- Algorand shifts more attention towards interoperability and post-quantum technology.

- ALGO bulls maintain control over the market as bears remain subdued.

As the blockchain industry continues to bloom and advance, there are undeniable challenges that need to be dealt with. Those challenges have shaped priorities for the top blockchains and this is the case for Algorand.

Is your portfolio green? Check out the Algorand Profit Calculator

Algorand recently revealed that it has two main goals, which include interoperability and post-quantum security. Interoperability is a necessity for a smoother flow of value.

Otherwise, a very fragmented ecosystem will be highly inefficient. Fortunately, there are numerous networks also working towards solving the interoperability challenge.

“We have two key goals: Interoperability & exchange between the #Algorand network and others, and post-quantum security.” –@ChrisPeikert

Watch the full video from #Decipher2022: https://t.co/R3REApEE6f pic.twitter.com/KOhgUo5WaN

— Algorand (@Algorand) February 3, 2023

Algorand acknowledged that quantum technology has been advancing at a rapid pace. Perhaps to a level that may compromise blockchain technology’s decentralized model.

This is why Algorand is actively pursuing measures that will boost security against attacks executed using quantum computers.

ALGO price action

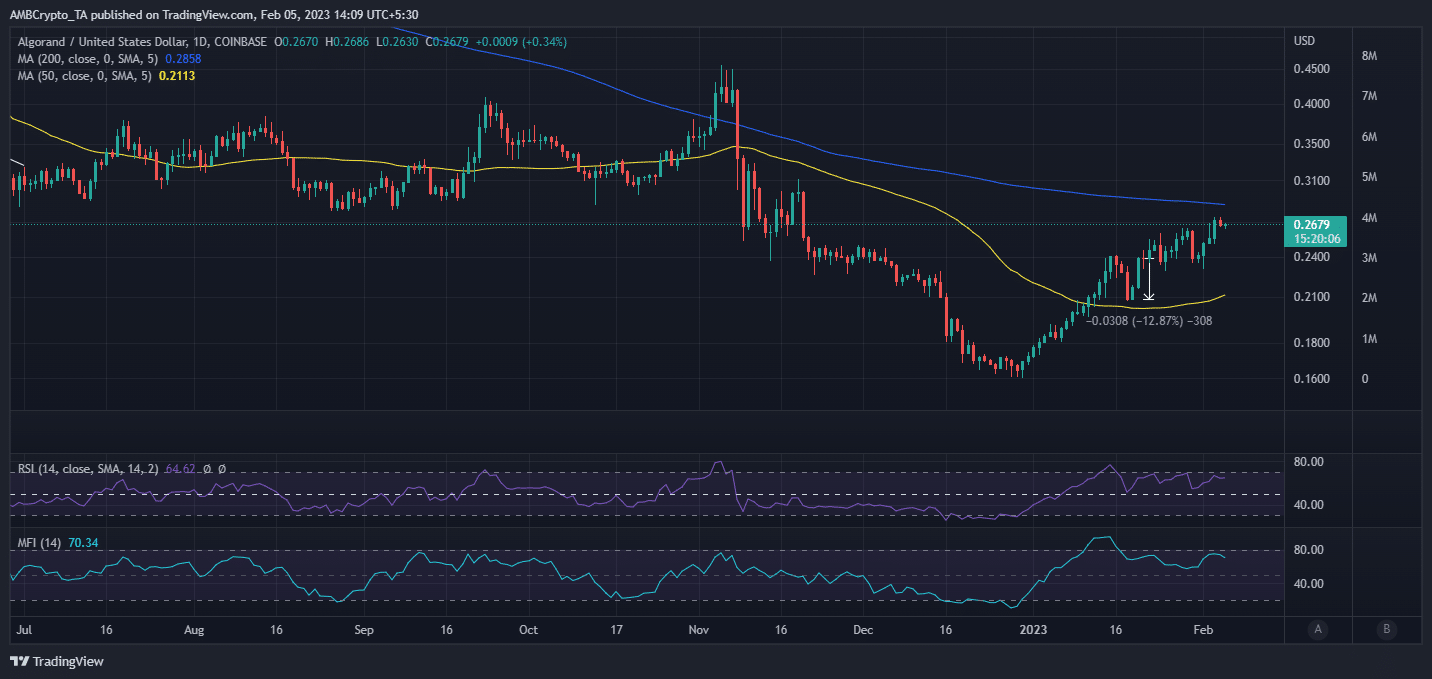

Algorand’s native cryptocurrency ALGO remains among the best-performing cryptocurrencies since the start of January. Its $0.267 press time price represents a 68% upside and it is up by 17% since the start of February.

