- Blur recorded exponential gains in trading volume and royalties.

- Blur’s growth prompted a change in OpenSea’s marketplace policies.

With its phenomenal growth over the last few months, the NFT marketplace Blur [BLUR] has become the talk of the town.

According to Blur’s financial statement released by Token Terminal, the total trading volume for the month of February has already hit $415 million, marking a 150% jump from November.

@blur_io *weekly* financial statement

https://t.co/UvZRTnxepd pic.twitter.com/DrmCVASKsl

— Token Terminal (@tokenterminal) February 18, 2023

Additionally, the royalties paid on the marketplace saw a meteoric rise as well. At press time, the total royalty fees paid in February soared to $3.24 million, which was a 20% jump over the previous month and a whopping 326% rise from November.

The launch of BLUR token earlier this week added strength to its performance.

How much are 1,10,100 BLURs worth today?

Blur surges ahead

Unlike other players in the ecosystem, Blur doesn’t charge any marketplace fee from its traders. Furthermore, since its launch, it has been dropping ‘Care Packages’ containing BLUR tokens, aimed at incentivizing trading activity on its platform.

With the launch of BLUR, users were allowed to redeem their care packages for the platform’s native token. According to data from Dune Analytics, a total of 360 million tokens have been airdropped and 93% of them have been claimed, at the time of writing.

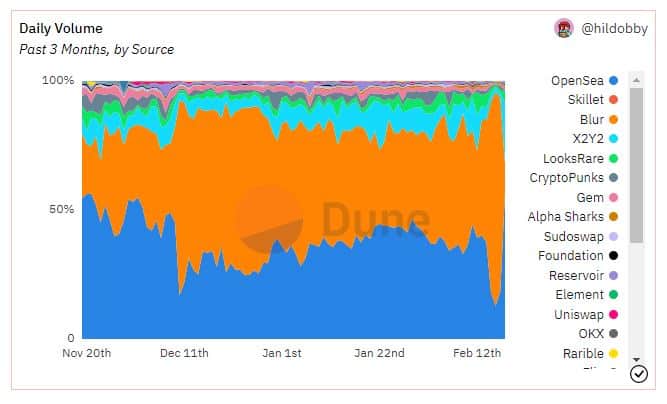

Blur’s daily trading volume quadrupled after the launch of BLUR and its market share stayed above 70% during a good part of last week, comfortably surpassing market leader OpenSea.

Source: Dune Analytics

Native token set to fly high?

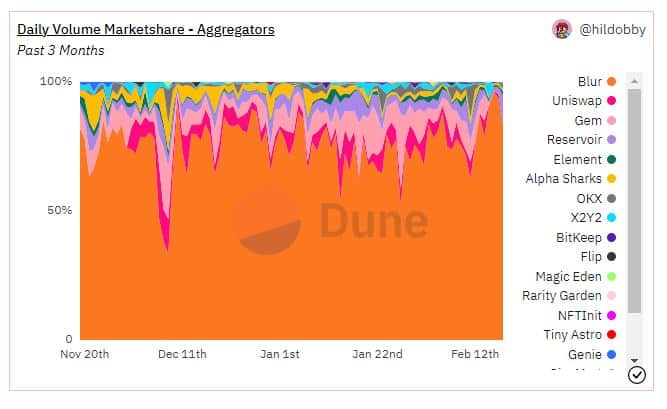

Interestingly, a large part of Blur’s recent growth could be attributed to its position as a leading NFT marketplace aggregator. Data from Dune Analytics showed that Blur enjoyed a monopoly in this landscape, accounting for more than 96% of the daily trading volume.

Source: Dune Analytics

With all the right boxes ticking, the focus shifts to the price of the newly launched BLUR token. At press time, it jumped 21% to be valued at $1.35, per CoinMarketCap. If growth in key marketplace indicators continues to hold, token holders could expect rapid gains in the coming weeks.

Is your portfolio green? Check out the BLUR Profit Calculator

In the face of stiff competition from Blur, OpenSea had to introduce sweeping changes to its marketplace policy. This included doing away with the 2.5% service fees on sales and making creator royalties optional, something which Blur already offered which arguably worked in its favor.