- A whale accumulated 28,672 ETH, worth $48.5 million from Binance and Coinbase over the past two months.

- Supply on exchanges decreased and metrics looked bullish.

Ethereum’s [ETH] much-awaited Shanghai upgrade is around the corner, and investors are excited.

The upgrade will finally allow investors to withdraw their staked Ethereum. Amidst the excitement, a Twitter handle by the name Technical Crypto Analyst revealed an update that was in investors’ favor.

Reportedly, 60% of all staked ETH was locked on-chain around the current ETH price or even higher.

About 60% of total #Ethereum staked is underwater at current price pic.twitter.com/jS2Bdt0z24

— Technical Crypto Analyst (@TechCryptoAnlst) February 18, 2023

The crypto community’s response to it was bullish. Some expected that the 60% of Ethereum staked would reduce the possibility of a sell-off after the Shanghai upgrade. Thus, giving rise to the opportunity for a price uptick.

Read Ethereum’s [ETH] Price Prediction 2023-24

Accumulation is on the rise!

Lookonchain’s data was also encouraging, indicating increased ETH accumulation. Notably, whale “0xB79c” accumulated 28,672 ETH, worth $48.5 million, from Binance and Coinbase over the past two months. This development suggested that the whales were expecting ETH’s price to pump further.

Whale”0xB79c” is still accumulating $ETH today.

The whale has accumulated 28,672 $ETH ($48.5M) from #Binance and #Coinbase over the past 2 months.

The average receiving price is $1,430.

And he/she received 1,304 $ETH($2.2M) from #Binance 12 hrs ago.https://t.co/IXExQZwAGN pic.twitter.com/00Ga9bQKTv

— Lookonchain (@lookonchain) February 18, 2023

It’s interesting to note that whale and shark addresses with 100,000 ETH still hold close to 47% of the total ETH supply.

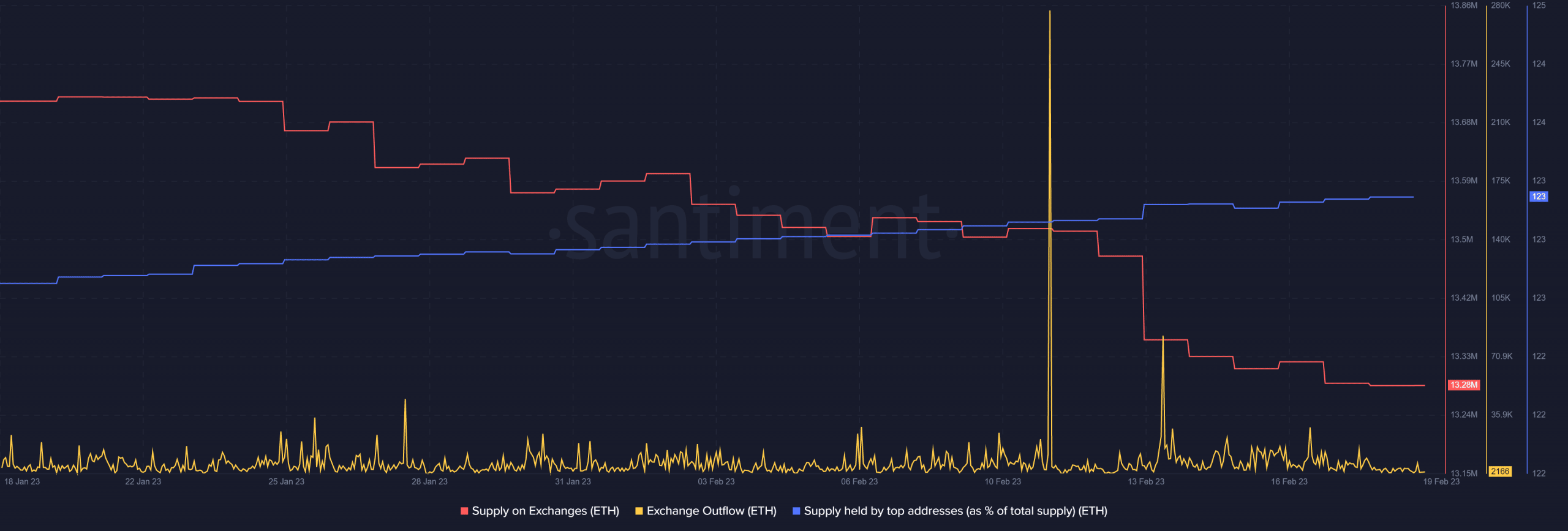

Increased accumulation was yet again proven through Santiment’s chart, as the total supply on exchanges registered a decline over the last month.

