Over the past few days, the prices of Bitcoin (BTC) and Ethereum (ETH) have seen a significant increase, recovering nearly 5% of their value. This price movement has been welcomed by cryptocurrency investors and enthusiasts alike, as the crypto market has been experiencing a downward trend for the past few weeks.

While the recovery is a positive sign, the question on everyone’s mind is – what’s in store for the weekend? Will the recovery rally continue, or will we see a reversal of the trend?

In this blog post, we’ll analyze the recent price movements of BTC and ETH and examine the factors that could influence their prices over the weekend.

Insights on the Crypto Market: Fundamental Outlook Update

Although economic statistics in the United States have led to speculation that the Federal Reserve may become more aggressive with interest rate hikes, Bitcoin (BTC), the world’s largest cryptocurrency, has surged above the $24,000 level and has continued to gain momentum throughout the day.

Meanwhile, Ethereum, the second-largest cryptocurrency, has also gained significant traction and is currently trading above the $1,700 mark.

Despite recent regulatory actions and rumors, investors’ interest in cryptocurrencies remains strong. This is due to several positive developments in the market, including increased adoption of Bitcoin (BTC) by businesses.

On the other hand, investors reacted positively to the release of economic data on February 14, which showed a 5.6% year-on-year increase in the US Consumer Price Index, and on February 15, which showed a 3% monthly gain in retail sales.

Moreover, the US dollar began to lose momentum and dipped slightly on the day as the market readjusted ahead of the long weekend and anticipated signals from the Federal Reserve on how it intended to tackle still-high inflation. As a result, the negative US dollar was viewed as another major element that had a positive influence on BTC prices.

Crypto Market Mood: Analyzing the Current Sentiment and Trends

The global cryptocurrency industry has surged in popularity and is now valued at over $1.12 trillion. Most cryptocurrencies gained value during the day, possibly in response to the January US Consumer Price Index (CPI) figures.

The reduction of regulatory concerns in the cryptocurrency industry, as well as recent positive developments in the market, have also had a significant impact on the overall cryptocurrency market.

Moreover, the rising popularity of non-fungible tokens (NFTs) and decentralized finance (DeFi) has further fueled the growth and value of cryptocurrencies.

However, the gains in the crypto market may be short-lived as economic statistics in the United States have led to speculation that the Federal Reserve may take more aggressive actions with interest rate hikes to counter persistent inflation. As a result, there could be increased uncertainty and volatility in the cryptocurrency market going forward.

Export prices rose by 0.8% year-on-year, surpassing predictions for a 0.2% decline. Additionally, recent data released on Thursday showed a monthly increase in producer prices in January and a lower-than-expected number of jobless benefit applications for the previous week.

These developments suggest that the US economy may be strengthening, which could impact the cryptocurrency market as investors assess the potential impact on the value of cryptocurrencies.

El Salvador Pioneers Bitcoin Diplomacy with Plans to Establish US Embassy

El Salvador has announced plans to open the world’s first “Bitcoin Embassy” in the United States. The embassy will serve as a hub for promoting the use of Bitcoin (BTC), the most widely used cryptocurrency worldwide.

Earlier this year, El Salvador became the first country in the world to recognize Bitcoin as a legal tender. The country is now expanding its Bitcoin strategy through a new partnership with the Texas government, which is expected to further boost the adoption and integration of cryptocurrencies in both countries.

El Salvador and the government of Texas have announced a collaboration to establish a “Bitcoin Embassy,” which will serve as a representative office for El Salvador in Texas. This intergovernmental effort is aimed at promoting the adoption of Bitcoin, and the embassy will provide a platform for members to work together on the creation of new initiatives.

The news was shared by Milena Mayorga, the Salvadoran ambassador to the United States, on Twitter on February 14. The embassy is expected to help drive the global adoption of Bitcoin, and facilitate new partnerships between governments, businesses, and investors in the cryptocurrency industry.

Consequently, this development was considered one of the key drivers behind the recent surge in BTC prices.

Shanghai Upgrade and the Future of Ethereum

The Ethereum Shanghai hard fork is scheduled for March 2023 and will represent the final stage of the network’s transition to a proof-of-stake (PoS) consensus mechanism, which began with the Merge on September 15, 2022. Once the Shanghai upgrade is implemented, Ether that was previously locked in staking will gradually become liquid again.

However, the implementation of Shanghai has been postponed until December 2022, which is when the unlocking process is expected to begin.

