- A look at the key growth areas where Cosmos can derive the most value from this year.

- ATOM struggles to maintain enough bullish demand to sustain its previous rally.

The Cosmos network has been on a healthy growth trajectory, especially in the last two years. But, 2023 may present robust growth opportunities especially if the market goes into recovery mode.

Read Cosmos [ATOM] price prediction 2023-2024

Cosmos might be among the crypto networks with the richest opportunities for growth. Let’s look into some of the areas or segments that can potentially support this expectation.

So far most of the organic growth that Cosmos achieved in the past was associated with blockchain interoperability and sovereign dApps. It is important to anticipate the next growth catalysts now that the market is anticipating another WEB3 cycle.

I interviewed @jaekwon & @buchmanster about Tendermint back in 2016.

I’ve since spent countless hours researching Cosmos & talked with hundreds of founders and builders.

Here are the 10 biggest trends that will put Cosmos on the map this year https://t.co/0UctCxYA8p

— seb3point0 (@seb3point0) February 2, 2023

There are still billions of people that are not yet enjoying the benefits of WEB3. Reportedly, Cosmos can leverage this opportunity through heavy infrastructure investments that can support more than one billion people in the next five years. Recent market challenges also present an opportunity for networks such as Cosmos to steer in the right direction.

Cosmos might steer towards the creation of open, censorship-resistant, and permission-less dApps. More importantly, there are some key sections that have the potential to put Cosmos on the fast lane for more growth.

A targeted focus for Cosmos

There are key areas where Cosmos can derive growth and these are segments that will likely be quite popular this year.

They include liquid staking which is already popular on other networks such as Ethereum. Cosmos is also expected to target other high-impact segments such as stablecoins, privacy protocols, and interchain security among others.

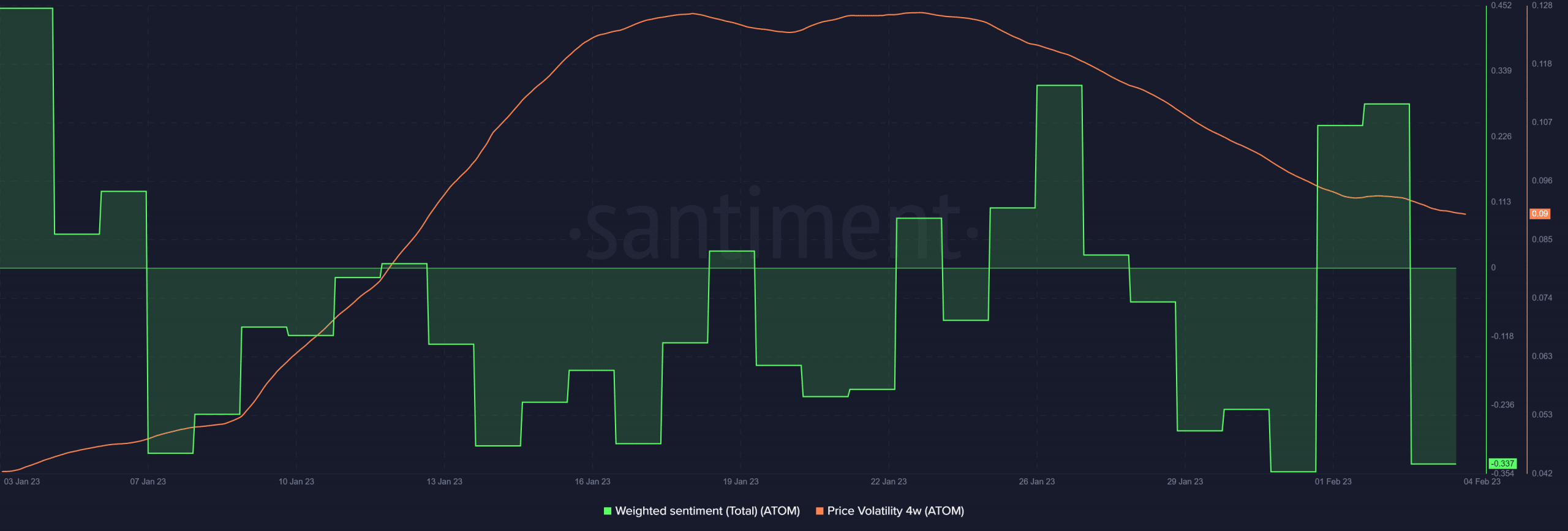

There is already a healthy degree of optimism among investors regarding Cosmos and ATOM’s’ prospects this year.

It is not as volatile as it was in January but investors are still optimistic about their prospects in February. This is evident in the slight spike in weighted sentiment at the end of January.

Source: Santiment

Unfortunately, the return of uncertainty due to economic conditions and regulatory uncertainty appears to have curtailed the optimism.

