Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- APE plunged by over 20% in the past few weeks.

- However, bulls had a glimmer of hope after crossing above a downtrend line.

ApeCoin [APE] is facing countering forces ahead. Notably, the NFT token plummeted by 20%, dropping from $6.417 but steadied around the $5.000 level.

Part of the drop was due to a planned token unlocks worth $40M scheduled for mid-March. BTC’s drop in early February also exerted more sell pressure on APE.

Read ApeCoin [APE] Price Prediction 2023-24

But BTC’s recent reclaim of the $25K level pushed APE to break above a critical multi-week downtrend line. Besides, OpenSea’s reduced fees and royalties to counter rival upstart, Blur, could further boost the NFT token’s value.

Where will APE investors look for gains amidst countering forces in the coming days/weeks?

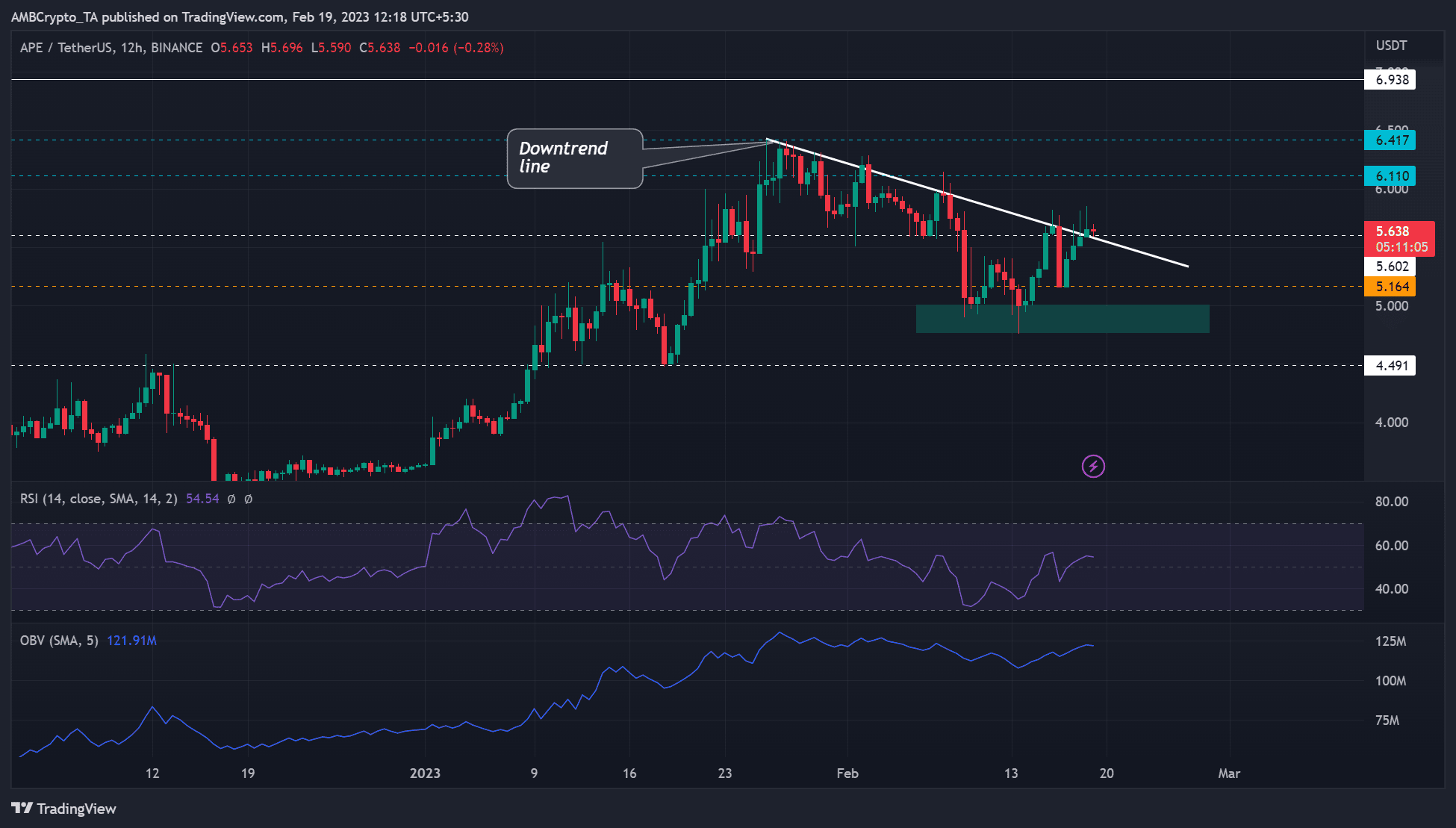

Source: APE/USDT on TradingView

At press time, APE closed above the downtrend line flipping the structure to bullish. But it was about to retest it to confirm whether the uptrend would continue.

Is your portfolio green? Check out the APE Profit Calculator

Long-term bulls could look to book gains at the overhead resistance levels of $6.110, $6.417, or $6.938. Such an upswing may depend on BTC’s upward rally above $25K. But bulls will need to wait for the confirmation of the uptrend if the APE retests the downtrend line and moves upwards.