Besides, ETH’s exchange outflow spiked lately. Furthermore, ETH’s supply held by top addresses was also on the rise, reflecting whales’ confidence in the king altcoin.

Source: Santiment

Is your portfolio green? Check that Ethereum Profit Calculator

Here is better news

On the other hand, LunarCrush’s data revealed yet another bullish update regarding Ethereum. The king of altcoins made it to the list of the top 15 cryptos in terms of the Galaxy Score, which was an optimistic sign for the token holders.

TOP 15 coins by @LunarCRUSH Galaxy Score

Galaxy Score is a proprietary score that is constantly measuring crypto against itself with respect to the community metrics pulled in from across web$NAKA $EXRD $HFT $ETH $UNCX $LN $LDO $MTL $CELR $APE $DOT $SKL $SUTER $FLOKI $AGIX pic.twitter.com/MRkp0aydkK

— CryptoDiffer – StandWithUkraine (@CryptoDiffer) February 18, 2023

All the updates, when combined, suggested a possible price uptick in the coming days after ETH’s dormant price action in the last 24 hours.

As per CoinMarketCap, ETH was trading at $1,701.26 with a market capitalization of more than $208 billion, at press time.

ETH’s exchange reserve was decreasing, which was a positive signal as it suggested less selling pressure.

The taker buy-sell ratio was positive, which indicated that buying sentiment was dominant in the derivatives market.

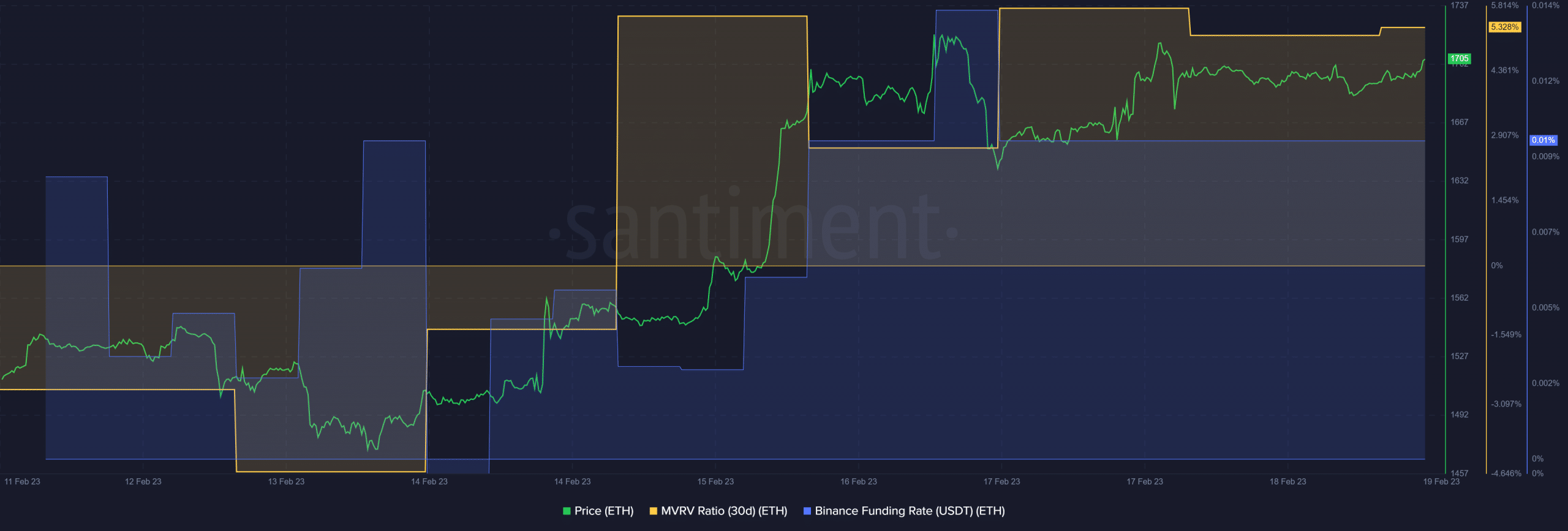

Santiment’s chart further showed that ETH’s Binance funding rate was up. Thus, reflecting its demand in the derivatives market.

Additionally, Ethereum’s MVRV Ratio registered an uptick, increasing the chances of a price surge.

Source: Santiment