Source: TradingView

ALGO still has some room for more upside before interacting with the 200-day Moving Average. The latter may act as a psychological sell zone. But can ALGO sustain the upside especially now that its RSI is demonstrating relative weakness and a price-RSI divergence?

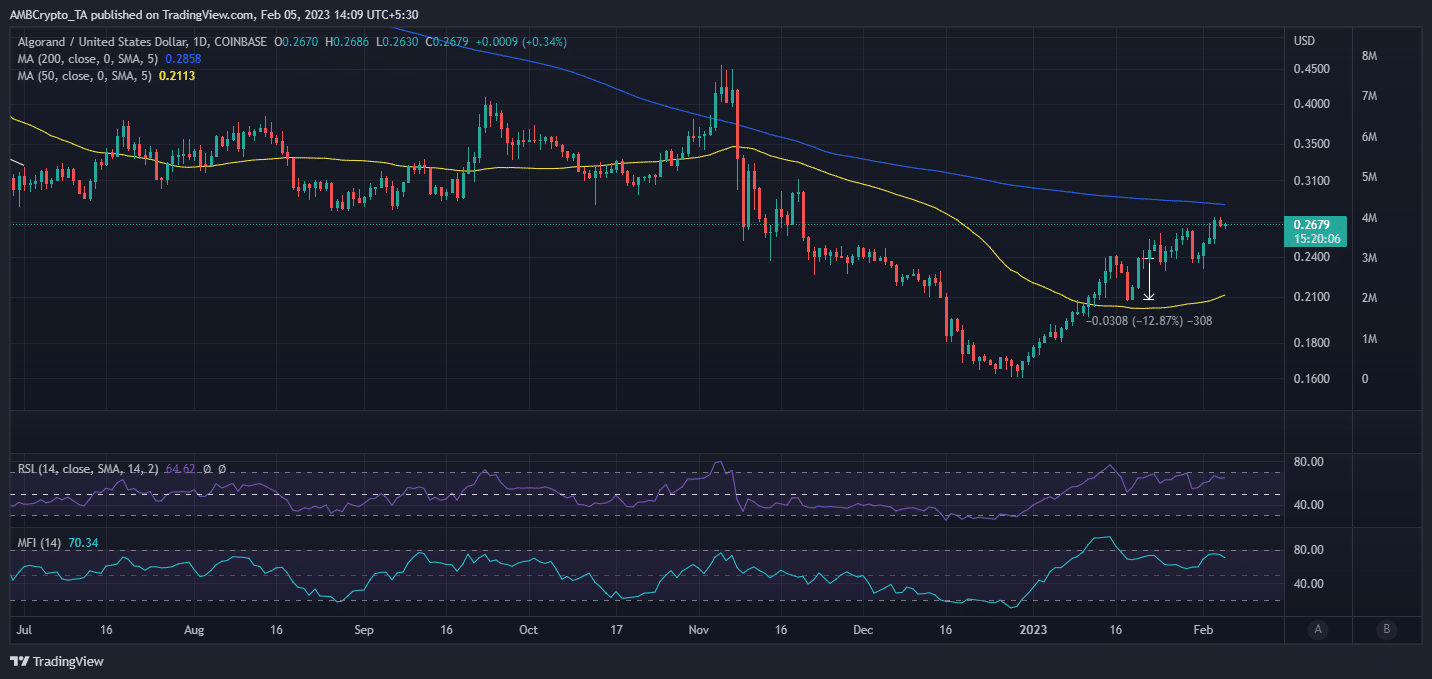

On the metrics side of things, we see that the weighted sentiment is currently in favor of the bears. The probability of a sizable bearish retracement is higher with such investor sentiment, especially now that the price has been going up.