As per on-chain Etherscan data, about 16.6 million ETH is presently locked in the proof-of-stake (PoS) staking protocol, with a total value of $28 billion as of February 16, 2023. With the transition from proof-of-work (PoW) to PoS, Ethereum’s initial goal to make Ether’s supply deflationary has started to take effect.

In the 154 days since the Merge, nearly 24,800 ETH has been burned, resulting in a 0.05% deflationary effect on the token’s yearly basis.

The total supply of Ether is 120 million, and as of February 16, slightly over 10% of that amount will be unlocked, resulting in yield benefits that will become available after the implementation of the Shanghai upgrade.

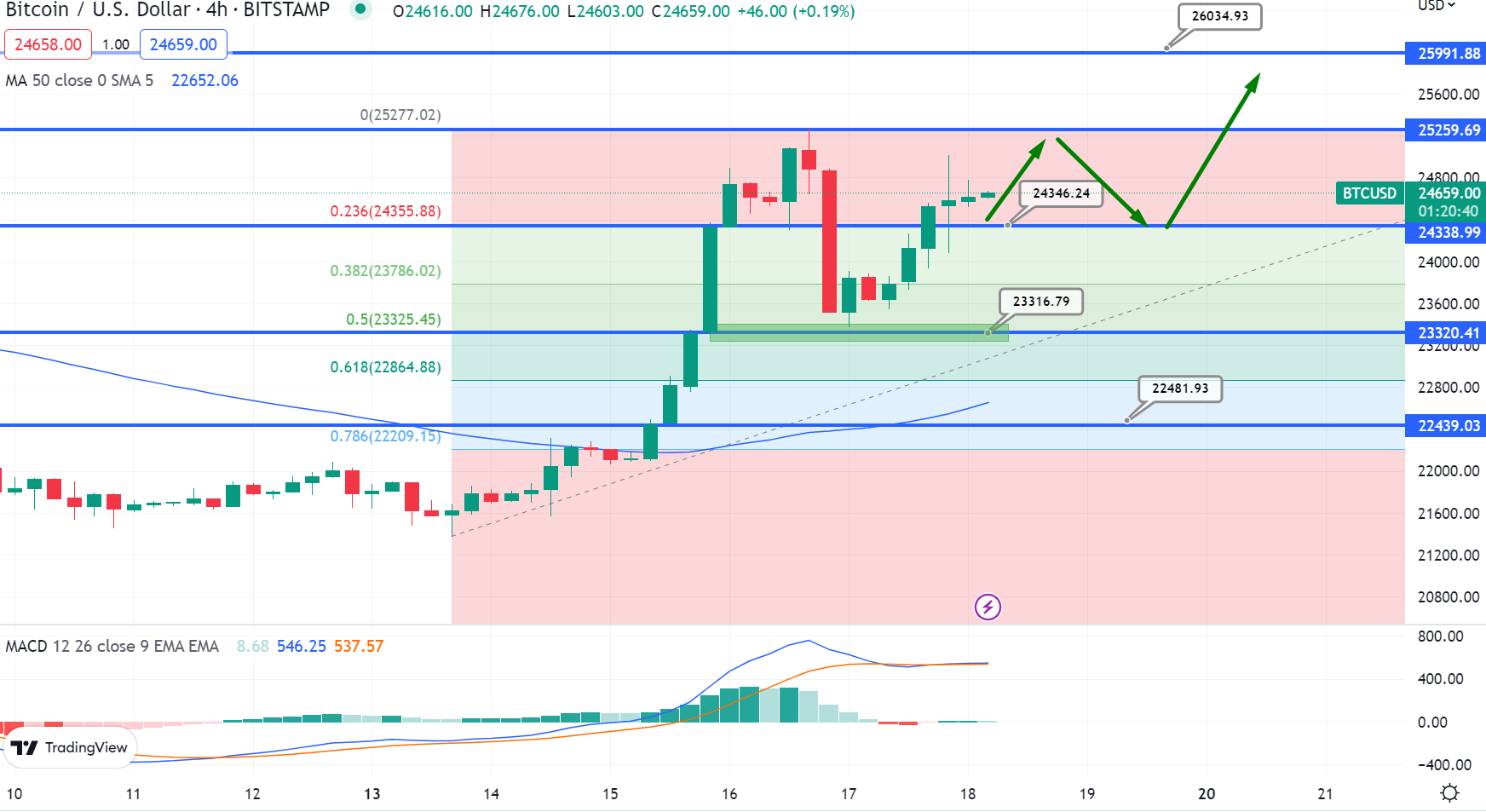

Bitcoin Price

Bitcoin is currently trading at $24,600, with a 24-hour trading volume of $38 billion and a 3% increase in the past 24 hours.

