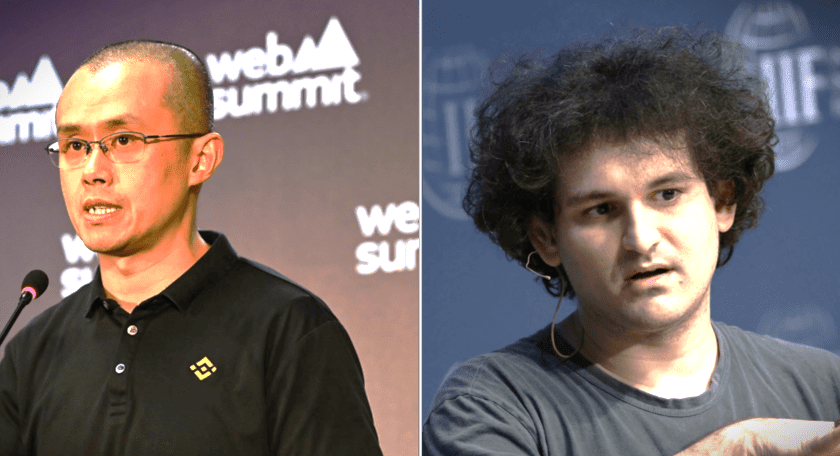

In a significant move back in March 2019, Binance CEO, Changpeng Zhao (commonly known as CZ), declined a lucrative $40 million offer by then FTX CEO, Sam Bankman-Fried (SBF). The proposal centered around launching a futures crypto exchange.

SBF’s Vision for a Safer Crypto Futures Exchange

Crypto trading is notorious for its extreme volatility. With large price fluctuations happening in short periods, there’s considerable risk for traders and exchanges alike. The traditional futures exchange lets traders leverage their funds with minimal collateral. However, in the unpredictable crypto realm, this can often lead to exchanges facing bad debts due to inadequate collateral.

SBF envisaged a futures exchange that actively tracked trader behavior. In situations where trades surpassed the collateral, the system would promptly liquidate the trader’s assets, ensuring the exchange’s losses were capped.

Divergent Paths for Binance and FTX

At this juncture, Binance and FTX had differing visions. FTX aimed to cater to institutional clients, while Binance had a strong retail customer base. After pondering over the proposal, CZ opted to craft Binance’s in-house futures platform. This decision caused a rift between the two, with SBF even terming CZ a “douche” due to this choice.

Nevertheless, FTX surged forward, launching its futures exchange in the same year. SBF candidly remarked, “While the venture had the potential to be worth billions, there was also a high chance it wouldn’t succeed.”

Michael Lewis, in his book “Going Infinite,” highlighted how Binance chose to pave its path in the futures exchange sector, sidestepping SBF’s proposal. The result was SBF’s establishment of FTX in May 2019, though by November 2022, financial challenges led FTX to bankruptcy, culminating in SBF’s trial.

Behind SBF’s Crypto Vision

The year before the proposal, SBF ventured into the crypto space with CryptonBTC, a bitcoin exchange. The major challenge was to get the marketing right and to draw customers. His ambitious plan involved teaming up with existing crypto exchanges. Alameda, his brainchild, would offer the tech, while partner exchanges would bring in the clientele.

Despite their collaborations, including SBF’s sponsorship of a Binance conference for $150,000, the two CEOs had different viewpoints.

Funding FTX: Introduction of the FTT Token

Determined to see his vision come to life, SBF introduced the FTX token (FTT). This digital currency allowed holders a slice of FTX’s yearly revenue, a model previously used by Binance. By May 2019, FTX released 350 million FTT tokens for global investors. Although most declined, including CZ, a few, like Ryan Salame, showed interest.

When the FTT was finally listed on FTX for public trading, its value soared. This success brought the two CEOs together again during a conference, marking a shift in their professional dynamics.

Recommended posts

More from Binance

Binance Anticipates Delisting Stablecoins Due to Upcoming MiCA Regulation

Posted On September 25, 2023

0

Binance, a global cryptocurrency powerhouse, might delist several stablecoins due to the upcoming MiCA regulation in the EU. Dive into …

CZ Binance Predicts DeFi’s Domination Over CeFi in Next Bull Run

Posted On September 10, 2023

0

In a recent “X Spaces” session, Binance CEO Changpeng “CZ” Zhao discussed the potential of decentralized finance (DeFi) surpassing centralized …

Binance NFT Adjusts Services: No More Polygon NFTs & The Sandbox Staking

Posted On September 8, 2023

0

Starting September 26, 2023, Binance NFT is making pivotal adjustments. They’re ending support for Polygon NFTs and The Sandbox staking. …