- Ripple’s development head held the firm’s ground on the global reserve currency proposal.

- XRP’s momentum drifted towards the reds.

A section of the Ripple [XRP] community has long hoped for approval for the token’s buyback proposal since 2021. But all that desire may now be a pipe dream as the project’s Chief Technology Officer (CTO) put a nail to the coffin.

How many are 1,10,100 XRPs worth today?

When asked about his comments on the matter, CTO David Schwartz said it was ridiculous, and directly called it a “scam”.

I haven’t looked at it very closely. But what I have seen looks an awful lot like a scam to me. If we’ve learned anything from 2012 and 2022 it’s that anyone promising high returns with low risk is almost certainly going to rob you.

— David “JoelKatz” Schwartz (@JoelKatz) February 5, 2023

Offer down and out as XRP slides

This response comes after Ripple’s legal counsel had recently opined that the suggestion was impossible. Those who supported the proposal argued that XRP could become the world’s reserve currency.

And, a buyback XRP rate based on the supply potential held by governments could help a retail reclaim.

While the legal opinion may have reflected some chance of approval, the public rebuttal from the development team may now mean there is no chance.

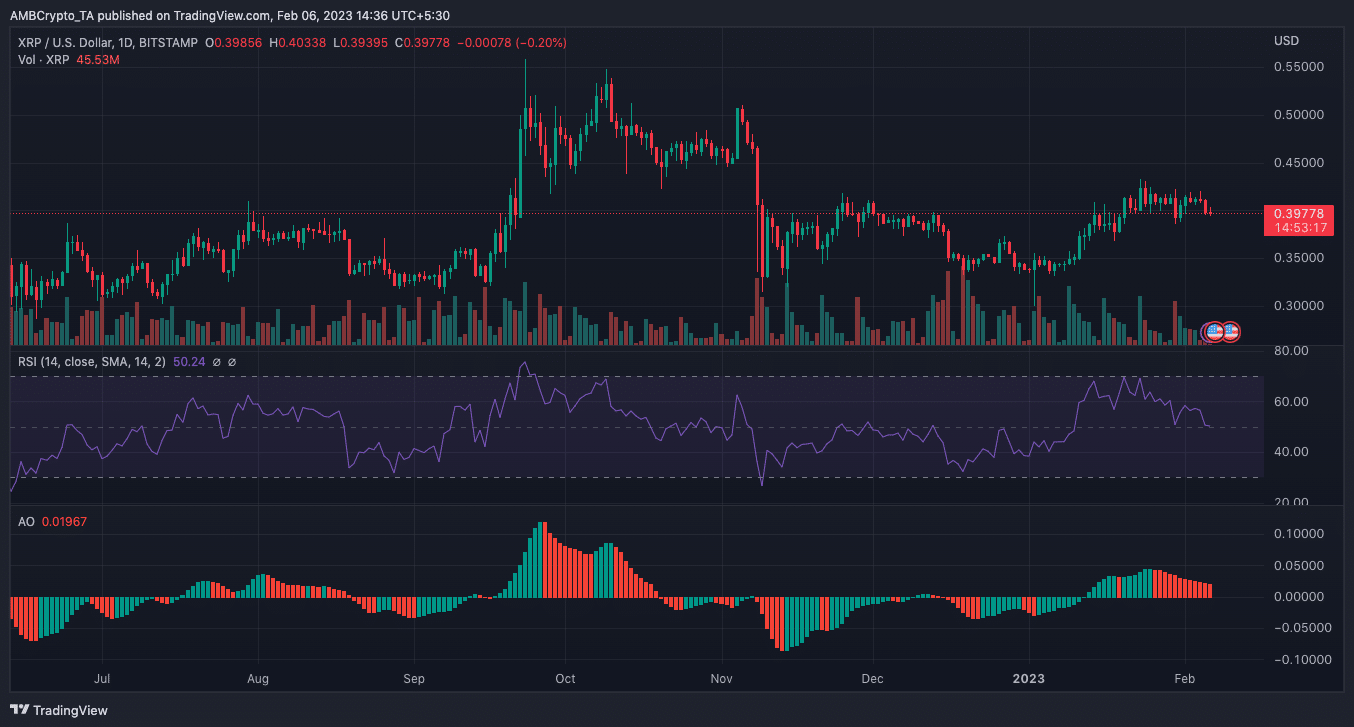

Following the clarification, the XRP price lost 2.71% of its value in the last 24 hours while exchanging hands at $0.3989. But does the blockchain-based payment token have the capability to oppose the trend?