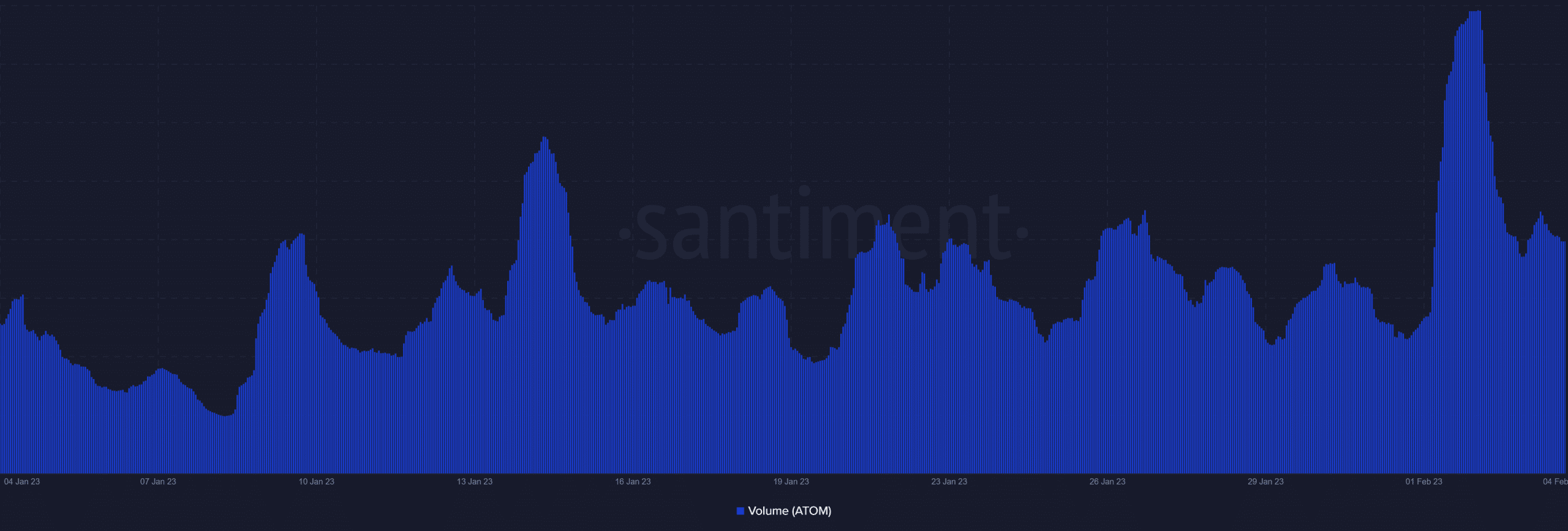

This is further backed by the strong surge in on-chain volume that occurred in the first two days of February.

Source: Santiment

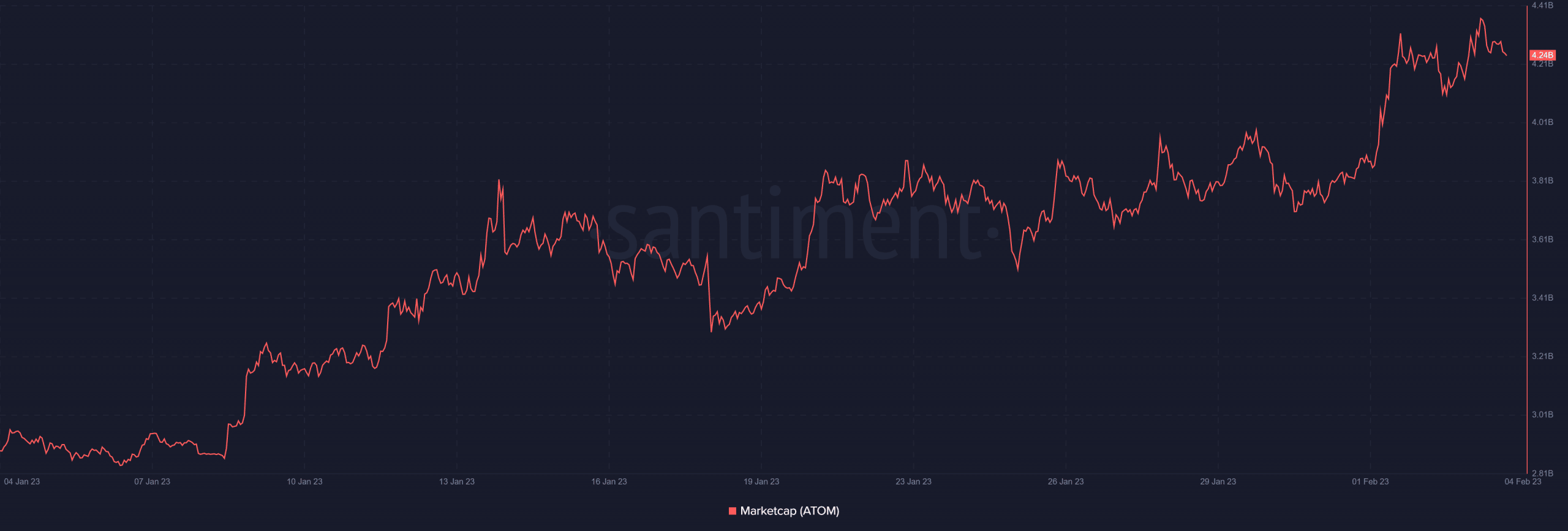

Realistic or not, here’s ATOM’s market cap in BTC’s terms

This volume surge was likely due to incoming sell pressure considering that the price did not extend its rally. Instead, Cosmos shaved over $126 million from its market cap within the last two days. This confirms the selling pressure.

source: Santiment

Despite this outcome, the volatility metric has not shifted. We can interpret this as a normal pull-back rather than a major selloff.