Source: Santiment

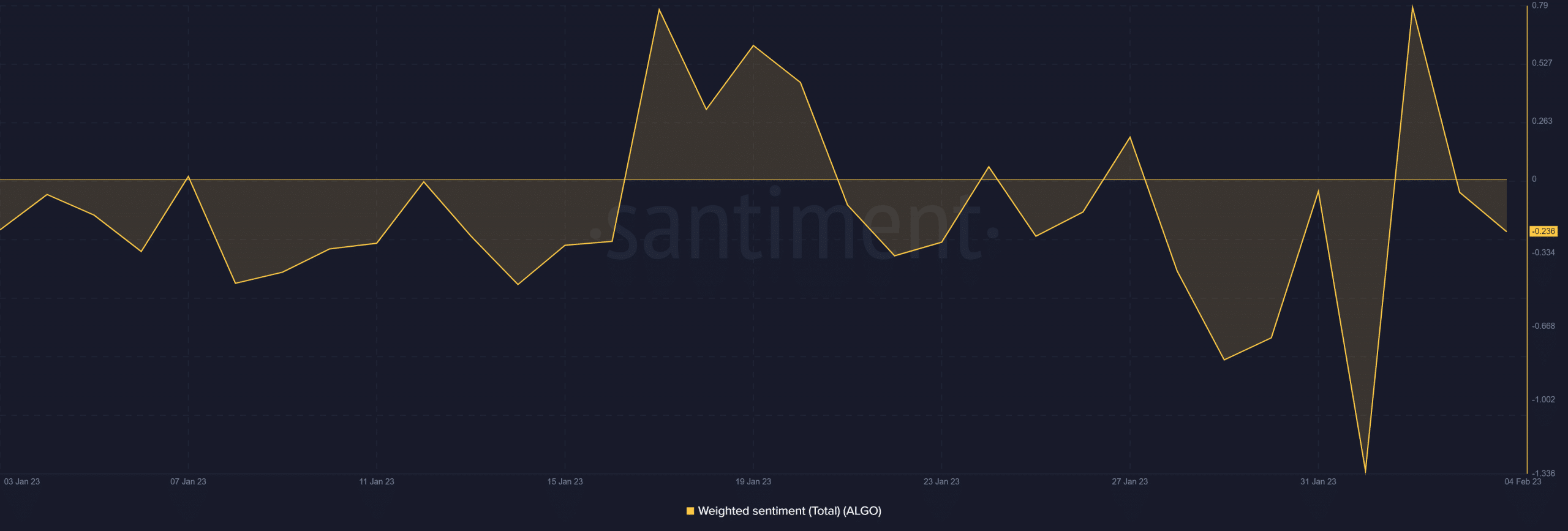

Perhaps derivatives demand may offer some clearer insights. Both the Binance and FTX funding rates remain within the upper range, and no pivot has been observed so far. This confirms that there is no incoming sell pressure from the derivatives segment.