After finding support near $23,325, a 50% Fibonacci retracement level, Bitcoin has rebounded and started an upward trend. The recent candle closing above this level prompted a buying trend in Bitcoin, which has contributed to the bullish sentiment in the market.

Looking ahead, the next resistance level for Bitcoin is at $25,300. If a bullish crossover occurs above this level, it could potentially push the BTC price higher to $26,000.

The 50-day moving average is adding to the likelihood of a sustained upward trend in Bitcoin. To capitalize on this trend, investors may consider watching the $24,250 level as a potential entry point to take a long position in Bitcoin.

Buy BTC Now

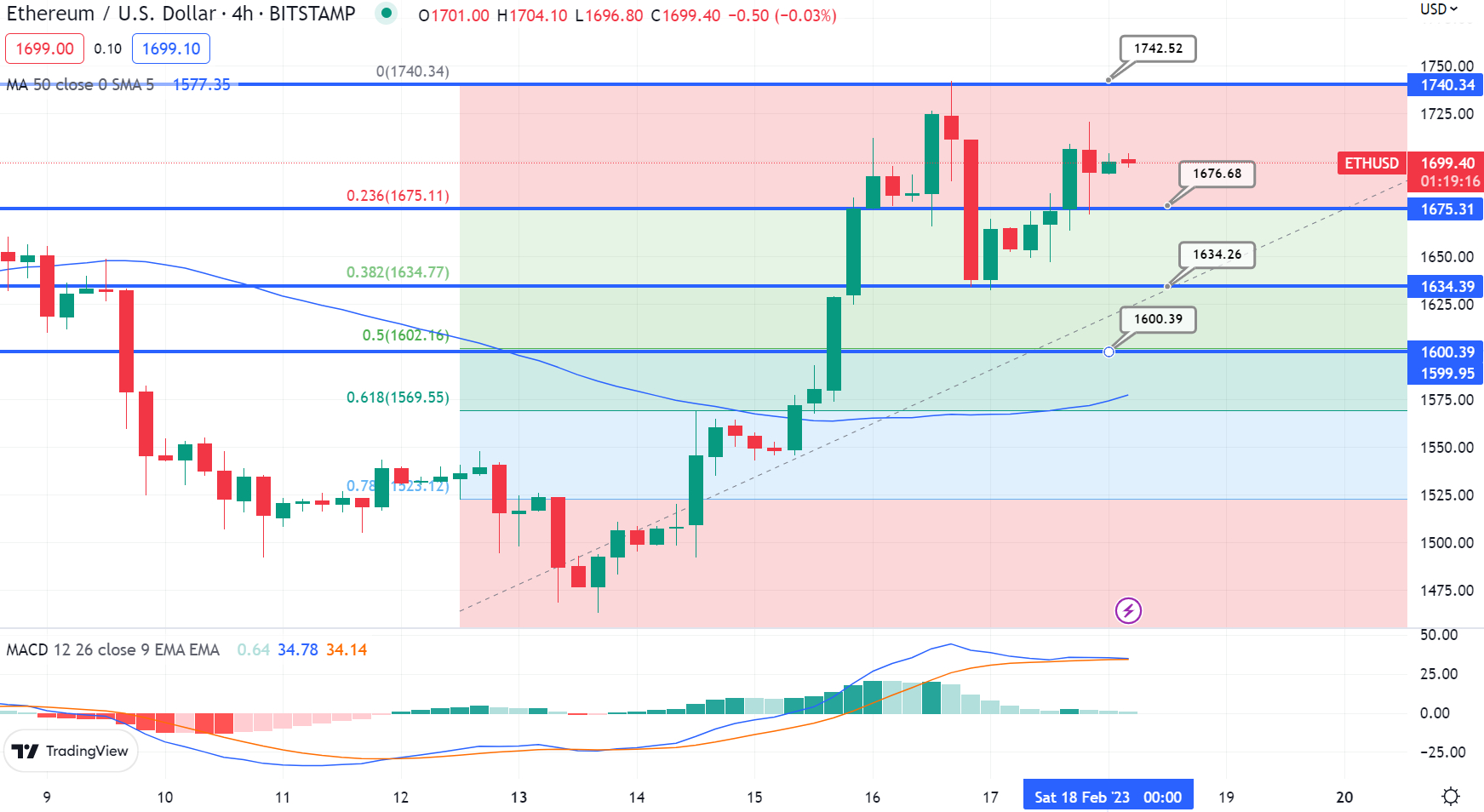

Ethereum Price

Ethereum is priced at $1,700, with a 24-hour trading volume of $9.2 billion and a 2.30% increase in the past 24 hours. On Saturday, the ETH/USD pair broke through the key resistance level of $1,670, signaling a bullish breakout that could lead to further buying opportunities up to the $1,750 mark.

