- New analysis suggested that BTC’s price could decline in the coming days.

- On-chain metrics and a few market indicators looked bearish.

For the last few days, the crypto market has been on a bullish streak, causing the prices of most cryptos to rise. Bitcoin [BTC], the market leader, also benefited from the situation.

According to CoinMarketCap, BTC’s price was up by more than 3% and 13% over the last 24 hours and the last seven days, respectively. At the time of writing, BTC was trading at $24,482.41 with a market capitalization of more than $472.4 billion. However, the table might turn soon.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Trouble in the near term

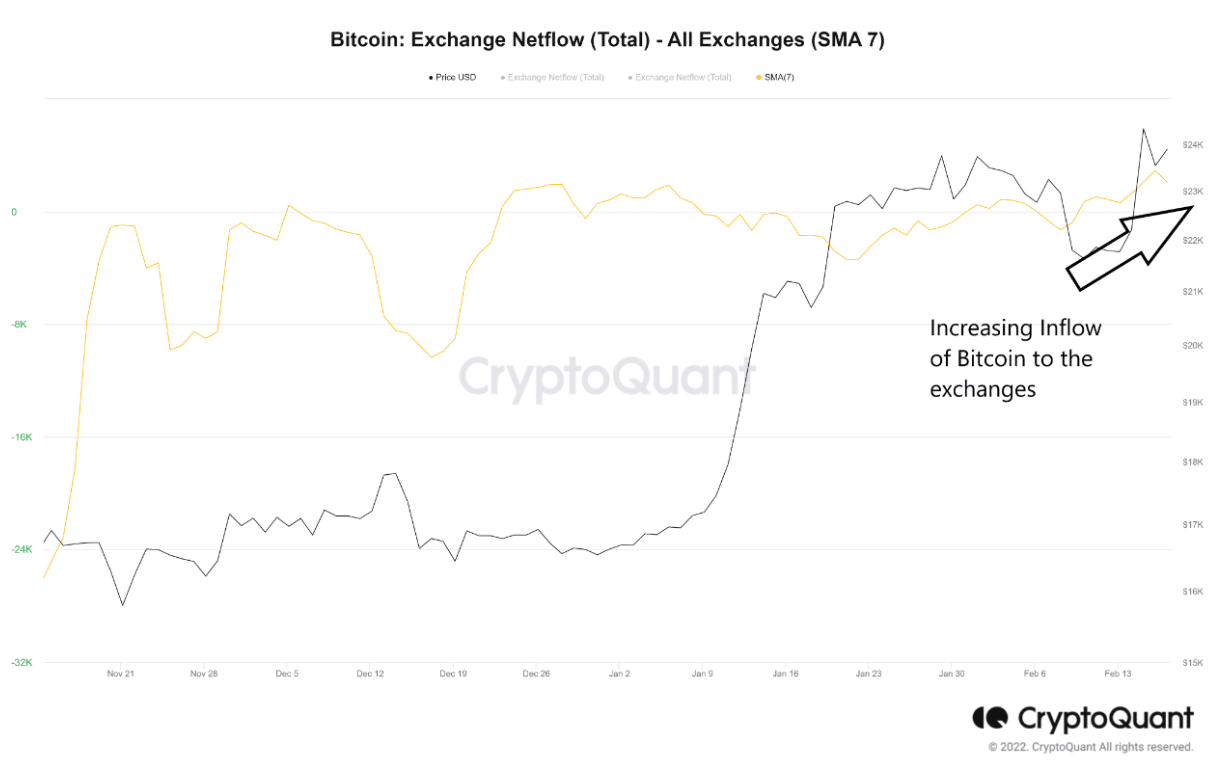

CryptoOnchain, an author and analyst at CryptoQuant, posted an analysis on 17 February, which suggested BTC’s good days might soon end. As per the analysis, there was an increase in the inflow of Bitcoins to exchanges and the outflow of stablecoins from exchanges – a bearish signal.