According to the daily chart, the XRP momentum was trending downward. At press time, the Relative Strength Index (RSI) was 50.21. The RSI displays the momentum of an asset. And, its movement towards the downside means that XRP had lost its buying power and; subsequently, could head towards an oversold region.

Besides the RSI, the Awesome Oscillator is another indicator that reflects the momentum of an asset. At the time of writing, the AO was above equilibrium.

But its bullish readiness was not in play due to the consistent red bars produced above equilibrium. Hence, XRP had a higher chance to fall to bearish pressure than recovering in bulls’ favor.

Source: TradingView

Community rallies as development activity keep the upside

In addition, some comments under Schwartz’s tweets revealed that a large part of the XRP army had wanted clarity on the matter before now. Surprisingly, many supported the CTO’s stance.

Is your portfolio green? Check out the Ripple Profit Calculator

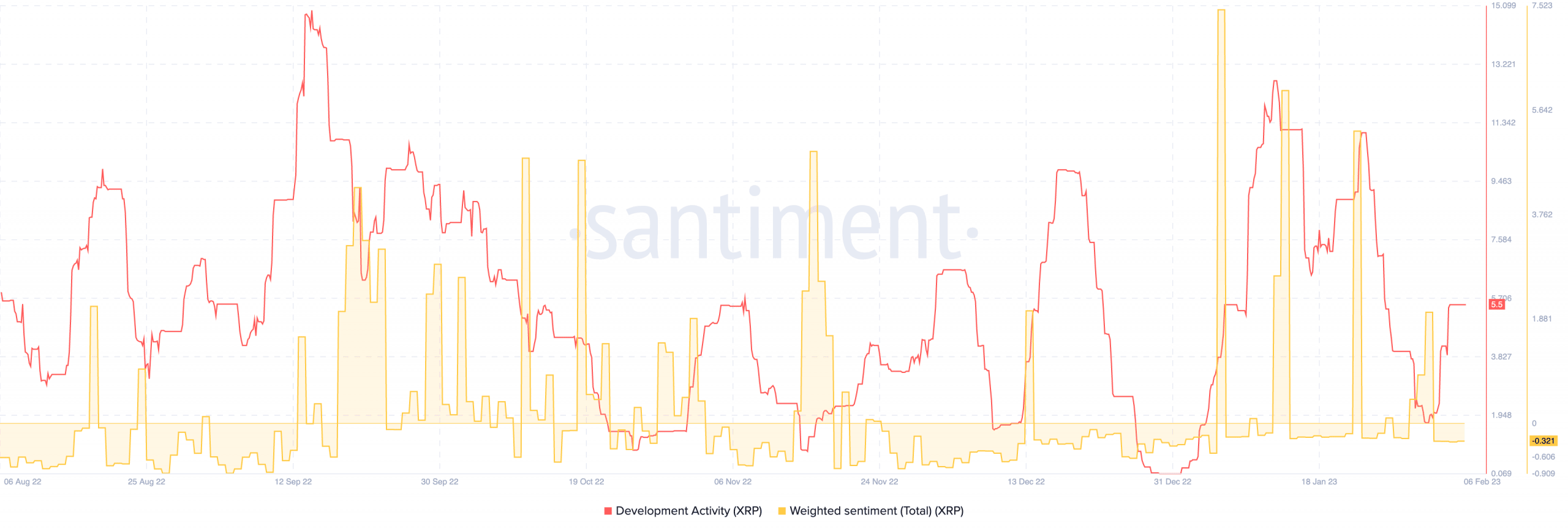

However, on-chain data showed that Ripple was unperturbed by the outright rejection. This was because the development activity had revived from its downturn at the beginning of February. The development activity measures the devotion of a project to sustaining upgrades on its network.

As of this writing, the metric had surged to 5.5. This implies that Ripple developers were actively contributing at a maximal rate.

But the weighted sentiment flatlined at -0.321. This metric takes into account the unique social volume. Since it was negative, then it meant that the vast majority of comments towards XRP were not cherry.