The bitcoin market is currently experiencing a surge in trading volume, reaching $40 billion in the past 24 hours. This is a significant increase from the previous record of $34 billion set in May of this year.

The bitcoin market is currently experiencing a surge in trading volume, reaching $40 billion in the past 24 hours. This is a significant increase from the previous record of $34 billion set in May of this year.

With this increased activity, it is important to consider the future of Bitcoin prices and where they may be headed next.

In this article, we will discuss the current state of the market and explore some potential scenarios for where Bitcoin prices may go next based on its current trading volume.

Blockchain.com Cuts Staff as Crypto Market Struggles

Blockchain.com, one of the leading crypto companies, has recently announced that it will be cutting its staff due to the current struggles in the cryptocurrency market. The company has been facing a difficult time with its operations as many investors have been pulling out of the market and prices have dropped significantly.

Blockchain.com, a digital currency company, has announced the layoff of around 150 employees which accounts for 25% of its staff. The current bear market in digital currencies, which started in 2022, has taken its toll on many companies. It doesn’t appear this trend will end soon and the company is just one of the victims.

Within recent weeks, Blockchain.com has joined a list of other cryptocurrency-centric companies that had to resort to laying off staff due to the financial effects of the pandemic. Recently, Coinbase, one of the most well-known digital currency exchanges, announced cutting down its workforce by about 1,000 people to reduce its operational expenditure by 25% in the coming months.

The news comes as a surprise to many in the industry as Blockchain.com had previously been seen as a leader in the space, providing a secure platform for users to store and trade their digital assets.

Bitcoin Derivatives Market Volumes Show Encouraging Signs Of Recovery After 2022 Downturn

In 2022, Bitcoin experienced a prolonged bear market resulting in a 60% drop in its price and a rapid decrease in bitcoin futures and options volumes.

Last November, the sudden shutdown of FTX caused investor sentiment to become very negative. This led to a massive withdrawal from derivatives trading, along with long liquidations and an overall bearish trend in the market.

According to statistics from the block, the trading volume of Bitcoin futures was around $1.3 trillion in December 2021 but dropped dramatically to just $620 million in November 2022, representing a decrease of almost 50%. These figures were obtained from leading cryptocurrency exchanges.

Since the start of 2023, there has been a substantial rise in Bitcoin price and its derivatives market has also become increasingly bullish. For example, Bitcoin was recorded to be trading at $24,000 earlier in the week.