A successful breakout above the $1,750 level could potentially propel the ETH price toward the $1,825 and $1,875 levels. Conversely, immediate support for Ethereum rests at the $1,670 level, and a breakdown below $1,600 could trigger a sell-off toward the $1,550 level.

Overall, investors are advised to closely monitor the $1,670 level for potential buying opportunities, while keeping an eye on any potential breakouts or breakdowns.

Buy ETH Now

Bitcoin and Ethereum Alternatives

In addition to BTC and ETH, there are several other altcoins in the market with high potential. The CryptoNews Industry Talk team has analyzed and compiled a list of the top 15 cryptocurrencies for 2023.

The list is updated weekly with new altcoins and ICO projects, so it’s advisable to check back frequently for new entries.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

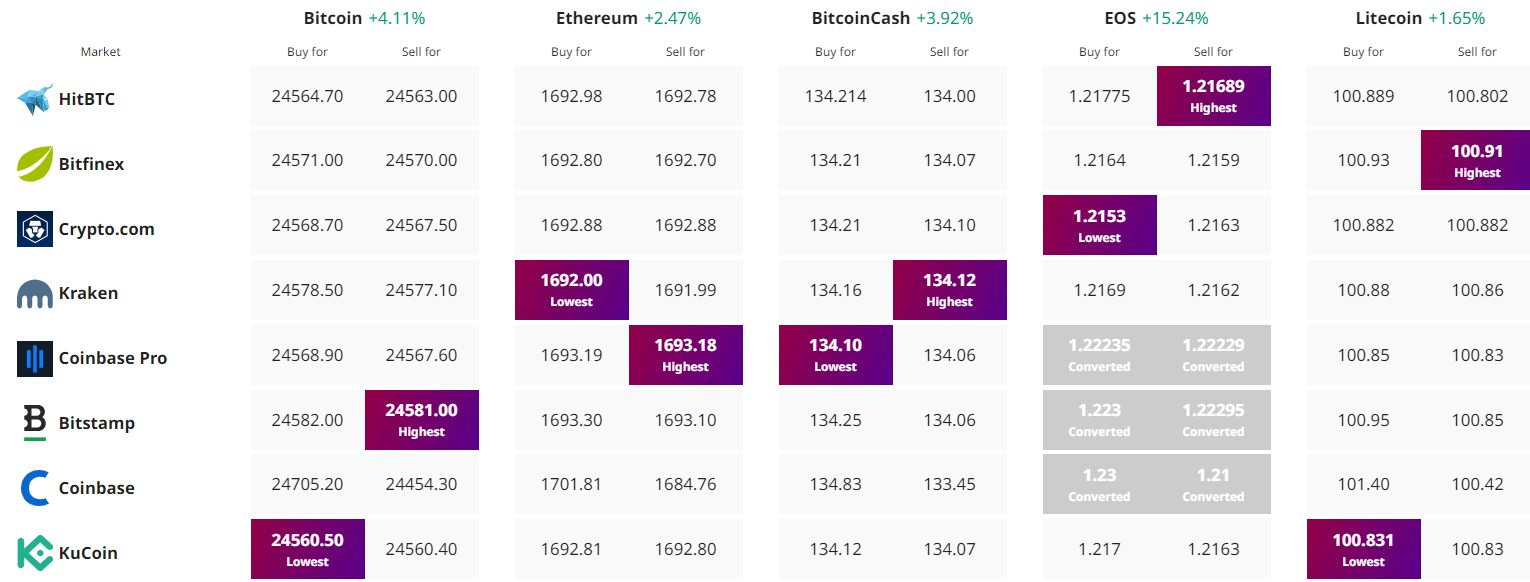

Find The Best Price to Buy/Sell Cryptocurrency