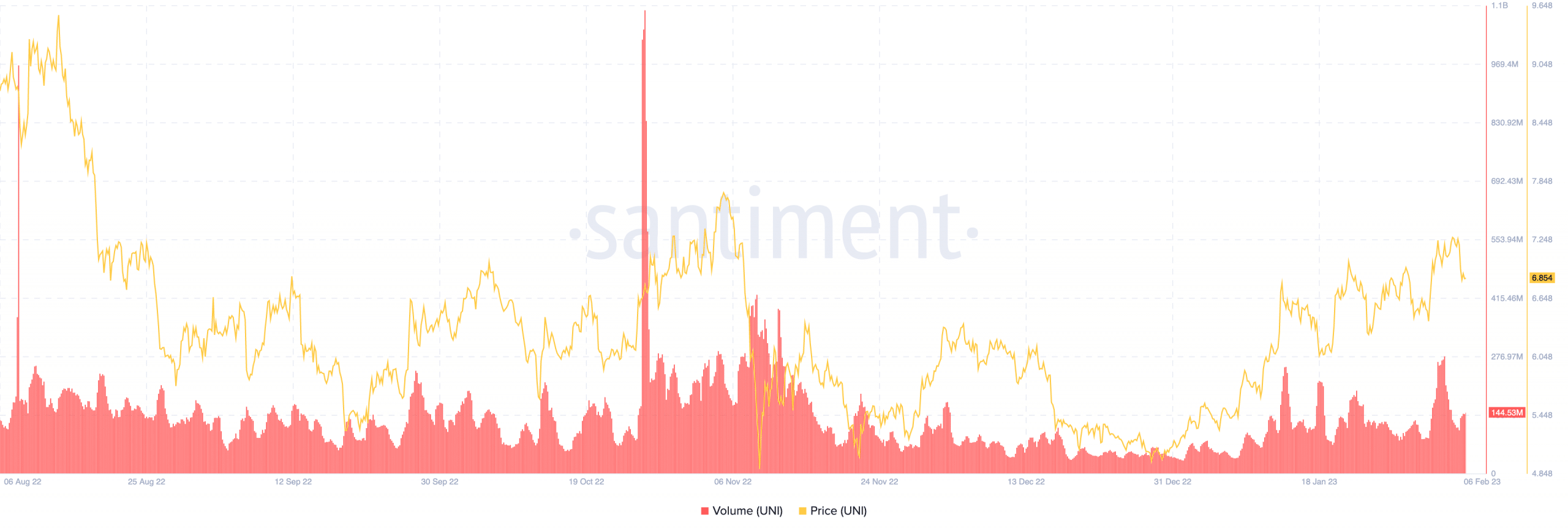

Meanwhile, the UNI price may have been affected by the claim. According to Santiment, UNI’s 24-hour performance was a 5.50% decrease. However, the volume within the same period increased by 30%.

The volume describes the aggregate amount of transactions that happened via a network within a particular time frame. So, the increase in volume could either point to outflows or accumulation.

Source: Santiment