Positive Gains in On-Chain Data in 2023

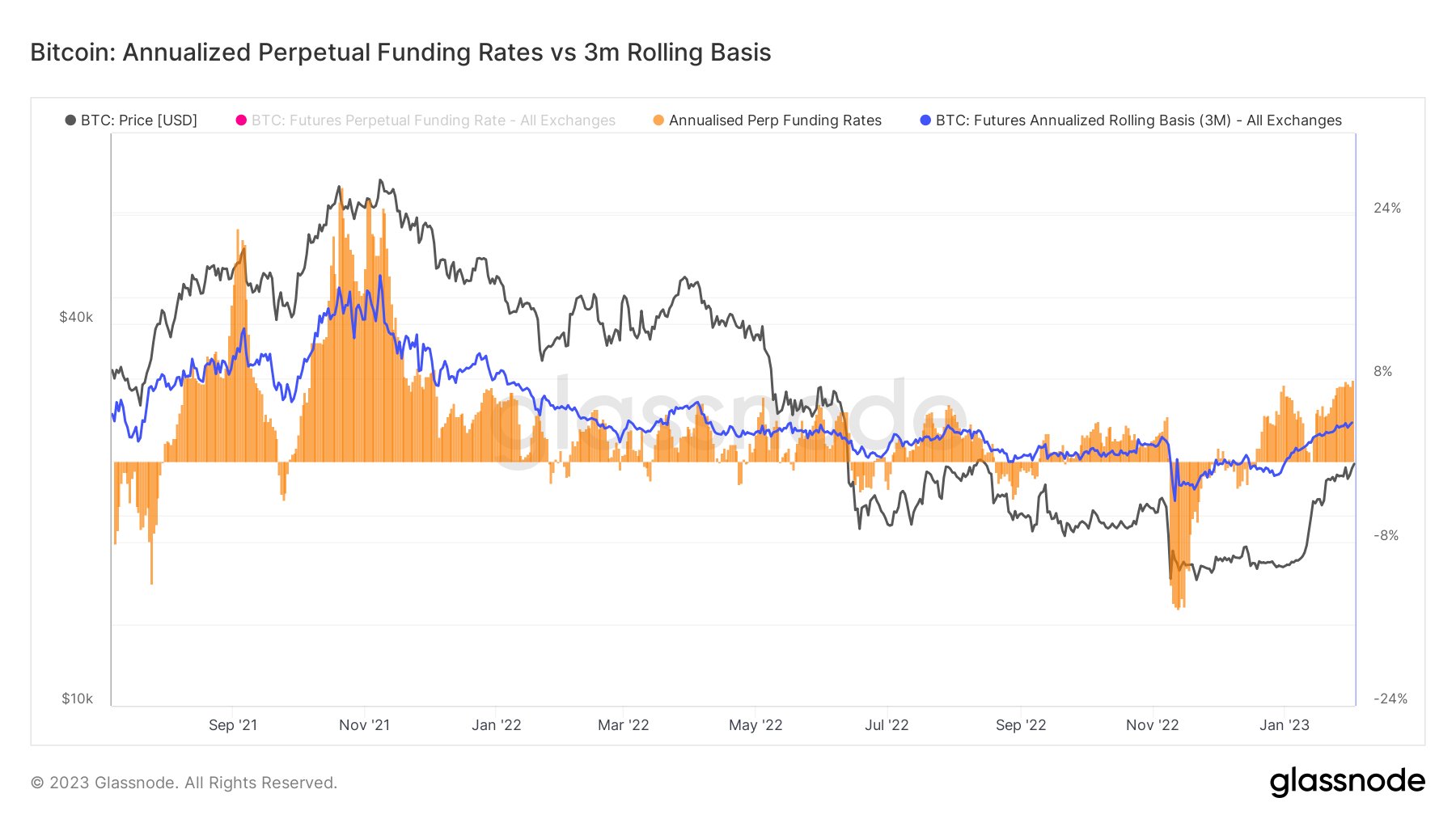

ProfChaine, a well-known market analyst, recently tweeted about the reversal of the derivatives market with a particularly strong short selling and bullish sentiment. His post was accompanied by multiple charts illustrating the 3-month moving annualized basis of bitcoin futures.

This metric demonstrates the variation in the average price of futures contracts when compared to the spot price, which can indicate an increase or a decrease. When speculating on the price of futures contracts, a positive expected rate is attained if the pricing trend is higher than the spot rate, whereas a negative expectation rate occurs if prices are expected to decrease.

As seen in the chart, open interest leverage has risen at the start of 2021, contradicting earlier predictions of a drop in market volumes this year. Moreover, a marked decrease was also witnessed in 2022.

The rise in futures trading suggests that the market is strong and is a positive indicator of an extended bull run. This implies that investors can expect to see their investments grow in the near future.

Hence, Bitcoin has been experiencing a positive trend lately, which is reflected in the surge of the derivatives market volume. This indicates further growth in the cryptocurrency’s price.

Bitcoin Price

The Bitcoin price currently stands at $23,417 and its 24-hour trading volume is $18 billion. There has been a 0.80% decrease in value over the last day. It holds the top spot on CoinMarketCap with a market cap of around $451 billion.

Bitcoin is currently in a bearish trend and, if the immediate support area at $23,300 is broken, it could potentially cause further losses to $23,000. However, it should be noted that this point may also act as a point of support due to the presence of an uptrend line.

The RSI and MACD indicators are suggesting that selling pressure is likely to increase, resulting in the BTC price dropping to $22,750 as its next support level.

At the moment, BTC/USD appears to be in a bullish phase due to its 50-day exponential moving average above $23,300. If the price successfully breaks past $23,950, it could potentially reach up to $24,500.

Bitcoin Alternatives

CryptoNews Industry Talk has evaluated the top 15 cryptocurrencies for 2023. If you’re looking for a more promising investment opportunity, there are other alternatives to consider.

The number of cryptocurrencies and new ICOs (Initial Coin Offerings) keeps increasing on a weekly basis.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

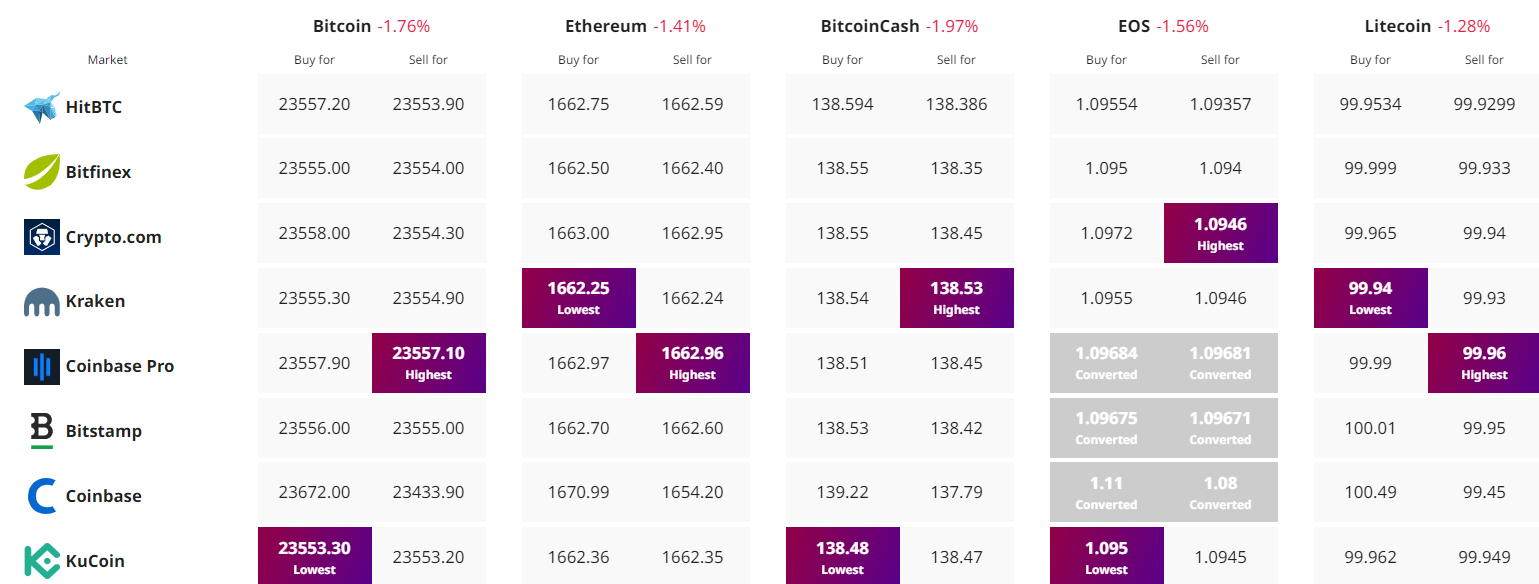

Find The Best Price to Buy/Sell Cryptocurrency