Source: Santiment

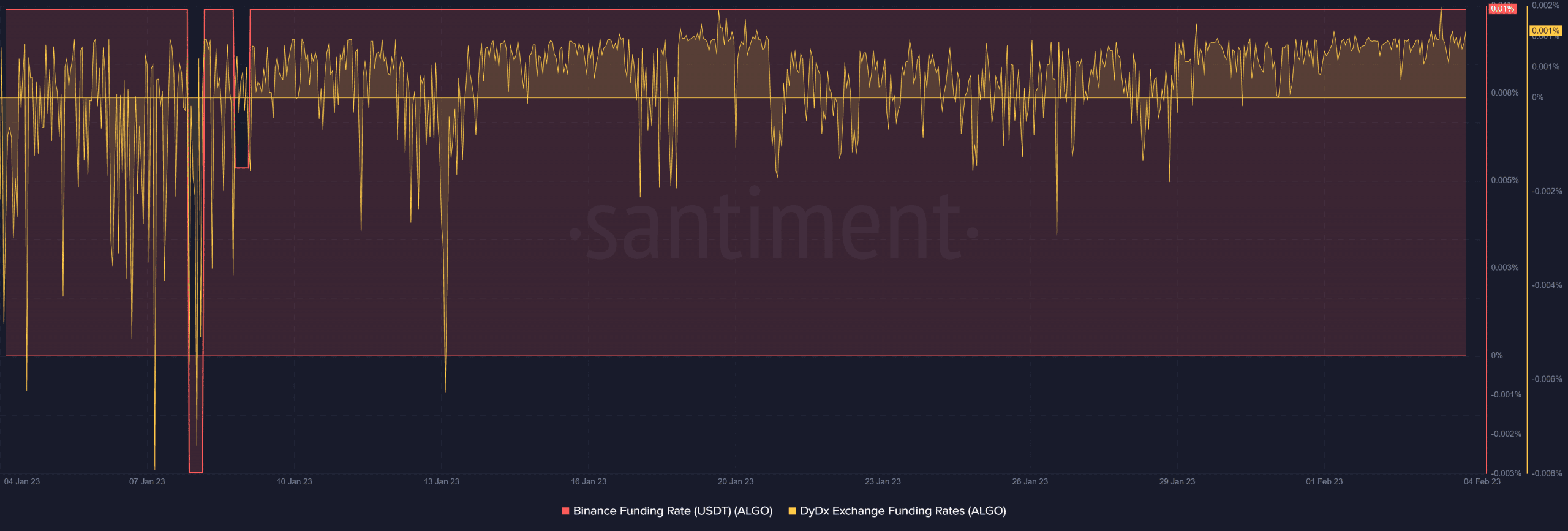

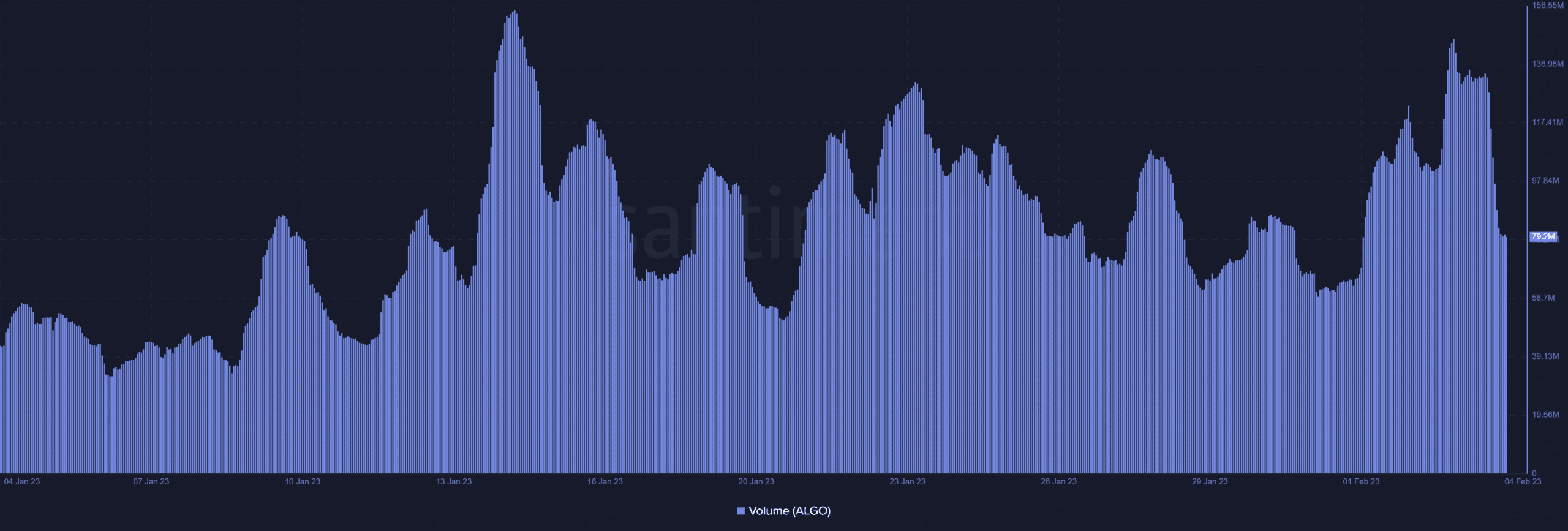

A potential reason for the absence of bearish volume is that ALGO is still recovering from the recent surge in sell pressure. Instead, we saw an increase in bullish volumes in the last few days.

Source: Santiment

How many are 1,10,100 ALGOs worth today?

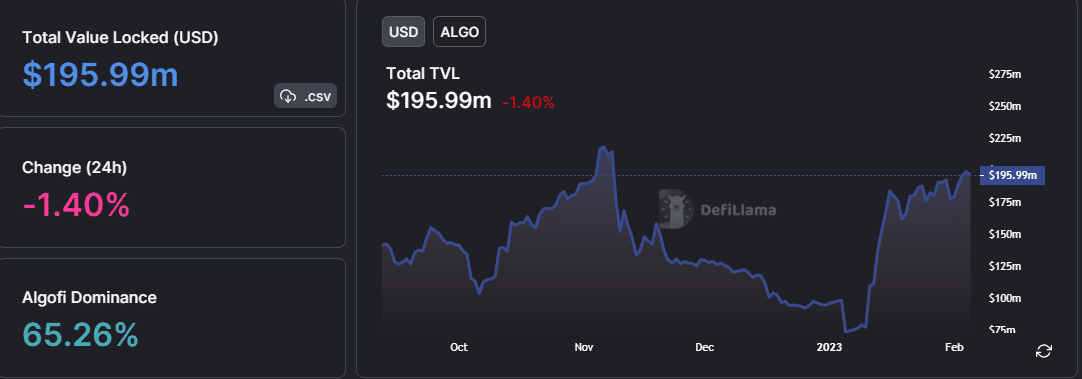

There is one key metric that explains ALGO’s strong performance. If we look at its total value locked (TVL) we observe a sharp surge since the start of the month.

This confirms that a large percentage of the ALGO purchased this year is now staked within the Algorand ecosystem.

Source: DeFiLlama

While these outcomes highlight a stronger network state, it remains unclear whether ALGO will maintain the rally. The market is currently in a resistance range which means things might go either way.