On the other hand, bears could benefit from short-selling opportunities at $5.374, $5.164, or $5.000. Sellers could wait for a close below the downtrend line and confirmation of the downtrend before making moves.

However, intense selling pressure, especially from token unlocks in March, could see APE drop towards $4.491. Therefore, investors should track BTC’s price action and planned token unlocks.

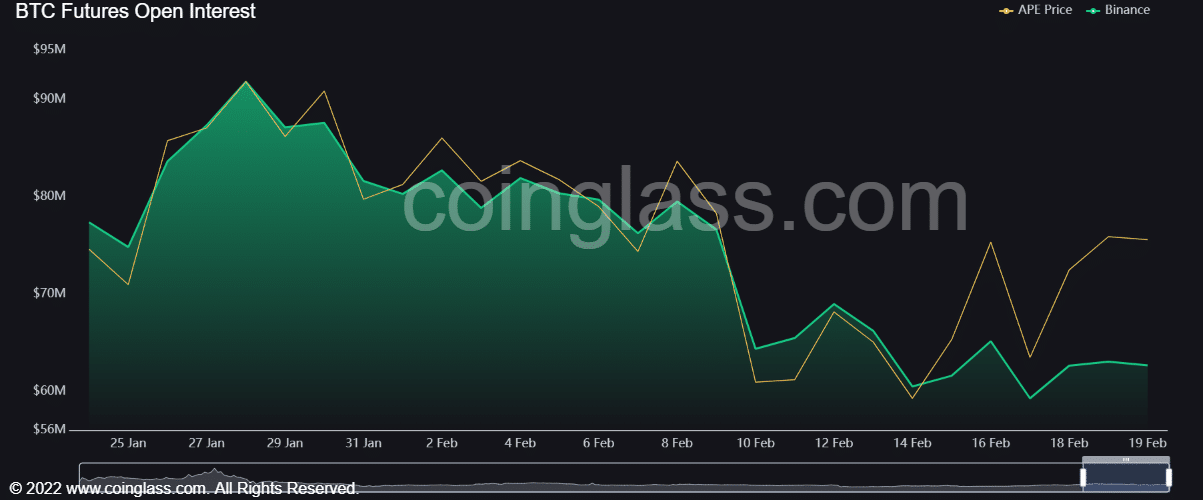

APE’s open interest rate slowed

Source: Coinglass

According to Coinglass, APE’s open interest (OI) has been making lower lows since the end of January. It means more money flowed out of its futures market, a bearish sentiment that weakened January’s uptrend momentum.

At the time of writing, the OI slanted, meaning demand for the NFT token stagnated, which could make the breakout above the downtrend line false. But an increase in OI and a price surge above $5.602 would tip bulls to target upper resistance levels.

Your article is excellent! The information is presented in a clear and concise manner. Have you considered the possibility of adding more images in your next articles? It could enhance the overall reader experience.