- GNS has rallied to an all-time high of $10.31

- Since it launched on Arbitrum, it has seen increased user activity.

Following its inclusion in Binance’s Innovation Zone on 17 February and the opening of trading for the GNS/BTC and GNS/USDT trading pairs on the cryptocurrency exchange, Gains Network [GNS] rallied to an all-time high of $10.31, data from CoinMarketCap showed.

How much are 1,10,100 GNS worth today?

On 17 February, Binance listed GNS in its Innovation Zone and opened it up for users to trade. This led to a significant jump in the alt’s price as it rallied by almost 40% 24 hours following Binance’s announcement.

Binance will list Gains Network (GNS) in the Innovation Zone and will open trading for these spot trading pairs at 2023-02-17 11:30 (UTC). Gains Network is a decentralized leverage trading platform. https://t.co/t81zfWS8o8

— Wu Blockchain (@WuBlockchain) February 17, 2023

Gains doing big things on Arbitrum

Gains Network was initially deployed on Polygon network. However, its growth trajectory witnessed a noteworthy uptick following its deployment on 31 December 2022, on Arbitrum, an Optimistic Rollup solutions provider on Ethereum.

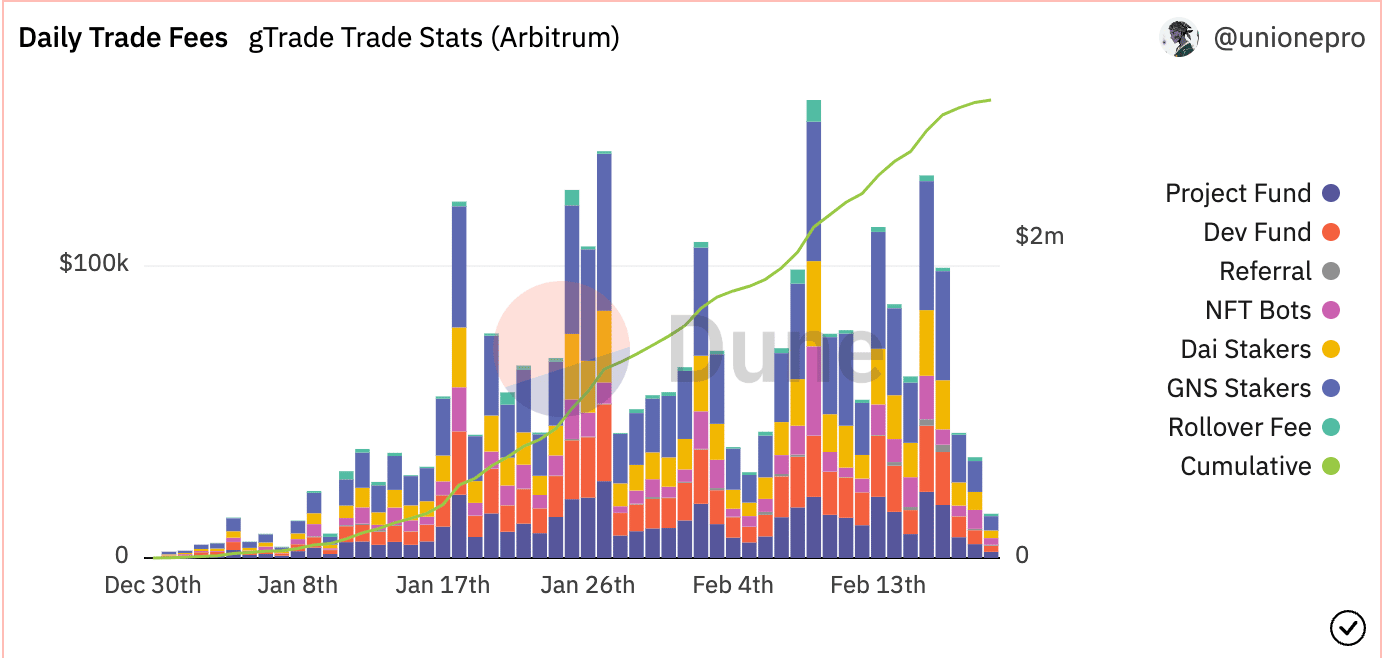

According to data from Dune Analytics, Gains has recorded over $4 billion in trading volume on the Arbitrum blockchain nearly two months after being deployed on the chain. This, however, merely represented 16% of the $24 billion logged as trading volume by the decentralized exchange (DEX) on Polygon.

According to data from Dune Analytics, the $4 billion trading volume on Arbitrum has resulted in users who provide liquidity to the platform earning over $2.8 million in fees.

This has further driven up the value of the platform’s GNS token, contributing to its recently achieved all-time high.

