- Fantom Foundation transferred FTM worth over $4 million to Binance.

- Metrics and market indicators looked bearish.

Fantom [FTM] did not manage to follow the current bullish market trend lately, as its price declined in the last 24 hours of press time.

According to CoinMarketCap, FTM registered a daily decline of more than 3%, and at the time of writing, it was trading at $0.5255 with a market capitalization of over $1.45 billion.

This was quite in contrast to Token Terminal’s data- FTM was also on the list of the top blockchains by the lowest P/S ratio, which suggested that the token was undervalued.

Let’s see the Top blockchains based on the lowest P/S ratio (fully diluted)

The index is calculated as FDV divided by total revenue for 1 year

This shows that the smaller the index, the greater the potential#Fantom @FantomFDN $FTM pic.twitter.com/HqrOxtztN0— Fantom Insider (@fantom_insider) February 20, 2023

Lookonchain recently pointed out an interesting development that can further push FTM’s price down in the coming days.

According to the tweet, the Fantom Foundation transferred FTM worth over $4 million to Binance, which was a negative update as it had the potential to increase the selling pressure.

A similar episode of FTM transfer happened last May during the Terra Luna crash.

The Fantom Foundation wallet transferred 7.5M $FTM($4M) to #Binance ~20 mins ago.

The last time Fantom Foundation transferred $FTM to $Binance was during the LUNA/UST crash in May 2022.https://t.co/fDLIs3mEXq pic.twitter.com/nonowpbZRP

— Lookonchain (@lookonchain) February 20, 2023

Read Fantom’s [FTM] Price Prediction 2023-24

This happened despite several positive developments in the ecosystem in the last few days. For instance, Travala announced that it would support payments with FTM on its platform.

It was an optimistic update for the Fantom ecosystem, as it indicated increased adoption at a global level.

What do the metrics suggest?

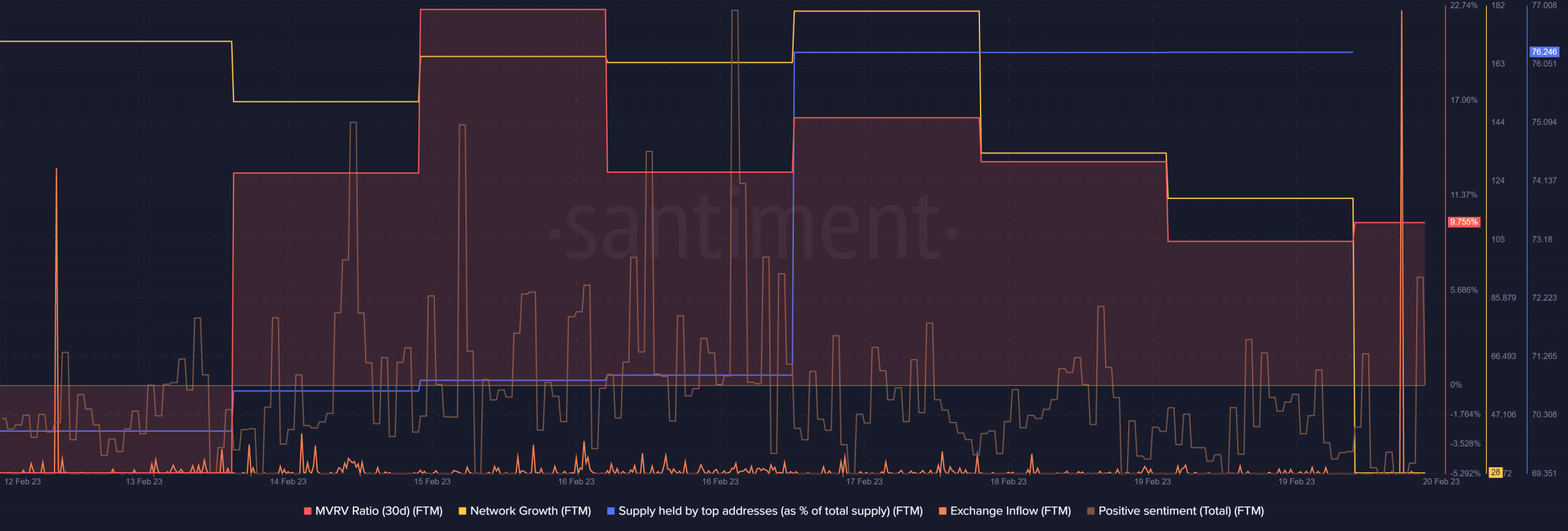

Santiment’s chart revealed that a few of the metrics went against FTM in the recent past.

For example, FTM’s exchange inflow registered a massive spike on 20 February, which was a bearish signal.

Its network growth also declined in the last two days, further increasing the chances of a price plummet. Positive sentiments around FTM also took a hit. Thus, reflecting less confidence among investors in the token.

Moreover, FTM’s MVRV Ratio too registered a gradual decline, which was a development in the bears’ favor.

However, whales’ interest in FTM seemed to have increased as FTM’s total supply held by top addresses registered a spike.

Source: Santiment

Is your portfolio green? Check the Fantom Profit Calculator

The bears are winning

Investors might have more reasons to worry as FTM’s market indicators clearly revealed a bearish upper hand in the market.

FTM’s Chaikin Money Flow (CMF) declined sharply, which was a negative signal. The MACD also revealed that the bears were leading the market.

FTM’s Relative Strength Index (RSI) registered a slight decline, which further increases the chances of a continued price decline.

Source: TradingView