Source: CryptoQuant

A few other metrics also looked bearish for BTC. For instance, Glassnode Alerts revealed that Bitcoin’s balance on exchanges reached a one-month high of 2,267,202.721 BTC.

#Bitcoin $BTC Balance on Exchanges just reached a 1-month high of 2,267,202.721 BTC

Previous 1-month high of 2,266,916.823 BTC was observed on 19 January 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/h8ytX0U6f6

— glassnode alerts (@glassnodealerts) February 18, 2023

As per CryptoQuant’s data, BTC’s exchange reserve was also on the rise, suggesting higher selling pressure. On top of that, the aSORP was also in the red, so more investors were selling at a profit, indicating a possible market top.

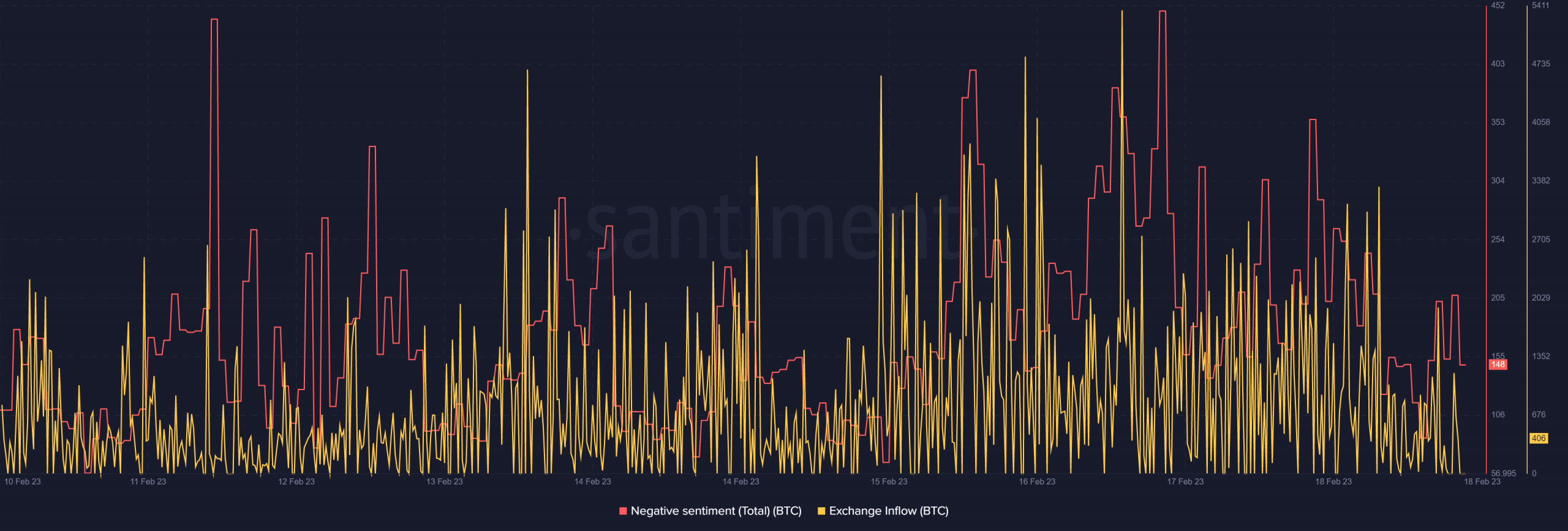

Demand from the derivatives market also seemed to dwindle, as BTC’s taker buy sell ratio suggested that selling sentiment was dominant in the futures market. According to Santiment’s chart, BTC’s exchange inflow spiked in the last few days. Moreover, negative sentiments around BTC also went up, reflecting less trust among investors.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