Source: Dune Analytics

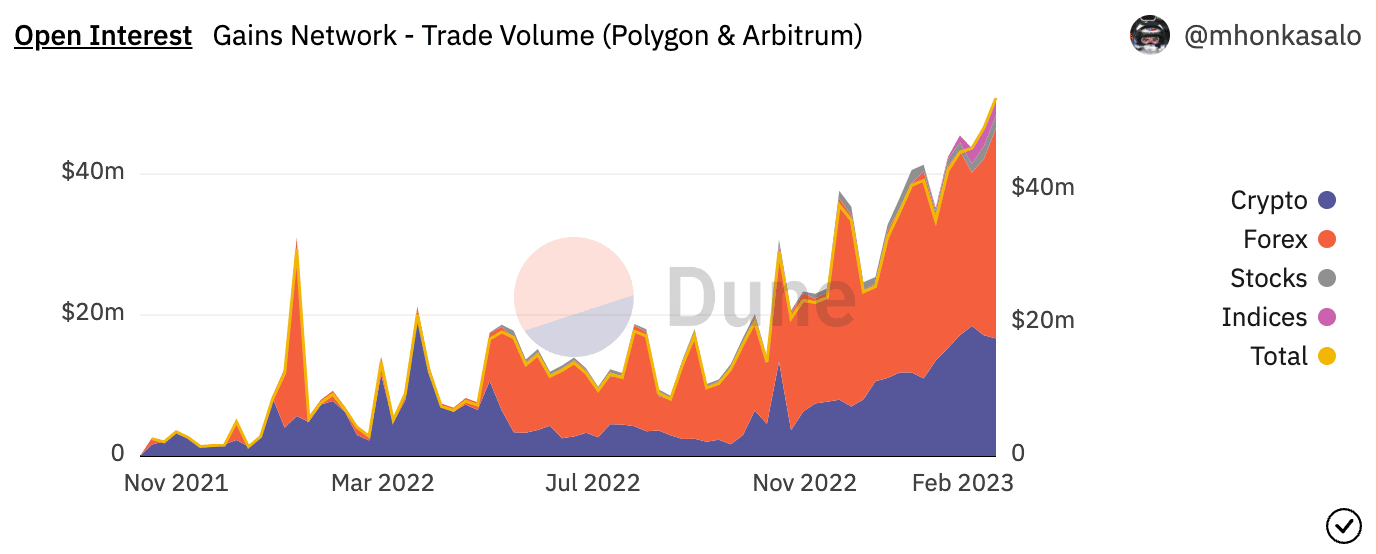

Further, since it launched on Arbitrum, there has been a significant surge in the number of crypto, FOREX, stocks, and Indices Open Interests on Gains Network. As of this writing, Open Interest on the protocol was $53.75 million, having increased over 30% since 31 December 2022.

When the open interest on a crypto exchange is increasing, it means that the number of contracts that have been created and are currently outstanding is growing.

This can be interpreted as an indicator of market activity, as it suggests that more traders are entering into positions on the several assets listed on the exchange.

Source: Dune Analytics

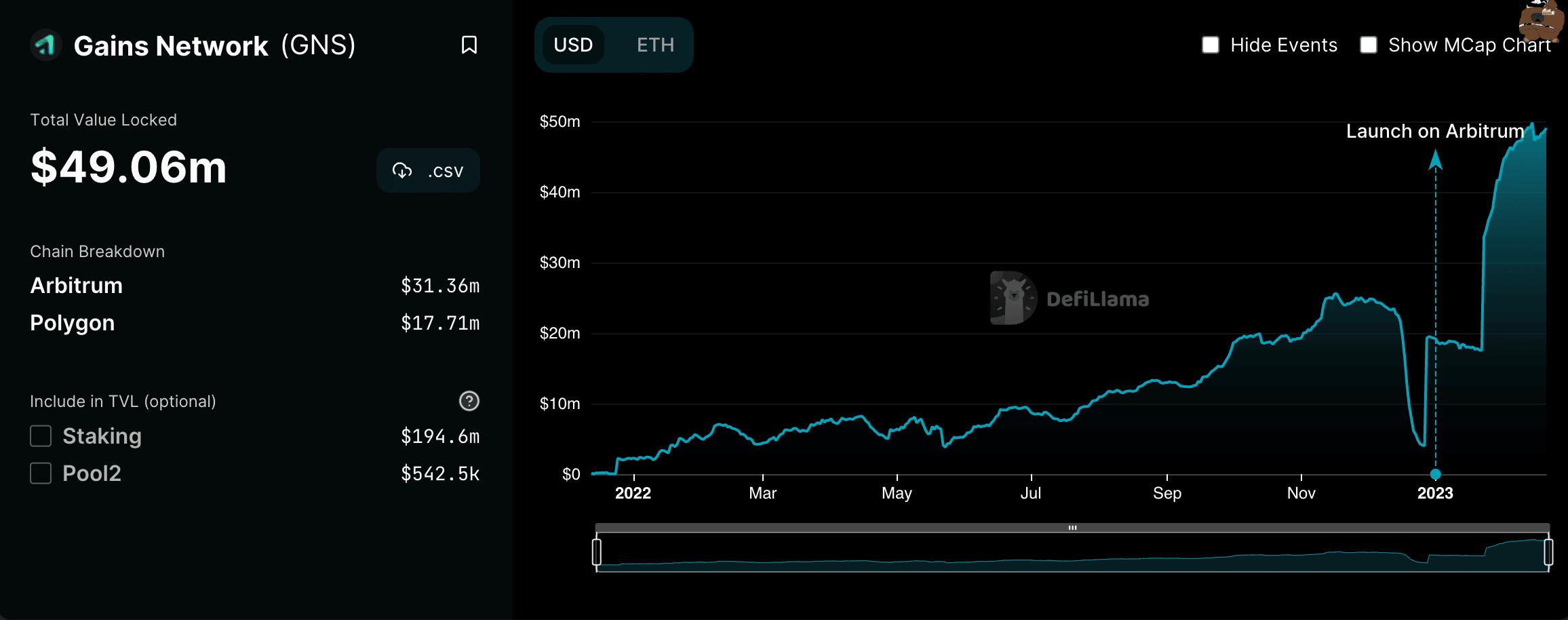

As for the total value of assets locked on the protocol, it has jumped by 155% since the year began, data from DefiLlama revealed.

While the protocol is barely two months old on Arbitrum, its TVL on the chain totaled $31.36 million, while its TVL on Polygon, at press time, was $17.71 million.

Source: DefiLlama