- Lido ranking on top in Aave, but challenges lie ahead.

- Declining APR, user base, whale interest, and network growth raised concerns for Lido.

Lido’s [LDO] Wrapped State ETH [wstETH] was at the top of charts at press time, as per the Ethereum [ETH] market on Aave [AAVE]. Lido‘s wstETH is a type of ERC-20 token that represents a stake in the Ethereum 2.0 deposit contract, allowing users to take part in the Ethereum 2.0 network and earn rewards for staking their tokens.

Ethereum market on @AaveAave V3 hits $55.9m with wstETH sitting at $22.9m (40.98%).https://t.co/MCJxxHGdvf pic.twitter.com/HonIONxdnc

— Lido (@LidoFinance) January 31, 2023

Read Lido’s [LDO] Price Prediction 2023-2024

Interest in the protocol grows

There has been growing interest in staking ETH through Lido, and this is reflected in the growing Total Value Locked (TVL) on the platform. According to Defi Llama’s data, Lido’s TVL increased from $7.86 billion to $8.07 billion over the last seven days.

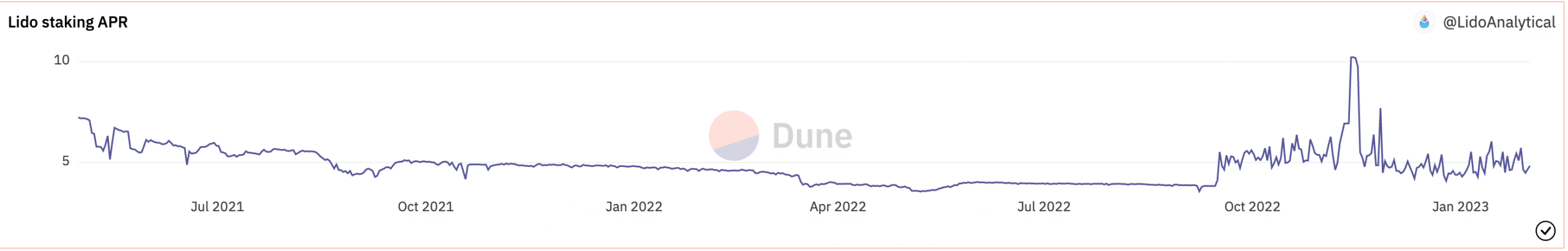

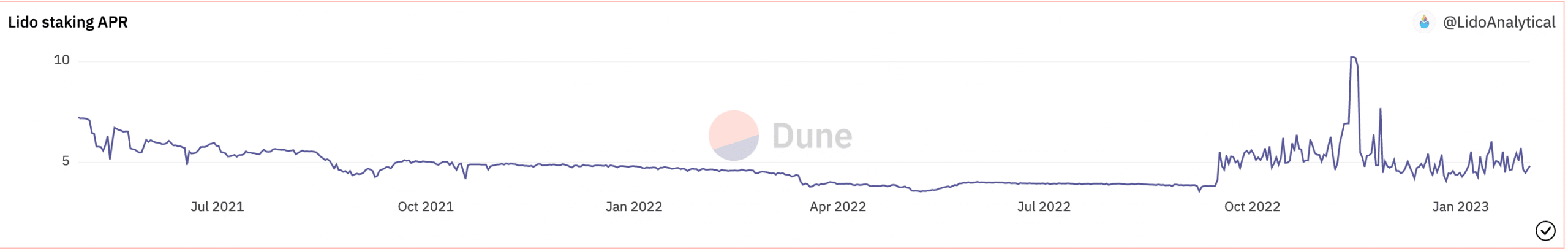

However, the growing TVL of Lido could come to a halt due to its declining APR (Annual Percentage Rate), which was supported by Dune Analytics’ chart.

Source: Dune Analytics

LDO holders beware

Over the last week, the number of unique users on the Lido protocol declined by 3.42%, prompting users to seek alternatives. This decrease in user base could impact the revenue generated by Lido in the future. At the time of writing, Lido generated 8.42 million in terms of revenue over the last week, according to Messari.

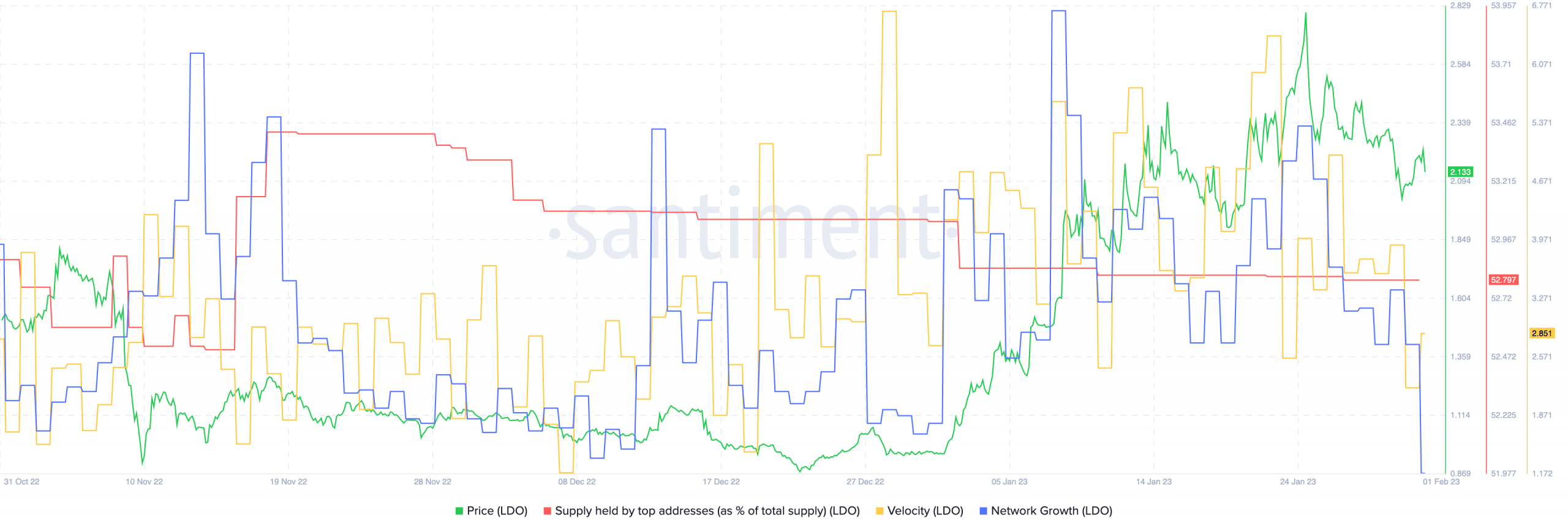

This could be one reason why whale interest in the LDO token declined over the last month, despite its prices moving upwards. If a large number of whales began selling their holdings, it could affect LDO’s price negatively.

Network growth, which is an indicator of the number of times LDO was transferred for the first time amongst new addresses, also decreased during this period. Thus, new addresses were not interested in LDO at press time.

Meanwhile, the velocity of the LDO token, or the frequency with which LDO was exchanged amongst addresses, also decreased, suggesting that the activity of the addresses holding the LDO token also declined.

Realistic or not, here’s LDO’s marketcap in BTC’s terms

Source: Santiment

In conclusion, although Lido’s wstETH is topping the charts on Aave, it is important to consider the declining APR, decreased number of unique users, and lack of whale interest in the token. These factors could impact the protocol’s performance in the near future.

It remains to be seen whether LDO can turn things around and continue to grow in the Ethereum market.