Bitcoin: What the metrics have to say

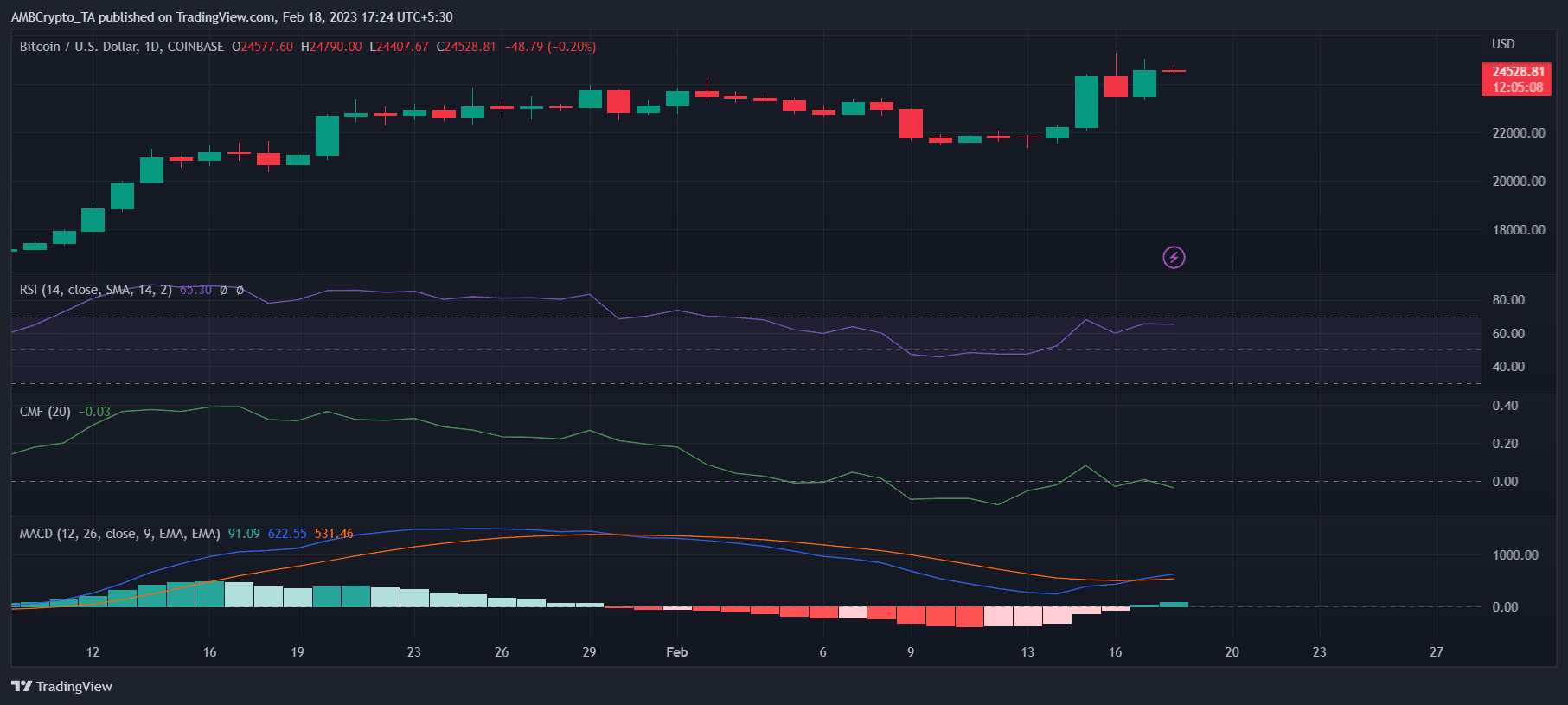

Continuing with the bearish trend, BTC’s Relative Strength Index (RSI) was hovering near the overbought zone, which might increase selling pressure. Moreover, the king coin’s Chaikin Money Flow (CMF) registered a downtick and was headed further below the neutral mark.

Regardless, the MACD displayed a bullish crossover, giving hope for a continued uptrend in the short term.

Source: TradingView